There has been no shortage of commentators, including this one, who have drawn parallels between the internet bubble at the turn of the century and today’s financial markets. Then, as now, we had a quantum leap forward in investor access (thanks to the advent of web-based trading) and an accommodative Federal Reserve (hoping to avoid a Y2K crisis). This morning, a series of headlines caused me to draw parallels to an earlier period of frothy stock markets – the late 1980’s

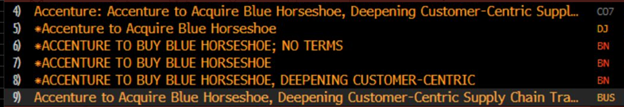

Fans of the movie Wall Street will recognize the significance of these headlines immediately:

Source: Bloomberg

In that movie, the phrase “Blue Horseshoe Loves Anacott Steel” was a code devised by Gordon Gekko (played by Michael Douglas) for use by Bud Fox (Charlie Sheen) to signal insider trading.[i] Popular movies often reflect the zeitgeist of the time, and the combination of Wall Street riches and insider trading were very much in the news then.[ii] Corporate raiders like Ivan Boesky and their enablers like Michael Milken were household names, especially when they met their downfall at the hands of prosecutors like Rudy Giuliani.

I started in the business full time in 1987. I had done internships at the now-departed firms of L.F. Rothschild and Salomon Brothers, but joined the famed Salomon training class in in January 1987. It was such raging bull market that the firm had begun running two classes a year. That allowed me to defer my start date and to instead spend the summer traveling through Asia and Australia. My classmates and I had no way of knowing that we were witnessing the end of an era.

Salomon Brothers was first and foremost a bond trading powerhouse, and it was fascinating to see the different moods between the bond and equity floors. The stock traders were ascendant, riding a giant bull market and a wave of innovation in derivatives[iii]. Meanwhile, after an astounding run of success, bond traders began to realize that they were enmeshed in a terrible bear market. After about 5 years of moving in relative lockstep, stock prices continued to advance while bond prices reversed course and began to fall sharply. We knew there was a major disconnect, but equity market momentum is a tough thing to fight – then as now. I finished my training in late summer, just as the cracks began to show in earnest. Some major pension funds recognized the cracks and made significant changes to their asset allocations. They sold highly valued stocks and used the proceeds to buy bonds whose yields had risen substantially. It was a great trade for those funds, and put a lid on stocks’ advance.

As we did in the ‘80s, stock traders have begun to pay attention to the bond market. But the message is quite different this time. Over the past year bond yields rose steadily, on the idea that an economic recovery would take root. That is indeed good for stocks and less so for bonds. Since April, however, bond yields have fallen consistently while stocks continued to rise. Some of the drop in yields could have been because they overshot during the winter, some could be because the pace of economic recovery might be slower than anticipated. The mindset has flipped to the idea that economic weakness is also OK for stocks – at least growth stocks – because the Fed will keep the liquidity flowing. Heads, I win; tails, I also win. Remember, equity market momentum is a tough thing to fight.

1 Year Chart, 10-Year Treasury Yields (white) vs. S&P 500 (SPX, blue)

Source: Bloomberg

Bonds had a volatile morning, as yields initially plunged on a light ADP number and a lighter government issuance calendar, then jumped on comments from Fed Vice Chair Clarida. We can see a nearly 10 basis point range in the intraday chart below. Yet during these gyrations, major stock indices stayed at the lower levels seen during overnight trading:

1 Day Chart, 10-Year Treasury Yields

Source: Bloomberg

I wish that I could say that the confluence of the ‘80s movie reference and the gyrations in bond yields could offer a meaningful signal. Sorry, I can’t. But we are approaching a tricky season for markets, one that proved to be especially treacherous in 1987 and other years. Over the next month or two, will stock markets be able to shrug off the effects of a debt ceiling limit, a Jackson Hole conference and FOMC meeting that could offer clues to changing Fed conduct, and the end of a student loan moratorium? We’ll know the answer soon enough, I suppose. In the meantime, I’ll be really glad that my cell phone fits in my pocket rather than being the size of a brick.

—

[i] Let me state for the record that I have no reason to believe that Accenture (ACN) acted in any manner that was illegal. And while I have no evidence that the principals at Blue Horseshoe were fans of the movie, they had to have been aware of the connection.

[ii] I realize now that it is rather interesting that there is far less popular media involving Wall Street like there was in the ‘80s or early ‘00s. Perhaps it is because it is difficult to depict drama watching traders who watch screens rather than shout loudly.

[iii] One of those innovations was “portfolio insurance”, which centered on the concept that portfolio managers could sell futures in down markets to hedge their stock holdings. It later became one of the reasons for the market crash, when too many traders tried to sell too many futures in a belated attempt to hedge.

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!