Tax Information and Reporting - FX P&L | Interactive Brokers LLC

TAX INFORMATION AND REPORTING

Forex Profit & Loss

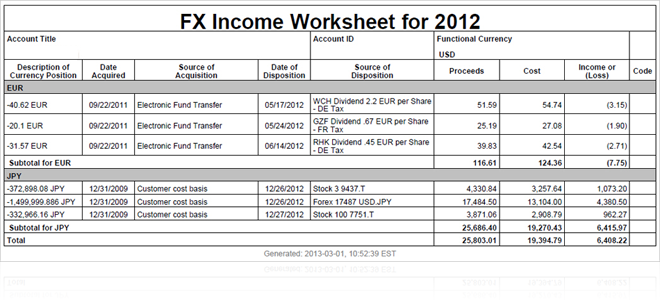

Forex Income Worksheet

The Forex Income Worksheet is an annual worksheet that provides income and loss information from your completed currency transactions for the year. The Worksheet lists income and loss from nonfunctional currency transactions, including forex trades, trades in securities denominated in a nonfunctional currency, debit and credit interest and other nonfunctional currency transactions.

Forex Income and Loss

The US Internal Revenue Service (IRS) requires that forex income and loss be calculated based on First In, First Out (FIFO) matching. The Forex Income Worksheet includes income and loss data from closed forex spot trades and closed securities trades denominated in a nonfunctional currency.

The forex income and loss information included on the Forex Income Worksheet is based on the following rules:

- Any transaction that changes the balance of a nonfunctional currency is considered a forex transaction against your functional currency. This includes but is not limited to forex trades, deposits, withdrawals, securities purchases and sales, dividends and interest.

- A nonfunctional currency cross-currency trade is recognized as two trades against your functional currency.

- The worksheet shows all closed forex transactions; that is, forex transactions that result in income or loss.

- All forex income and loss is reported in USD for 1099-eligible clients and in the base currency for all other clients.

The US IRS recognizes forex income and loss on a settlement date basis, but IBKR calculates forex income and loss on a trade date basis. This requires adjustments to be made, and you will see these adjustments on the Forex Income Worksheet.

Acquisitions and Dispositions

The Worksheet includes detailed information about the acquisition and disposition of each nonfunctional currency transaction that closed in the year just ended. Each acquisition can be either a forex spot trade or a trade in securities denominated in a nonfunctional currency, a dividend or interest payment or other nonfunctional currency transaction.

- The sale of a security in a nonfunctional currency is considered an acquisition of that currency.

- The purchase of a security in a nonfunctional currency is considered a disposition of that currency.

For example, a completed forex transaction might be the purchase of 100 CAD, followed by purchase of a Canadian stock for 100 CAD on the next day. The first transaction, the purchase of CAD, is considered an acquisition of 100 CAD. The second transaction, the purchase of Canadian stock, is considered a disposition of 100 CAD.

Forex Income and Loss Example

The following example shows a typical sequence of forex transactions and securities trades denominated in nonfunctional currencies, explains how the income and loss for those transactions is calculated, and shows how the transactions are recorded on the Forex Income Worksheet.

In this example, our series of trades begins with a simple forex spot trade for CAD, followed by the purchase of GBP for CAD. This is followed by the purchase of 20 shares of Rolls Royce stock for GBP, then by an adjustment due to changes in the exchange rate. We then sell the stock, close out the GBP position, and make another adjustment.

1/2/2012 Activity

| Activity Date | Activity | Exchange Rate | Cost or Proceeds in USD |

|---|---|---|---|

| 1/2/2012 | Buy 15,000 CAD. | USD.CAD = 1.5 | Cost = 10,000 |

| Summary | Opened position of 15,000 CAD on 1/2/12 |

This is a forex spot trade for 15,000 Canadian dollars (CAD). Since the exchange rate is 1 USD = 1.5 CAD, this purchase cost 10,000 USD. The trade results in an open position of 15,000 CAD and because there is no income or loss realized, there is no line item added to the Forex Income Worksheet for this transaction.

