Interactive Brokers | NEWs @ IBKR Vol. 26

News @ IBKR

2025 - Volume 26

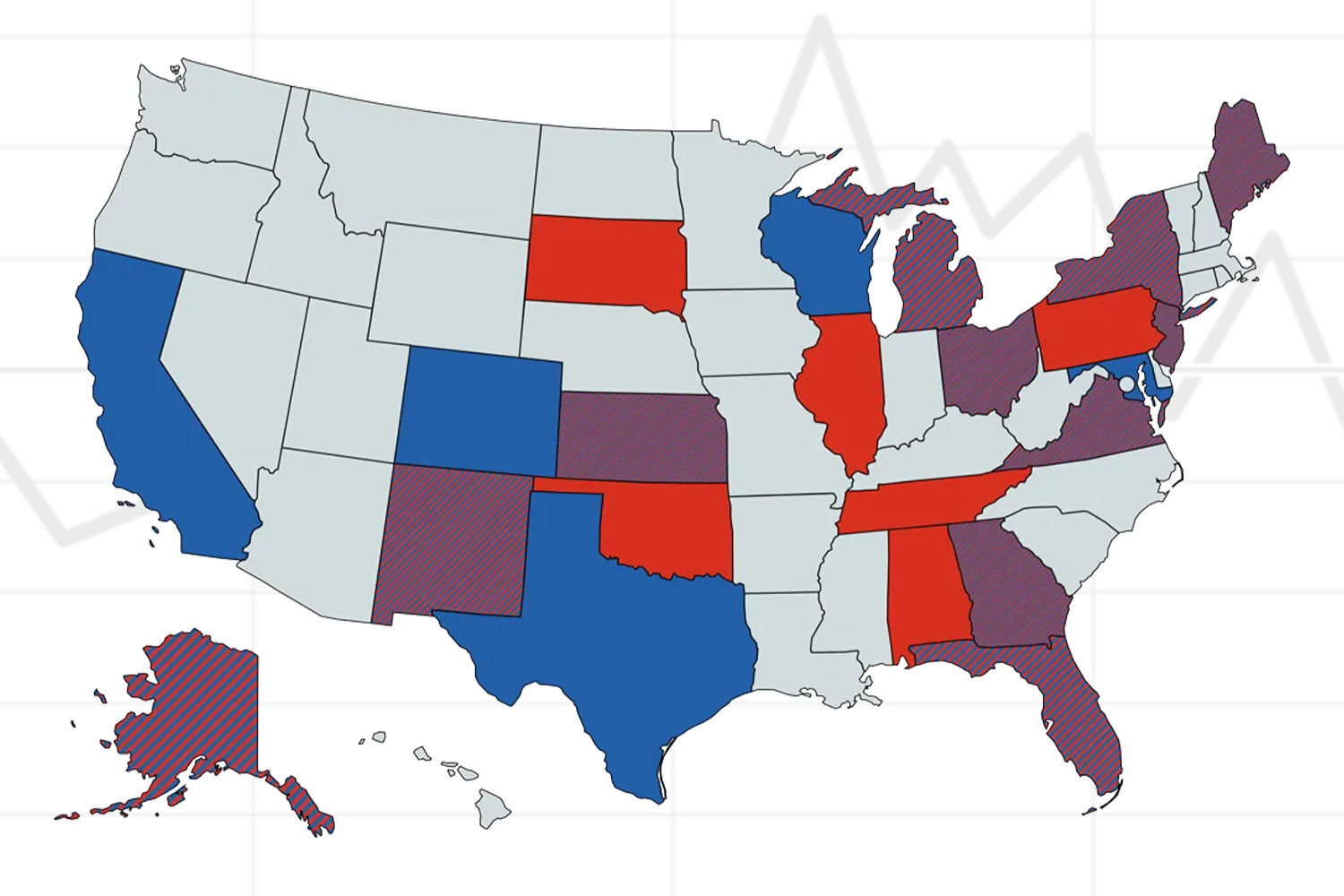

Forecast Contracts on State Governor Primary Races Now Available!

