Technology Features In Focus

Technology Features in Focus

Features in Focus provide in-depth descriptions and instructions for some of our most popular features.

Filter Category:

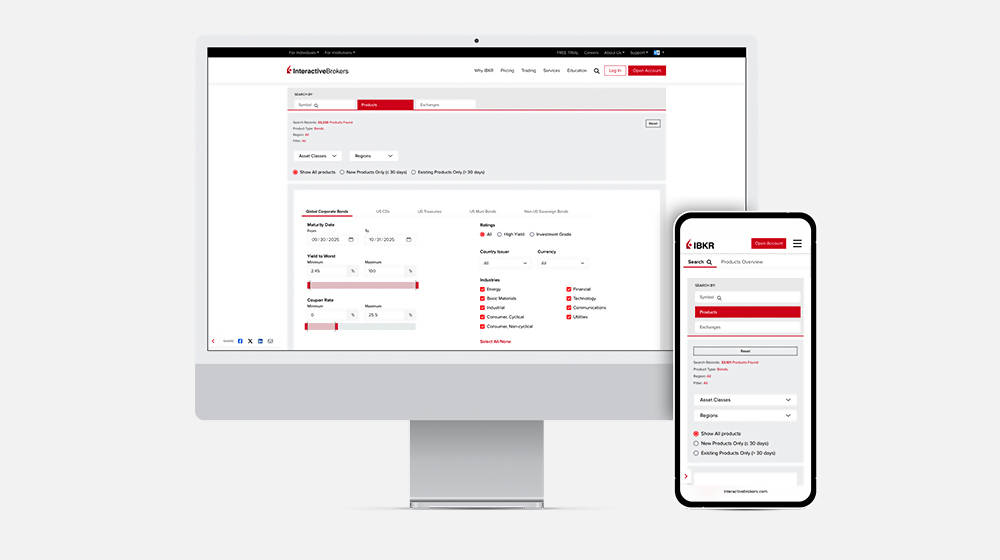

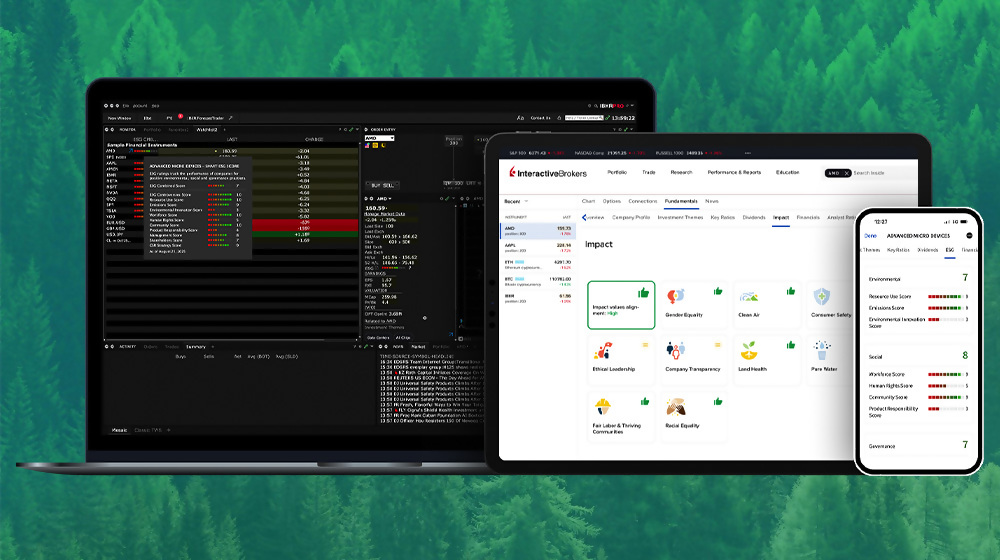

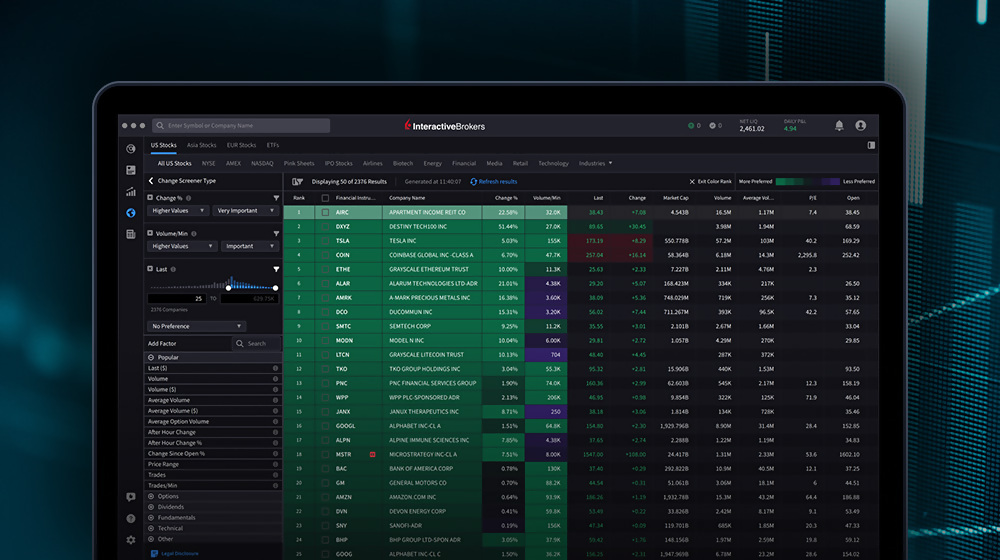

The Best-Informed Investors Choose

Interactive Brokers