1/3/2012 Activity

| Activity Date | Activity | Exchange Rate | Cost or Proceeds in USD |

|---|---|---|---|

| 1/3/2012 | Sell 15,000 CAD for GBP 8,000 | GBP.CAD = 1.875 | |

| Summary | Closed position of 15,000 CAD on 1/3/12 | USD.CAD = 1.25 | Proceeds = 12,000 |

| Summary | Opened position of 8,000 GBP on 1/3/12 | GBP.USD = 1.5 | Cost = 12,000 |

For purposes of calculating income and loss, the exchange of CAD for GBP is treated as two separate transactions, both against the functional currency USD. On the Forex Income Worksheet however, the closing transaction is shown as a single line item. Summarizing this transaction, a CAD position was closed and the income or loss that appears on the worksheet is your functional currency (USD) equivalent of that closed position.

Here are the details:

- First, the position of 15,000 CAD is closed on 1/3/12. For purposes of calculating income or loss, this part of the transaction is treated as an exchange of CAD for USD, resulting in proceeds of 12,000 USD (the exchange rate is USD.CAD = 1.25). The proceeds from this part of the trade are 12,000 USD and the resulting 2000 USD income appears on the worksheet.

- The second part of the transaction involves exchanging the 12,000 USD for 8,000 GBP on 1/3/12. You now have an open position of 8,000 GBP and the CAD position has been closed. This is listed as an acquisition of GBP and a disposition of CAD on the Forex Income Worksheet.

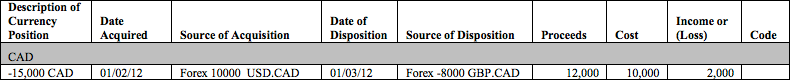

On the worksheet, the transaction appears as follows:

- Description of Currency Position (always on the closing side of the transaction): −15,000 CAD. This represents the 15,000 CAD that were sold.

- Date Acquired: 1/2/2012.

- Source of Acquisition: Forex 10000 USD.CAD. This represents the original spot trade of 15,000 CAD for 10,000 USD.

- Date of Disposition: 1/3/2012.

- Source of Disposition: Forex -8000 GBP.CAD. This represents the closing of the 15,000 CAD position.

- Proceeds = 12,000 USD. These are the proceeds from closing the 15,000 CAD position.

- Cost = 10,000 USD. This is the cost of the original purchase of CAD.

- Income or Loss: Income = 2,000 USD (Proceeds – Cost).

1/4/2012 Activity

| Activity Date | Activity | Exchange Rate | Cost or Proceeds in USD |

|---|---|---|---|

| 1/4/2012 | Buy 20 shares of Rolls Royce for GBP 20,000 | ||

| Summary | Closed position of 8,000 GBP on 1/4/2012 | GBP.USD = 1.75 | Proceeds = 14,000 |

| Summary | Opened a short position of 12,000 GBP | GBP.USD = 1.75 | Cost = 12,000 Proceeds = 21,000 (not reported yet) |

| Summary | Opened position of 20 shares of Rolls Royce stock for 35,000 USD |

In this transaction, 20 shares of Rolls Royce stock were bought for 20,000 GBP, which means that we essentially used the 8,000 GBP bought on 1/3/2012, and borrowed the remaining 12,000 GBP. For purposes of calculating income and loss, we consider the 20,000 GBP as 35,000 USD. For purposes of calculating income or loss, this is treated as three separate transactions, including two forex transactions and one stock transaction, all against the functional currency USD. On the Forex Income Worksheet however, the closing transaction is shown as a single line item. Summarizing the transaction, a GBP position was closed and the income or loss that appears on the worksheet is your functional currency (USD) equivalent of that closed position.

Here are the details:

- The 8,000 GBP was exchanged for 14,000 USD, closing the position of 8,000 GBP (the exchange rate is GBP.USD = 1.75). The proceeds from this part of the trade are 14,000 USD and the resulting 2000 USD income appears on the worksheet.