IBLLC’s US clients can now use IBKR ForecastTrader to take a position on over 100 election primary races1 in 22 states. In addition, all eligible IBLLC clients can trade yes-or-no predictions on government, economic, financial, and climate indicators.

Plus, earn 3.83% APY* on your investment through an interest-like incentive coupon and receive USD 3.00 when you start trading Forecast Contracts.

Whether you are hedging against political risk or acting on election insights, Forecast Contracts offer a simple, transparent way to express your views around the clock, six days a week.

US clients can choose from over 100 primary races in 22 states.

All clients can express a view on government, economic or climate indicators.

What are Forecast Contracts?

Forecast Contracts let you trade your opinion on political,1 economic, financial and climate events.

Whether you expect inflation to rise or a particular party to win, you can take a position.

Why trade Forecast Contracts?

- Hedge against political, economic, financial and climate risks

- Speculate on major events and election outcomes

- Simple, cost-effective, and easy to trade

How do Forecast Contracts work?

- Buy a "Yes" contract if you think the event will happen

- Buy a "No" contract if you think it will not

- Correct predictions pay USD 1; incorrect ones pay USD 0

- Contract prices fluctuate based on market sentiment

- Earn an interest-like incentive coupon of 3.83% APY*

on the daily value of your contract

Forecast Contracts trade around the clock from 3:00 am ET Sunday to 10:30 pm ET Friday with a 15 minute break at 5:00 pm ET, and can be traded on any of our desktop and mobile platforms or via IBKR ForecastTrader, our easy-to-use web platform that can be accessed with your existing login credentials.

If you do not have Forecast Contracts trading permission but would like to trade your opinion, please log in to Portal to request Forecast Contracts trading permission.

- Log in to Portal

- Select the User ("head/shoulders" icon) > Settings

- Under Trading, select Trading Permissions

- Select Forecast and Event Contracts - Request

- Select Request Permissions

- Read and acknowledge legal documents and disclosures

- Select OK

Trading permission upgrade requests are subject to Compliance review and are typically approved in 1 - 2 days.

Want to know more about how Forecast Contracts can help you hedge, speculate, or capitalize on economic and climate risks? Explore the resources below:

- Using Forecast Contracts to Hedge Economic and Climate Risks - Learn how to hedge against economic and climate risks and take advantage of these innovative contracts.

- IBKR Economic Landscape - Access expert commentary, analysis, and insights from Interactive Brokers' Senior Economist José Torres, on key US economic indicators.

- Economic Events Calendar - Stay informed about market-moving events worldwide, sortable by region and event type.

[1] Forecast Contracts on US election results are only available to eligible US residents.

*Incentive coupon subject to variation with benchmark rates. Restrictions apply.

Interactive Brokers is a CFTC-registered Futures Commission Merchant and a clearing member and affiliate of ForecastEx LLC ("ForecastEx"). ForecastEx is a CFTC-registered Designated Contract Market and Derivatives Clearing Organization. Interactive Brokers LLC provides access to ForecastEx forecast contracts for eligible customers. Interactive Brokers Hong Kong does not make recommendations with respect to any products available on its platform, including those offered by ForecastEx.

THIS IS A SOLICITATION TO ENTER INTO A DERIVATIVES TRANSACTION WITHIN THE MEANING OF CFTC REGULATION 1.71

Restrictions apply. Forecast contracts are not suitable for all investors.

For information about trading rules and contract specifications, visit ForecastEx's website.

Supporting documentation for any claims and statistical information will be provided upon request.

Futures, event contracts and forecast contracts are not suitable for all investors. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at Interactivebrokers.com.