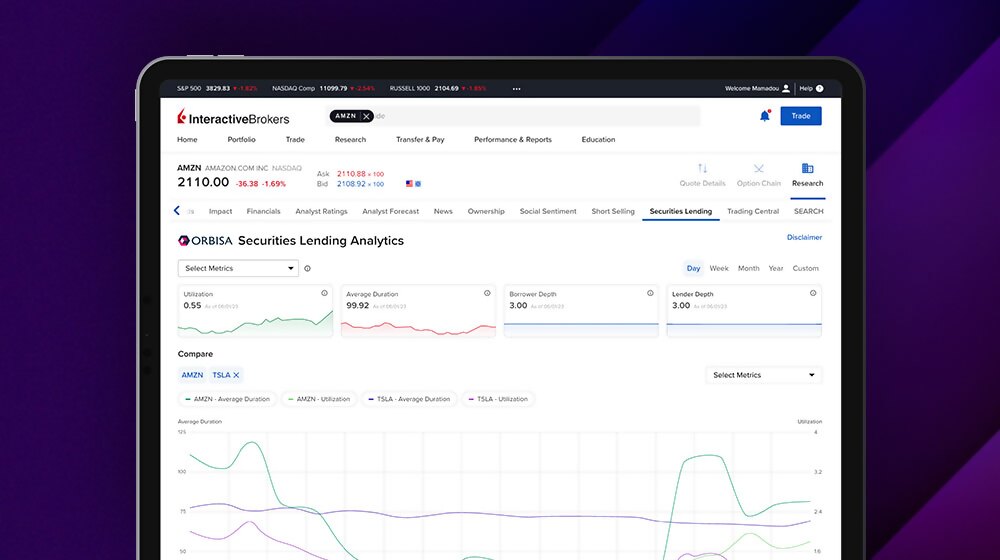

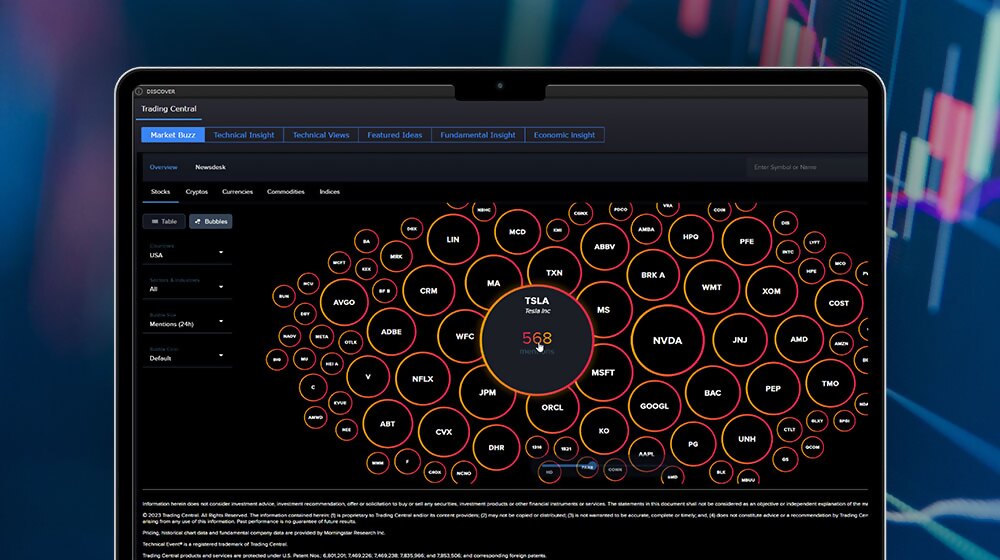

Investors rely on IBKR's suite of advanced tools, including fractional shares, recurring investments, overnight trading hours, Options Wizard and many more. These features give clients transparent execution, complete market visibility, and help them stay one

step ahead.