- To buy 20 shares of Rolls Royce, we need 20,000 GBP, so we borrow 12,000 GBP (12,000 + the original 8,000).

- We sell the 12,000 GBP for 21,000 USD. (When this transaction is reported on the worksheet, the proceeds are 21,000 USD.)

- For tax purposes, the position of 20 shares of Rolls Royce was bought for 35,000 USD (subject to adjustment). In actuality, the shares of Rolls Royce cost 20,000 GBP (using the 8,000 GBP we already had plus the borrowed 12,000 GBP).

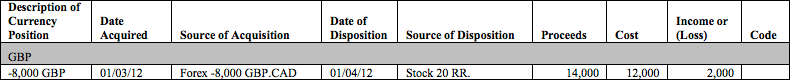

On the worksheet, the transaction appears as follows:

- Description of Currency Position: −8,000 GBP. This represents the 8,000 GBP that were sold.

- Date Acquired: 1/3/2012.

- Source of Acquisition: Forex -8000 GBP.CAD. This represents the purchase of 8,000 GBP.

- Date of Disposition: 1/4/2012.

- Source of Disposition: Stock 20 RR. This represents the closing of the 8,000 GBP position.

- Proceeds = 14,000 USD. These are the proceeds from closing the 8,000 GBP position.

- Cost = 12,000 USD. The cost of the borrowed GPB.

- Income or Loss: Income = 2,000 USD (Proceeds – Cost).

1/9/2012 Activity

| Activity Date | Activity | Exchange Rate | Cost or Proceeds in USD |

|---|---|---|---|

| 1/9/2012 | Adjust closing proceeds for the sale of the 8,000 GBP | GBP.USD = 2.0 | Adjustment to Proceeds = 2,000 |

| 1/9/2012 | Adjust proceeds for the open −12,000 GBP position. | GBP.USD = 2.0 | Adjustment to Proceeds = 3,000 (adjustment made after transaction closes) |

By the settlement date of 1/9/2012 for the closing transaction of 8,000 GBP, the exchange rate was GBP.USD = 2.00, so an adjustment must be made to the closing proceeds for the 8,000 GBP and for the proceeds of the short 12,000 GBP position. A similar adjustment is made to the basis of the Rolls Royce stock position, but that adjustment is reported elsewhere.

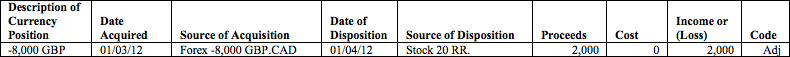

On the worksheet, the adjustment to the closed GBP position appear on its own line as follows:

- Description of Currency Position: −8,000 GBP. This represents the 8,000 GBP that were sold.

- Date Acquired: 1/3/2012.

- Source of Acquisition: Forex -8000 GBP.CAD. This represents the purchase of 8,000 GBP.

- Date of Disposition: 1/4/2012.

- Source of Disposition: Stock 20 RR. This represents the closing of the 8,000 GBP position.

- Proceeds = 2,000 USD. The proceeds from the sale of GBP are adjusted by 2,000 USD.

- Cost = 0 USD. There is no adjustment to the cost.

- Income or Loss: Adjustment to Income = 2,000 USD.

- Code: Adj.

The second adjustment has not been reported yet.

1/10/2012 Activity

| Activity Date | Activity | Exchange Rate | Cost or Proceeds in USD |

|---|---|---|---|

| 1/10/2012 | Sell 20 shares of Rolls Royce for 25,000 GBP | ||

| Summary | Closed short position of 12,000 GBP | GBP.USD = 1.6 | Cost = 19,200 |

| Summary | Open a position of 13,000 GBP | GBP.USD = 1.6 | Cost = 20,800 |

On 1/10/2012, we sold the 20 shares of Rolls Royce for 25,000 GBP. For purposes of calculating income or loss, we closed the short position of 12,000 GBP, which cost 19,200 USD, then opened a long position of 13,000 GBP for a cost of 20,800 (the exchange rate is GBP.USD = 1.6).

