WTI and Brent oil dropped below US70/bbl and US75/bbl respectively for the first time since March 2023. Notably oil is trading lower today (04/05/2023) than before the Organization of the Petroleum Exporting Countries and its partner countries’ (OPEC+) intervention announced on Sunday 2 April. When OPEC+ announced its cut of 1.66 million barrels per day, the oil markets rose 10% within a space of a week, but prices have been slipping since then.

Oil markets are pessimistic

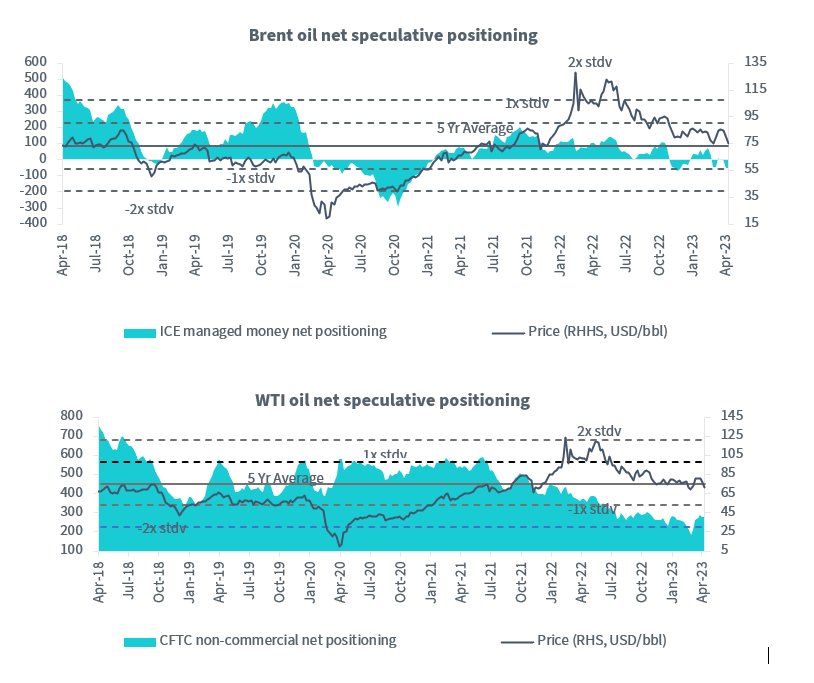

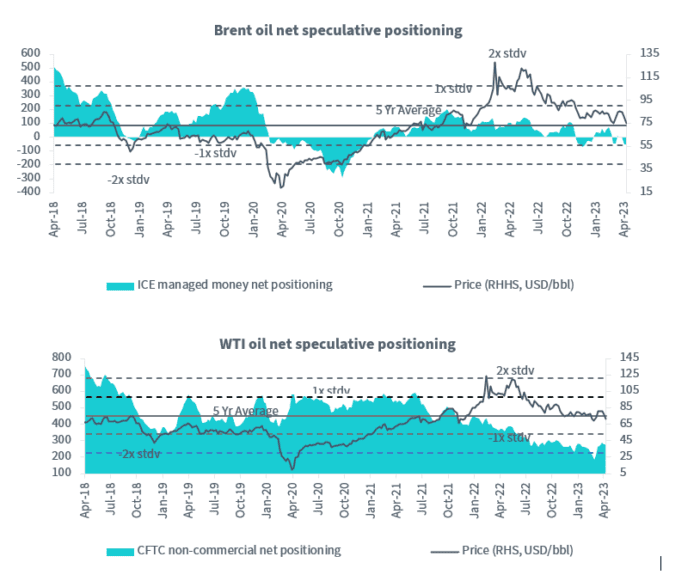

Markets seem to be hyper-focused on the effects of monetary tightening on future oil demand. Hence the pessimism in oil markets. Speculative positioning in Brent and WTI is depressed with Brent net short and WTI positioning more than 1 standard deviation below 5-year average.

Source: Bloomberg, April 2018 – April 2023

Historical performance is not an indication of future performance and any investments may go down in value.

The Bank of England (BOE) shares the US Federal Reserve’s focus on getting inflation back to a range around 2% but, during 2022, inflation in the UK spiked to roughly 11.5% – an overshoot of 9.5%. The rate of inflation is likely to drop smartly but Trevor expects to see more of these episodes with inflation spiking and then falling back, a phenomenon he calls “Spike-flation”.