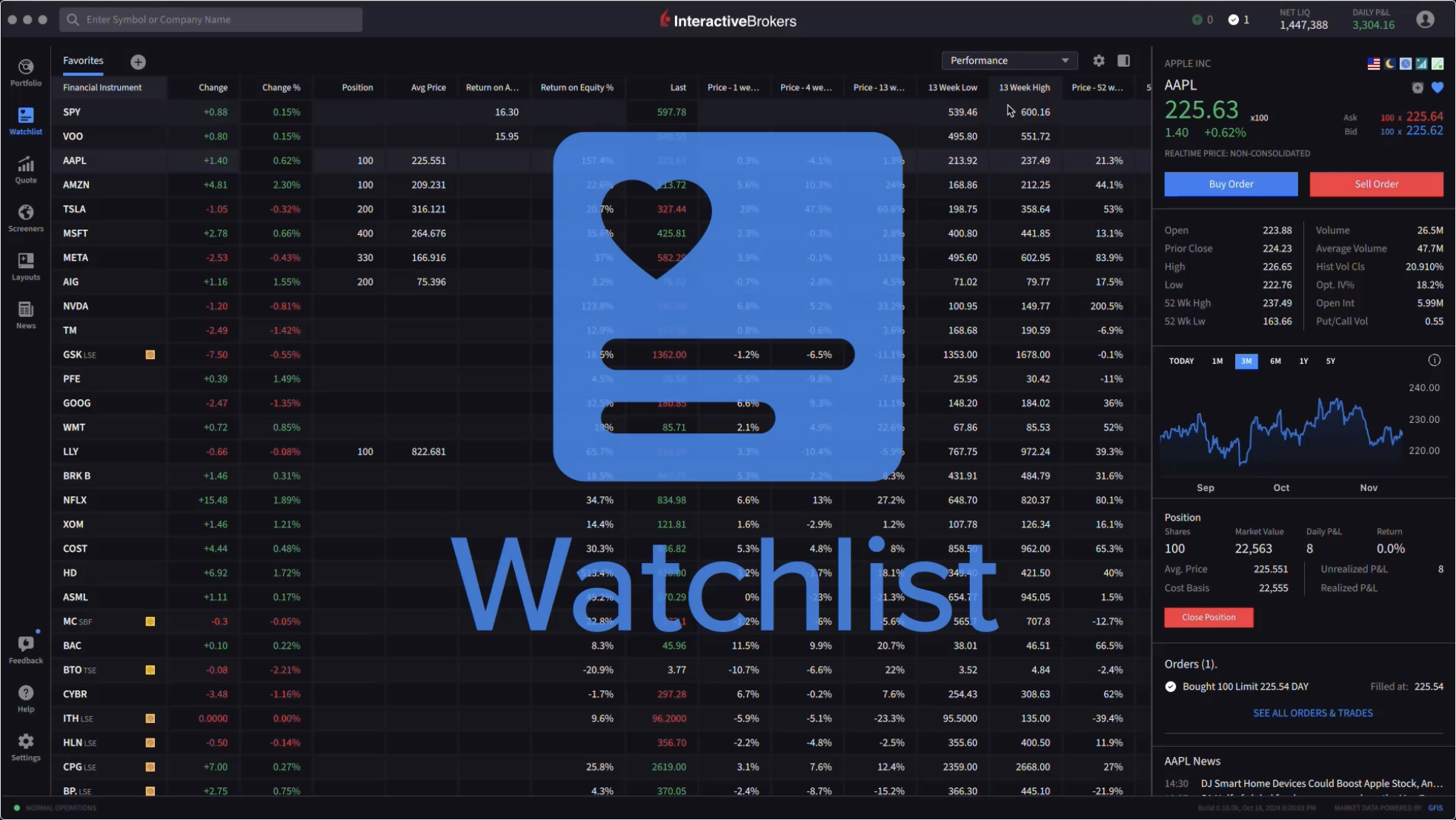

