Excerpt

A General Overview of Deep Learning

Deep Learning is a part of Artificial Intelligence which provides the output for even extremely complex inputs.

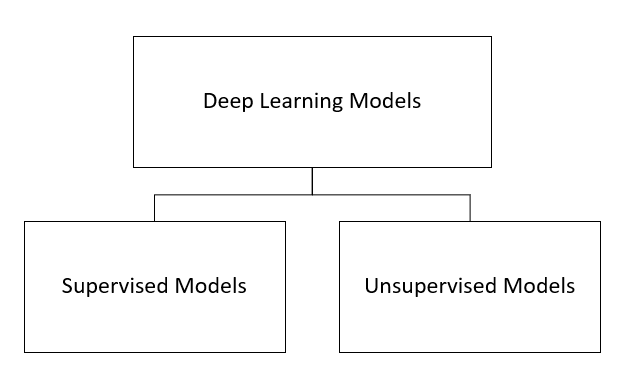

Below, we have made a visual representation in the way of a flowchart to understand where exactly Deep Learning plays a role:

Models of Deep Learning

Categorising the models broadly, there are two types, i.e., Supervised Models and Unsupervised Models. Both of these models are trained differently and hold various different features.

Let us first take Supervised Models, whichare trained with the examples of a particular dataset. These models are:

- Classical Neural Networks

- Convolutional Neural Networks

- Recurrent Neural Networks

Classical Neural Networks

Classical Neural Networks are also known as Multilayer perceptrons or the Perceptron Model. This model was created by American psychologist in 1958. It can also be termed as A Simple neural network. This is singular in nature and adapts to basic binary patterns with a series of inputs to simulate the learning patterns of human-brain. Its basic condition is to consist of more than 2 layers.

Application of Deep Learning in Finance

In this code below, we try to predict the direction of market movement using a set of features. Since it can either be an uptrend or downtrend it’s a binary classification problem.

# Importing the modules

import yfinance as yf

import pandas as pd

import numpy as np

import math

from sklearn.preprocessing import MinMaxScaler

from sklearn.metrics import mean_squared_error

from keras.models import Sequential

from keras.layers import Dense, Activation, Dropout

from keras.layers import LSTM

from sklearn.metrics import confusion_matrix

# Downloading GOOGLE OHLCV using yfinance

dataset = yf.download(“GOOG”, start=”2017-01-01″, end=”2019-11-30″)

# Re-adjusting OHL data using Adjusted Close

dataset[‘adjustment’] = dataset[‘Adj Close’]/dataset[‘Close’]

dataset[‘Adj Open’] = dataset[‘adjustment’] * dataset[‘Open’]

dataset[‘Adj High’] = dataset[‘adjustment’] * dataset[‘High’]

dataset[‘Adj Low’] = dataset[‘adjustment’] * dataset[‘Low’]

# The features used for classification:

# 1) Mean of Adjusted Open, High, Low and Close

OHLCV_mean = dataset[[‘Adj Open’,’Adj High’,’Adj Low’]].mean(axis = 1)

# 2) Adjusted Close

close_val = dataset[[‘Adj Close’]]

# 3) Returns of day before

returns = dataset[[‘Adj Close’]].pct_change()

# Creating a feature matrix – X – by merging all the above features

X = pd.concat([OHLCV_mean,close_val,returns],axis=1)

X.columns = [‘OHLC’,’Adj Close’,’Returns’]

# Convert the feature matrix to a numpy array

X = X.to_numpy()

# Get the corresponding binary labels for uptrend(1) or downtrend(0)

Y = (np.sign(np.roll(X[:,2],shift=-1))+1)/2

# Defining the min-max scalar for scaling the features

scaler = MinMaxScaler(feature_range=(0, 1))

# Scaling the features

X = scaler.fit_transform(X)

# Stack the label with the features

XY = np.concatenate([X,Y.reshape(-1,1)],axis=1)

# Remove all rows with either feature or label null

XY = XY[~np.isnan(XY).any(axis=1)]

# Test-Train split of the dataset

train_XY_len = int(XY.shape[0] * 0.75)

trainXY, testXY = XY[0:train_XY_len], XY[train_XY_len:]

# Separating the features and the label

# for both test and train sets

trainX = trainXY[:,:3]

trainY = trainXY[:,3]

testX = testXY[:,:3]

testY = testXY[:,3]

# Reformat or reshape test and train sets to make them compatible with

# model input stipulations

trainX = np.reshape(trainX, (trainX.shape[0], 1, trainX.shape[1]))

testX = np.reshape(testX, (testX.shape[0], 1, testX.shape[1]))

# Number of features

step_size = 3

#Define the sequential object

classifier = Sequential()

# Add LSTM later with 50 units and input size (1,3)

classifier.add(LSTM(units = 50, return_sequences = True, input_shape = (1, step_size)))

# Add dropout for regularisation

classifier.add(Dropout(0.2))

# Add another LSTM unit

classifier.add(LSTM(units = 50, return_sequences = True))

# Add dropout for regularisation

classifier.add(Dropout(0.2))

classifier.add(LSTM(units = 50, return_sequences = True))

classifier.add(Dropout(0.2))

classifier.add(LSTM(units = 50))

classifier.add(Dropout(0.2))

# Add fully connected layer with one output

classifier.add(Dense(units = 1))

# Compile the model – set loss function, optimisation algorithm and evaluation metric

model.compile(loss=’mean_squared_error’, optimizer=’adam’,metrics=[‘accuracy’])

# Train the model

model.fit(trainX, trainY, epochs=10, batch_size=1)

# Get test and train set predictions

trainPredict = model.predict(trainX)

testPredict = model.predict(testX)

# Get the confusion matrix for binary classification

confusion_matrix(testY,np.where(testPredict>0.5,1,0))

Visit QuantInsti website to read the full article:

https://blog.quantinsti.com/deep-learning-finance/

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from QuantInsti and is being posted with its permission. The views expressed in this material are solely those of the author and/or QuantInsti and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!