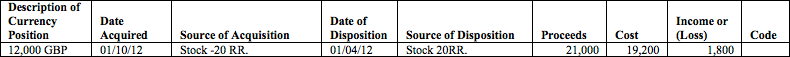

On the worksheet, the closing of the short position of 12,000 GBP appears on its own line as follows:

- Description of Currency Position: 12,000 GBP. This represents the short GBP position that was closed.

- Date Acquired: 1/10/2012.

- Source of Acquisition: Stock -20 RR. This represents the original purchase of the stock.

- Date of Disposition: 1/4/2012.

- Source of Disposition: Stock 20 RR. This represents the sale of the stock.

- Proceeds = 21,000 USD. These are the proceeds from the short sale of the 12,000 GBP.

- Cost = 19,200 USD. This is the cost of covering the short sale of the 12,000 GBP.

- Income or Loss: Income = 1,800 USD.

1/13/2012 Adjustment

| Activity Date | Activity | Exchange Rate | Cost or Proceeds in USD |

|---|---|---|---|

| 1/13/2012 | Adjust closing cost for the short sale of the 12,000 GBP | GBP.USD = 1.5 | Adjustment to Cost = −1,200 Adjustment to Proceeds = 3,000 |

| 1/13/2012 | Adjust cost for the open 13,000 GBP position (not reported yet) | GBP.USD = 1.5 | Adjustment to Cost = −1,300 |

By the settlement date of 1/10/2012 for the closing transaction of the short position of 12,000 GBP, the exchange rate was GBP.USD = 1.50, so an adjustment must be made to the closing cost for the short 12,000 GBP and for the cost of the open 13,000 GBP position.

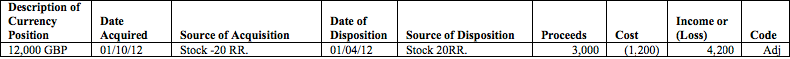

On the worksheet, the adjustment to the closed GBP position appear on its own line as follows:

- Description of Currency Position: 12,000 GBP.

- Date Acquired: 1/10/2012.

- Source of Acquisition: Stock -20 RR. This represents the sale of the stock for the 12,000 GBP needed to close the GBP short position.

- Date of Disposition: 1/4/2012.

- Source of Disposition: Stock 20 RR. This represents the purchase of the stock, which is also the disposition of the 12,000 GBP.

- Proceeds = 3,000 USD. This is the adjustment of the short sale of GBP from 1/9/2012 that had not yet been reported.

- Cost = −1,200 USD. This is the adjustment to the cost of the short sale of GBP.

- Income or Loss: Adjustment to Income = 4,200 USD.

- Code: Adj.

1/16/2012 Activity

| Activity Date | Activity | Exchange Rate | Cost or Proceeds in USD |

|---|---|---|---|

| 1/16/2012 | Closed the 13,000 GBP position | ||

| Summary | Exchanged 13,000 GBP for 18,200 USD. | GBP.USD = 1.4 | Proceeds = 18,200 |

On 1/16/2012, we sold the 13,000 GBP for 18,200 USD. The transaction results in a loss of 2,600 USD.

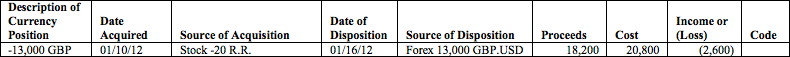

On the worksheet, the closing of the position of 13,000 GBP appear on its own line as follows:

- Description of Currency Position: -13,000 GBP. This represents the closed GBP position.

- Date Acquired: 1/10/2012.

- Source of Acquisition: −Stock 20 RR. This represents the sale of the stock for GBP.

- Date of Disposition: 1/16/2012.

- Source of Disposition: Forex 13,000 GBP.USD. This represents the closing of the 13,000 GBP position.

