Tax Loss Harvesting

ADVISOR TOOLS

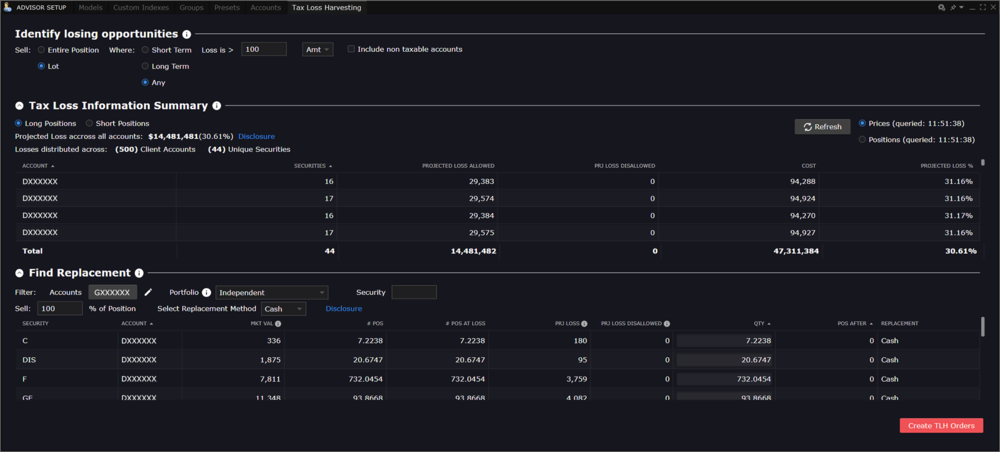

Tax Loss Harvesting

Harvest capital losses to offset clients’ capital gains

IBKR’s Tax Loss Harvest tool helps financial advisors to potentially reduce their clients’ tax liability by easily harvesting losses across multiple assets for multiple clients at the same time.

Key Features and Benefits

- Continuously watch for and identify opportunities to minimize taxes.

- Simultaneously identify stocks (long or short) with unrealized losses across all client accounts.

- Find suggested replacement securities and easily allocate the proceeds into chosen replacement stocks.

- Identify losses and transact at the lot level, not just at the entire position level. This can be beneficial in instances where the security has overall gains, but has some lots that are at a loss.

- Immediately know what portion of projected losses will be allowed losses versus disallowed losses. The IRS has strict wash-sale rules that affect how much of the losses are permissible.

Investors can also proactively manage gains and losses by changing the tax-lot matching method using the IBKR Tax Optimizer.

Visit the Tax Information and Reporting FAQs for more helpful tax resources.

USER GUIDES

Get Started with Tax Loss Harvesting

For more information on Tax Loss Harvesting, select your trading platform.

Disclosures

The projections or other information generated by Tax Loss Harvesting or Tax Optimizer regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results and are not guarantees of future results. Please note that results may vary with use of the tool over time.

The information provided here is not intended to serve as tax advice and should not be used by the recipient or any other taxpayer to avoid penalties under any federal, state, local, or other tax statutes or regulations. It is also important to acknowledge that this information cannot be relied upon to resolve any tax issues.

IBKR does not provide legal or tax advice and nothing in this Tax Loss Harvesting Tool should be construed as tax advice. The Tax Loss Harvesting Tool is designed to simplify your calculation of the potential tax benefits of selling securities subject to a loss and, if you choose, replacing them with other securities you select. Tax laws are complex and subject to change. Capital gains are not taxed in all jurisdictions and thus the Tax Loss Harvesting Tool may not be suitable for tax residents of certain jurisdictions. You should consider consulting a tax advisor to determine your specific situation.

IBKR PROVIDES THE TAX LOSS HARVESTING TOOL FOR INFORMATIONAL PURPOSES ONLY. IT IS FACTUAL IN NATURE, IT DOES NOT CONSIDER THE USER’S PERSONAL CIRCUMSTANCES, AND IT IS NOT INTENDED AS A RECOMMENDATION THAT YOU BUY OR SELL ANY SECURITIES OR AN OFFER OR SOLICITATION TO BUY OR SELL SECURITIES. It does not consider positions you may hold or transactions you may undertake in other accounts (including those at IBKR) and the effect they would have on any transaction undertaken with the Tax Loss Harvesting tool.

The Tax Loss Harvesting Tool seeks to maximize either short term or long term losses, as selected by you within the tool, and will override any default tax lot matching method otherwise applicable to you or your account settings. Where “any position with a capital loss” is selected, the Tax Loss Harvesting Tool seeks to maximize any losses.

Non-US residents should be aware that the Tax Loss Harvesting tool differentiates between short term versus long term capital losses based on IRS definitions which apply to US residents; similarly, the application of wash sale rule is also based on IRS definitions and apply to US residents.

IBKR does not provide any warranty, expressed or implied, regarding the accuracy of the data or results obtained by its use and disclaims any liability arising out of your use of it. IBKR does not warrant that the assumptions are accurate for your particular circumstances.

The information provided as part of the Tax Loss Harvesting Tool should not be used to determine your tax liability, if any. The Tax Loss Harvesting Tool is not intended to be used for the purpose of avoiding any penalty that may be imposed by any taxation authority.

By using the Tax Loss Harvesting Tool, you agree that you have read and understand the above disclaimers and limitations of liability and that you will not seek to hold IBKR liable for any claim or cause of action arising from your use of Tax Loss Harvesting.