Disclosures

TRADING IN BITCOIN FUTURES IS ESPECIALLY RISKY AND IS ONLY FOR CLIENTS WITH A HIGH RISK TOLERANCE AND THE FINANCIAL ABILITY TO SUSTAIN LOSSES.

For more information about the risks of trading Bitcoin products, click here.

Mutual Funds are investments that pool the funds of investors to purchase a range of securities to meet specified objectives, such as growth, income or both. Investors are reminded to consider the various objectives, fees, and other risks associated with investing in Mutual Funds. Please read the prospectus accordingly. This communication is not to be construed as a recommendation, solicitation or promotion of any specific fund, or family of funds. Interactive Brokers may receive compensation from fund companies in connection with purchases and holdings of mutual fund shares. Such compensation is paid out of the funds’ assets. However, IBKR does not solicit you to invest in specific funds and does not recommend specific funds or any other products to you. For additional information please view our Mutual Fund Product Listings.

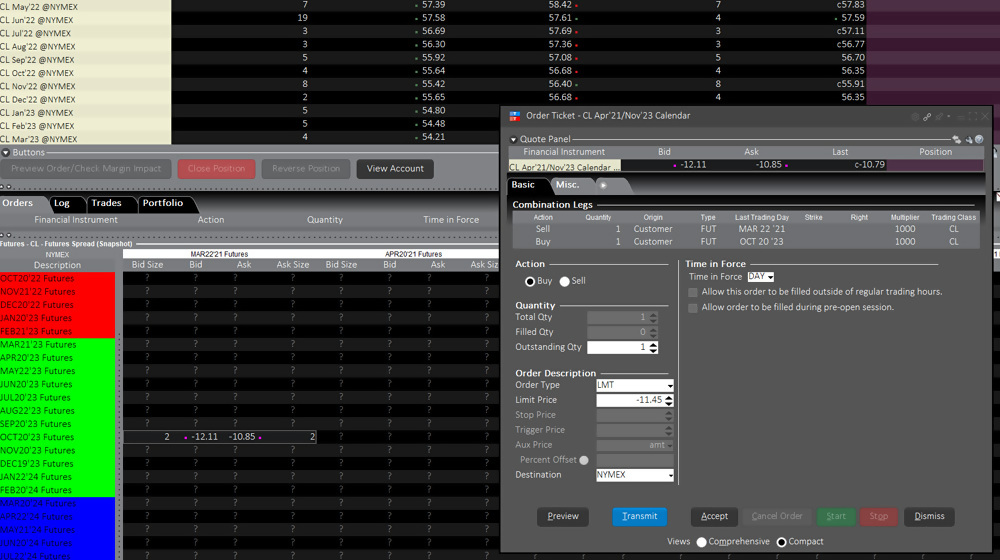

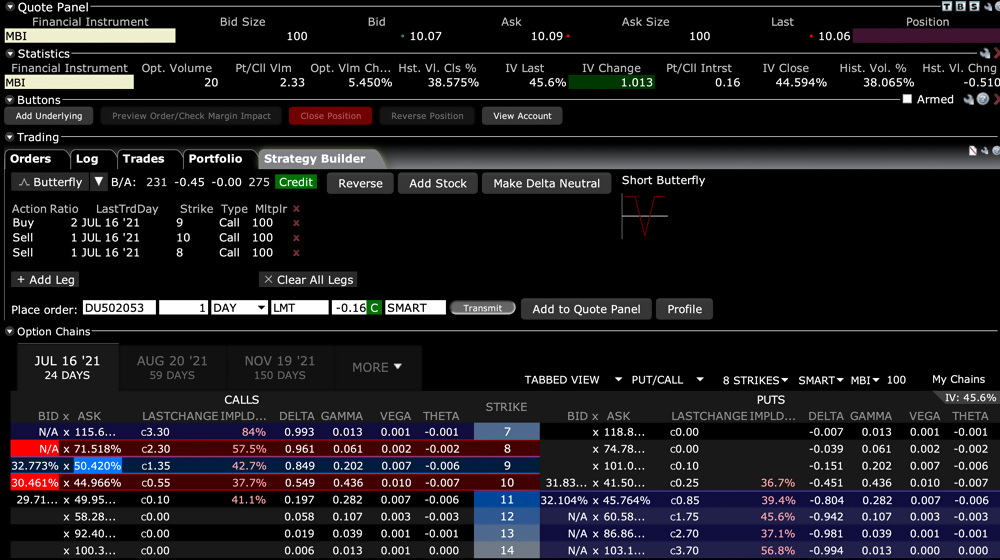

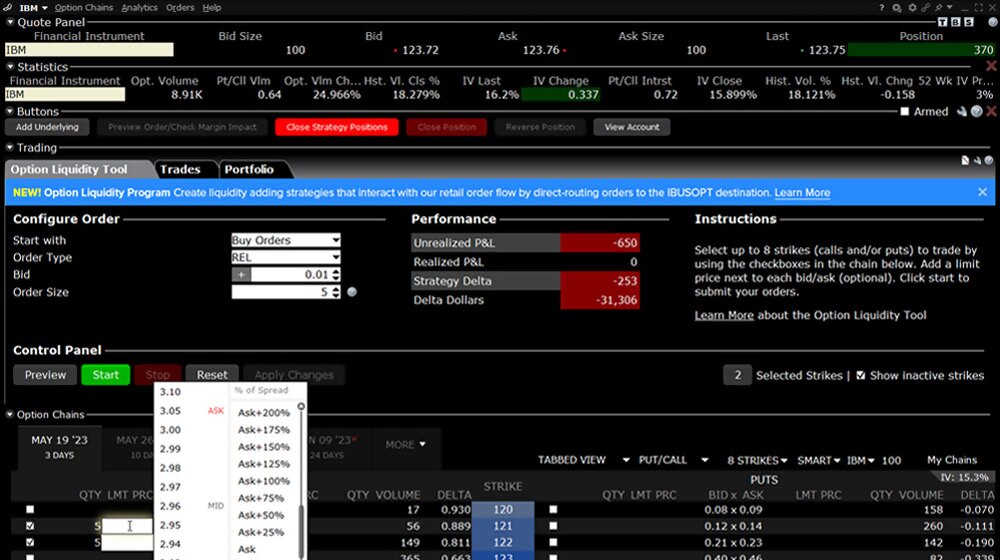

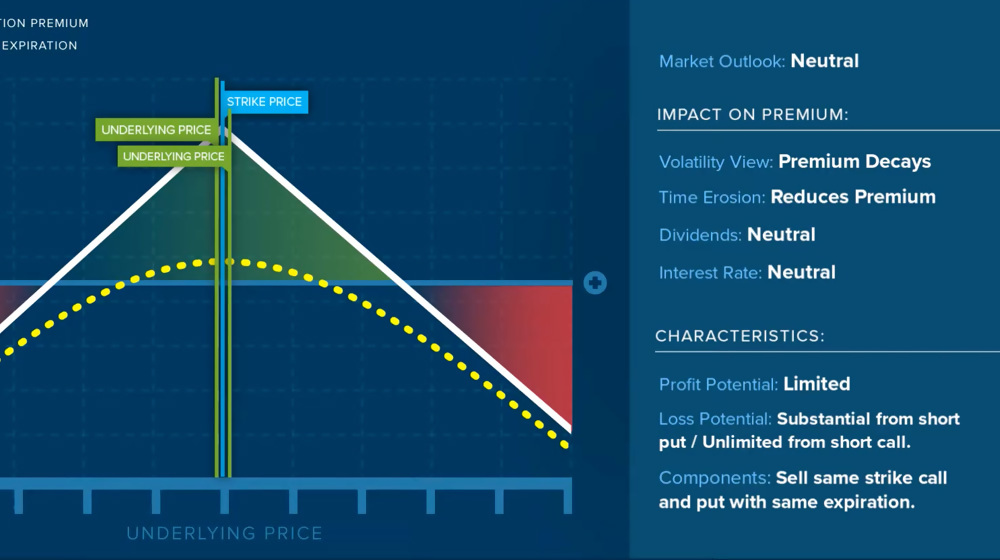

Options and Futures: Options and Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading options read the Characteristics and Risks of Standardized Options. Before trading futures, please read the Security Futures Risk Disclosure Statement.