- Proceeds = 18,200 USD. These are the proceeds from the sale of the 13,000 GBP.

- Cost = 20,800 USD. This was the cost of acquiring the 13,000 GBP.

- Income or Loss: Loss = 2,600 USD.

1/16/2012 Adjustment

| Activity Date | Activity | Exchange Rate | Cost or Proceeds in USD |

|---|---|---|---|

| 1/16/2012 | Adjust cost for the open 13,000 GBP position | GBP.USD = 1.5 | Adjustment to Cost = −1,300 |

On 1/16/2012, the adjustment to the cost of the open position of 13,000 GBP was reported.

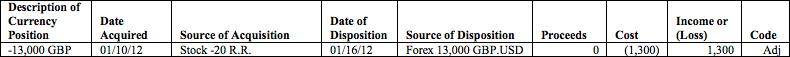

On the worksheet, the adjustment to the GBP position appears on its own line as follows:

- Description of Currency Position: −13,000 GBP.

- Date Acquired: 1/10/2012

- Source of Acquisition: Stock -20 RR. This represents the sale of the stock for 13,000 GBP.

- Date of Disposition: 1/16/2012.

- Source of Disposition: Forex 13,000 GBP.USD. This represents the sale of the GBP.

- Proceeds = 0. There is no adjustment to the proceeds.

- Cost = −1,300 USD. This is the adjustment to the cost of the open GBP position.

- Income or Loss: Adjustment to Income = 1,300. The income is adjusted by 1,300 USD.

- Code: Adj

The proceeds, cost and income of all GBP closing transactions are totaled at the bottom, and the totals for all proceeds, cost, and income or loss is reported below that on the Forex Income Worksheet.

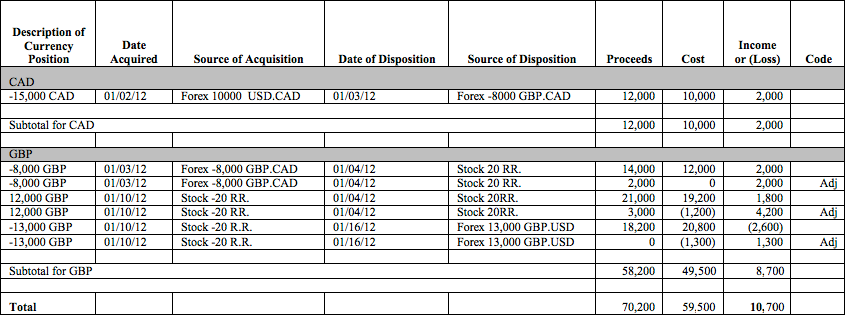

Here are the same transactions as they would appear on the Forex Income Worksheet. Notice that all transactions are grouped and totaled by currency.

Description of the Forex Income Worksheet

Transactions included on the Forex Income Worksheet are grouped by currency and each closing transaction is displayed on its own row.

Income and loss are displayed in USD for all 1099-eligible accounts. All non-1099 eligible accounts use the base currency specified in their IBKR accounts for the specific tax year.

The Forex Income Worksheet includes the following information:

| Column | Description |

|---|---|

| Description of Currency Position | Displays the amount and the three letter currency code on the closing side of the transaction. For example, if you sold 15,000 CAD, that would appear as −15,000 CAD, a negative number. |

| Date Acquired | Date on which the currency or position was acquired. |

| Source of Acquisition | Description of the trade or reason for the acquisition:

|

| Date of Disposition | Date on which the currency was exchanged or the position was sold. |

| Source of Disposition | Description of the trade or reason for disposition in the same format as the Source of Acquisition column.

|

| Proceeds | The value of the nonfunctional currency position at the time of disposition:

|

| Cost | The value of the nonfunctional currency position at the time of acquisition. The amounts in this column follow the same convention as the amounts in the Proceeds column. |

| Income or Loss | Proceeds – Cost |

| Code | For adjustments, this column displays Adj. |