Inventory draws don’t support this level of pessimism

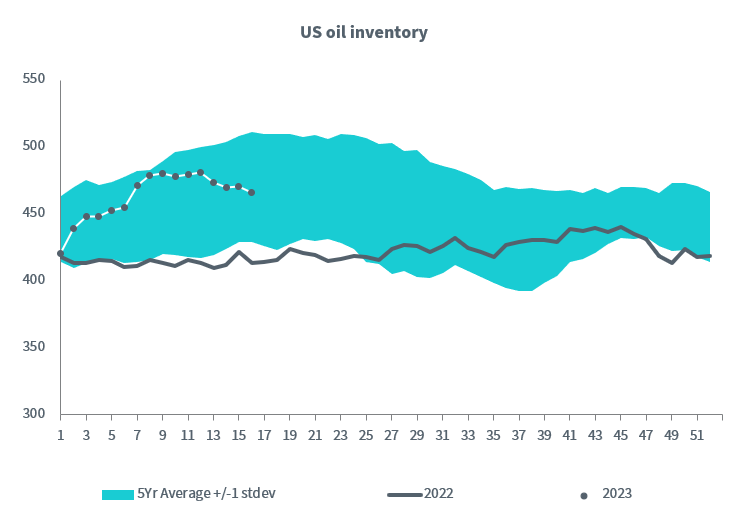

The hard data doesn’t support such level of pessimism. US oil inventory is declining at a rate stronger than seasonal trends would normally dictate and preliminary data for Europe and Japan indicate sizable inventory declines1. In fact, we expect production deficits to continue to eat into inventory for the rest of the year.

Source: Bloomberg, May 2018 – May 2023

Historical performance is not an indication of future performance and any investments may go down in value.

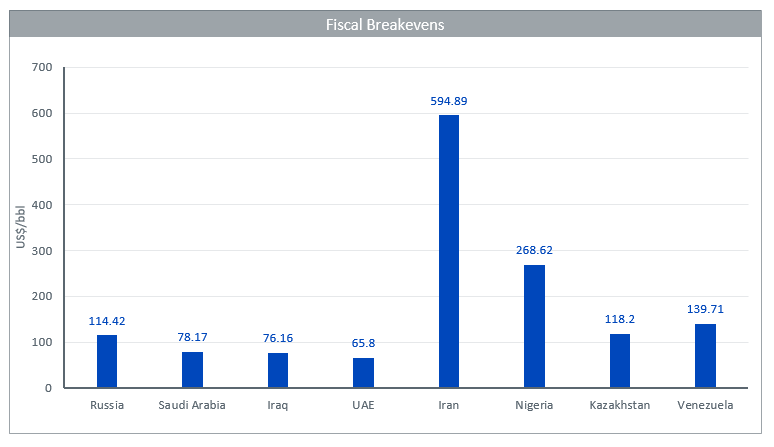

Fiscal breakevens explain OPEC+’s motivations

We believe OPEC+ could follow with another intervention as the group will be disappointed with current prices. Even though the cartel states its purpose of existence is to balance oil markets, the reality is, it is more focused on maintaining relatively high oil prices. Many governments of OPEC+ nations are highly reliant on oil revenues to finance their expenditures. Low oil prices act as a constraint on social expenditure. In fact, the fiscal breakevens – the price of oil needed for governments to balance their expenditures with their revenue – for many OPEC+ countries are significantly higher than where oil is trading today. Oil is currently trading below Saudi Arabia’s estimated fiscal breakeven $78.17/bbl, and that should sharpen the focus of the largest OPEC member on driving prices higher. Most OPEC+ nations do not expect oil prices to reach their fiscal breakevens as that would choke off significant amount of demand. But, as a group have become comfortable with oil trading at close to US$90/bbl. That, we believe, will motivate the OPEC+ group to intervene again at its June 4th meeting.

Source: S&P Global, International Monetary Fund, January 2023.

Historical performance is not an indication of future performance and any investments may go down in value.

Sources:

1 https://www.iea.org/reports/oil-market-report-april-2023

—

Originally Posted May 5, 2023 – What’s Hot: Oil too low for OPEC+’s comfort

Disclosure: WisdomTree Europe

This material is prepared by WisdomTree and its affiliates and is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of the date of production and may change as subsequent conditions vary. The information and opinions contained in this material are derived from proprietary and non-proprietary sources. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by WisdomTree, nor any affiliate, nor any of their officers, employees or agents. Reliance upon information in this material is at the sole discretion of the reader. Past performance is not a reliable indicator of future performance.

Please click here for our full disclaimer.

Jurisdictions in the European Economic Area (“EEA”): This content has been provided by WisdomTree Ireland Limited, which is authorised and regulated by the Central Bank of Ireland.

Jurisdictions outside of the EEA: This content has been provided by WisdomTree UK Limited, which is authorised and regulated by the United Kingdom Financial Conduct Authority.

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from WisdomTree Europe and is being posted with its permission. The views expressed in this material are solely those of the author and/or WisdomTree Europe and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!