The stock market has decided to take a mulligan. We started off quite positively when global markets seemed far less perturbed by the President’s comments about the Fed Chair than domestic investors were. FOMO remains a key motivator, so any whiff of a potential rally is greeted with an exuberant response. And the latest leg of the rally is understandable after Treasury Secretary Bessent described the China tariff situation as unsustainable. We’ll see if today’s enthusiasm carries through Tesla’s (TSLA) earnings report after today’s close.

While Nvidia (NVDA) seems to have surpassed TSLA as the mindshare leader among active traders, TSLA remains a key name, nonetheless. Furthermore, the company has become a political lightning rod, thanks to Elon Musk’s key role at the Department of Government Efficiency (DOGE). Global vehicle sales fell 13% in the first quarter, the biggest drop in the company’s history, bringing them back to levels not seen since 2022. Some of the decline could be attributed to the CEO’s partisan politics, which alienated some potential buyers, while the company blamed the need to temporarily suspend production ahead of a planned Model Y refresh. Yet some sales concerns could stem from Musk seeming to spend more time in D.C. and environs than in his car factories. While his role at DOGE is widely believed to be temporary, with President Trump saying, “at some point, he’s going to be going back [to his companies]. He wants to…”, TSLA investors will be eager to learn whether that return is imminent.

Remember, a key element of TSLA’s very rich valuation is its futurism. The stock wouldn’t sport a triple-digit P/E if it was being valued strictly as an auto company. Hopes for robotaxis, robotics, and other inventions play an integral part in that valuation, and frankly, a visionary who is busy with the day-to-day mechanics of government bureaucracy is highly unlikely to be simultaneously making concrete progress toward those corporate goals. Musk has a unique ability to refocus investors on those elements of futurism if a particular quarter comes up short. His credibility about being able to deliver on his promises will be far greater if he commits to returning to TSLA soon.

Market expectations are for EPS of about $0.41 on revenues of $21.3 billion. Compared to the year ago quarter, the latter number is flat while the former is less than the prior $0.45. To my mind those seem a bit optimistic in light of the previously reported declines in deliveries, but I will defer to the analysts who regularly cover the company. Besides, the point of this piece is to suss out how options traders might be positioned ahead of the results, not come up with our own estimates.

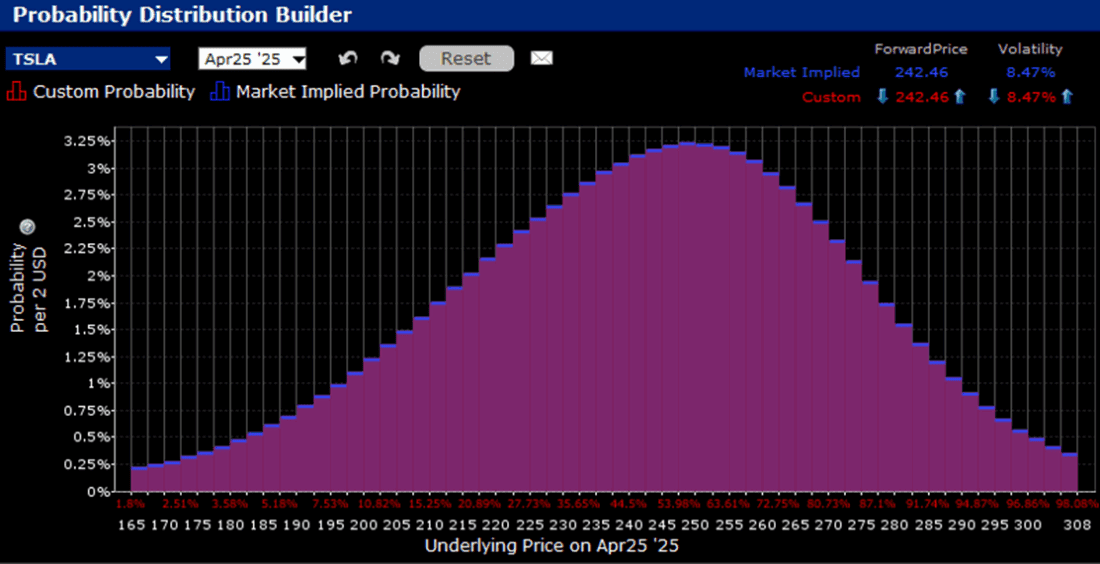

After yesterday’s -5.7% decline, giving it a -43% year-to-date drop, one might have been concerned that sentiment has gotten too negative. Today’s 6.2% rise, which recouped all of yesterday’s drop, seems to have relieved some of the short-term pressure, if not the medium-term disappointment. As such, we see from the IBKR Probability Lab that the peak expectation for options expiring this Friday is in the $248-250 range, about 3-4% above the current stock price. Traders are showing some belief that TSLA could be oversold ahead of the report:

IBKR Probability Lab for TSLA Options Expiring Friday, April 25th, 2025

Source: Interactive Brokers

That said, it is not as though traders have ignored potential downside risks. We see a relatively steep downside skew in near-term options, indicating that many are willing to pay elevated prices for below-market options.

Skews for TSLA Options Expiring April 25th (top), May 2nd (middle), May 16th (bottom)

Source: Interactive Brokers

The risk aversion, however, is not reflected in at-money implied volatility. Friday’s options sport a daily volatility of about 9%, which is well below the recent average post-earnings move of 11.8% (+2.87%, +21.92%, -12.33%, 12.06%, -12.13%, -9.30%). Perhaps the most recent humdrum move is playing an outsized role in traders’ expectations for tomorrow’s reaction.

Bottom line: we see some risk aversion, but also a fair degree of positivity. Whether that is based upon actual results, futurism, or simply the CEO’s potential return to the office remains to be seen.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!

Leave a Reply

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.

“Some of the decline could be attributed to the CEO’s partisan politics, which alienated some potential buyers,” sounds just like the Yahoo comments section. Would this comment be used to justify the unlawful acts by the left against private owners or the Tesla corporation? I am interested in your financial acumen without any of your political bias, so leave those comments out of your newsletters please.

“Hopes for robotaxis, robotics, and other inventions play an integral part in that valuation,” sounds just like the Yahoo comments section. Would this comment be used to justify the unlawful acts by the left against private owners or the Tesla corporation? I am interested in your financial acumen without any of your futurism bias, so leave those comments out of your newsletters please.

It absolutely alienated at least some buyers. Did you not see the protests, boycotts, vandalism, criminal arrests, etc occurring? Musk has even publicly spoken about it. That is not a political statement.

This whole 3 month presidency has been an exercise in political bias. It has affected every facet of the economy and society. Enough with the feigned ignorance and selective scrutiny.

I don’t think his questionable salute at the inauguration helped him much. Having lost their lead position to Chinese EVs, the tariffs from Trump. I really can’t see anything positive from such an overvalued stock. But they clearly rallied despite a huge earnings miss and lack of guidance. Most of it just because Trump decided against firing Powell after he saw the market reaction to his criticism of the Fed.