Any discussion or mention of an ETF is not to be construed as a recommendation, promotion or solicitation. All investors should review and consider associated investment risks, charges and expenses of the investment company or fund prior to investing. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

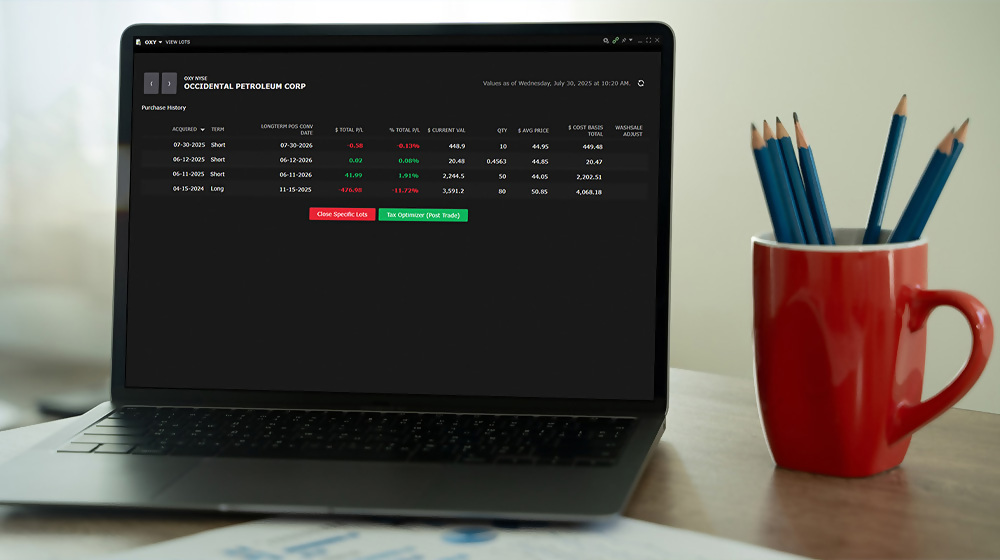

The projections or other information generated by Risk Navigator or Tax Loss Harvesting regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results and are not guarantees of future results. Please note that results may vary with use of the tool over time.

- There is a substantial risk of loss in foreign exchange trading. The settlement date of foreign exchange trades can vary due to time zone differences and bank holidays. When trading across foreign exchange markets, this may necessitate borrowing funds to settle foreign exchange trades. The interest rate on borrowed funds must be considered when computing the cost of trades across multiple markets.

-

The information provided here is not intended to serve as tax advice and should not be used by the recipient or any other taxpayer to avoid penalties under any federal, state, local, or other tax statutes or regulations. It is also important to acknowledge that this information cannot be relied upon to resolve any tax issues.

IBKR does not provide legal or tax advice and nothing in this Tax Loss Harvesting Tool should be construed as tax advice. The Tax Loss Harvesting Tool is designed to simplify your calculation of the potential tax benefits of selling securities subject to a loss and, if you choose, replacing them with other securities you select. Tax laws are complex and subject to change. Capital gains are not taxed in all jurisdictions and thus the Tax Loss Harvesting Tool may not be suitable for tax residents of certain jurisdictions. You should consider consulting a tax advisor to determine your specific situation.

IBKR PROVIDES THE TAX LOSS HARVESTING TOOL FOR INFORMATIONAL PURPOSES ONLY. IT IS FACTUAL IN NATURE, IT DOES NOT CONSIDER THE USER’S PERSONAL CIRCUMSTANCES, AND IT IS NOT INTENDED AS A RECOMMENDATION THAT YOU BUY OR SELL ANY SECURITIES OR AN OFFER OR SOLICITATION TO BUY OR SELL SECURITIES. It does not consider positions you may hold or transactions you may undertake in other accounts (including those at IBKR) and the effect they would have on any transaction undertaken with the Tax Loss Harvesting tool.

The Tax Loss Harvesting Tool seeks to maximize either short term or long term losses, as selected by you within the tool, and will override any default tax lot matching method otherwise applicable to you or your account settings. Where “any position with a capital loss” is selected, the Tax Loss Harvesting Tool seeks to maximize any losses.

Non-US residents should be aware that the Tax Loss Harvesting tool differentiates between short term versus long term capital losses based on IRS definitions which apply to US residents; similarly, the application of wash sale rule is also based on IRS definitions and apply to US residents.

IBKR does not provide any warranty, expressed or implied, regarding the accuracy of the data or results obtained by its use and disclaims any liability arising out of your use of it. IBKR does not warrant that the assumptions are accurate for your particular circumstances.

The information provided as part of the Tax Loss Harvesting Tool should not be used to determine your tax liability, if any. The Tax Loss Harvesting Tool is not intended to be used for the purpose of avoiding any penalty that may be imposed by any taxation authority.

By using the Tax Loss Harvesting Tool, you agree that you have read and understand the above disclaimers and limitations of liability and that you will not seek to hold IBKR liable for any claim or cause of action arising from your use of Tax Loss Harvesting.

TAX TREATMENT DEPENDS ON INDIVIDUAL CIRCUMSTANCES AND MAY BE SUBJECT TO CHANGE IN THE FUTURE