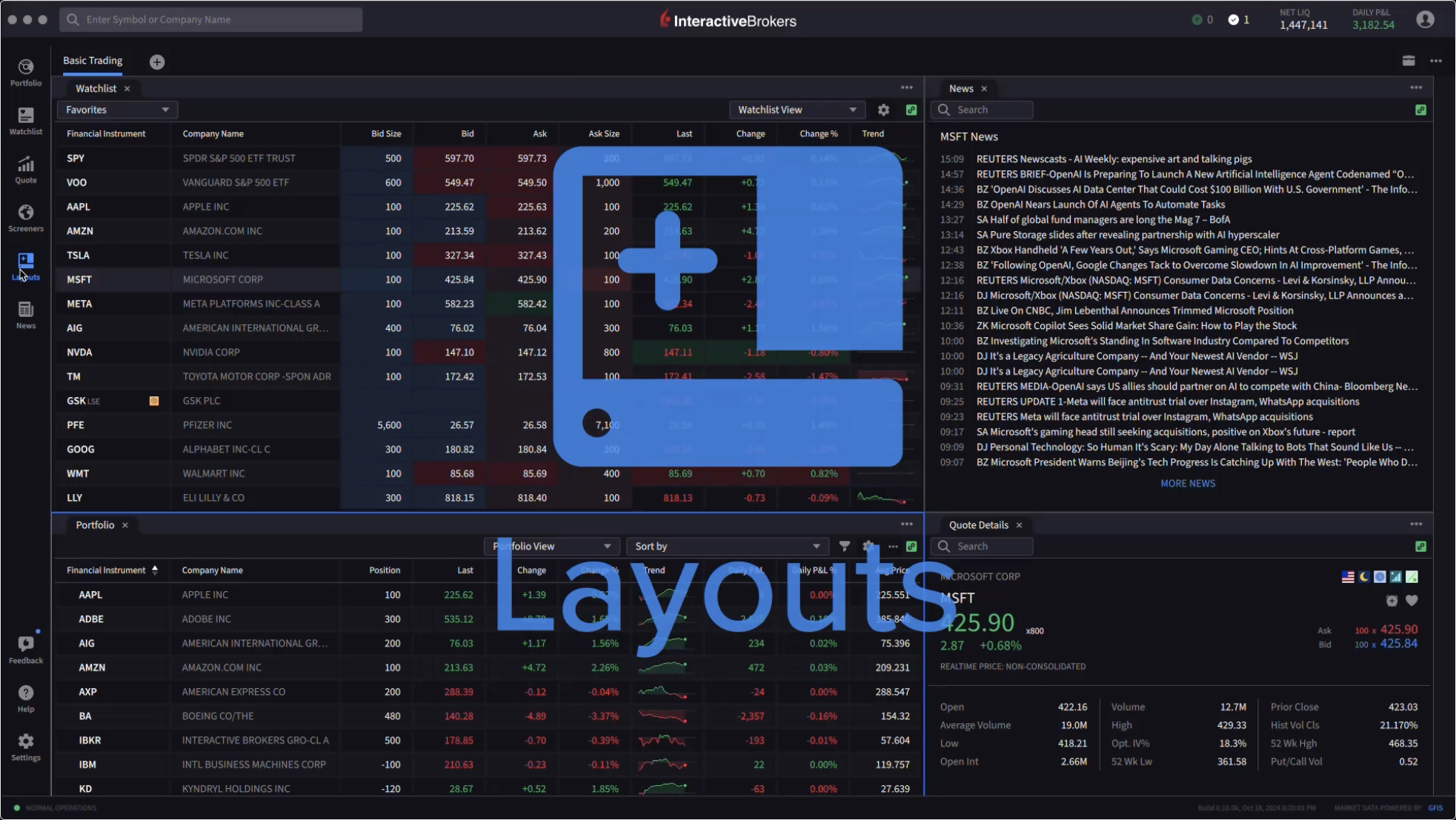

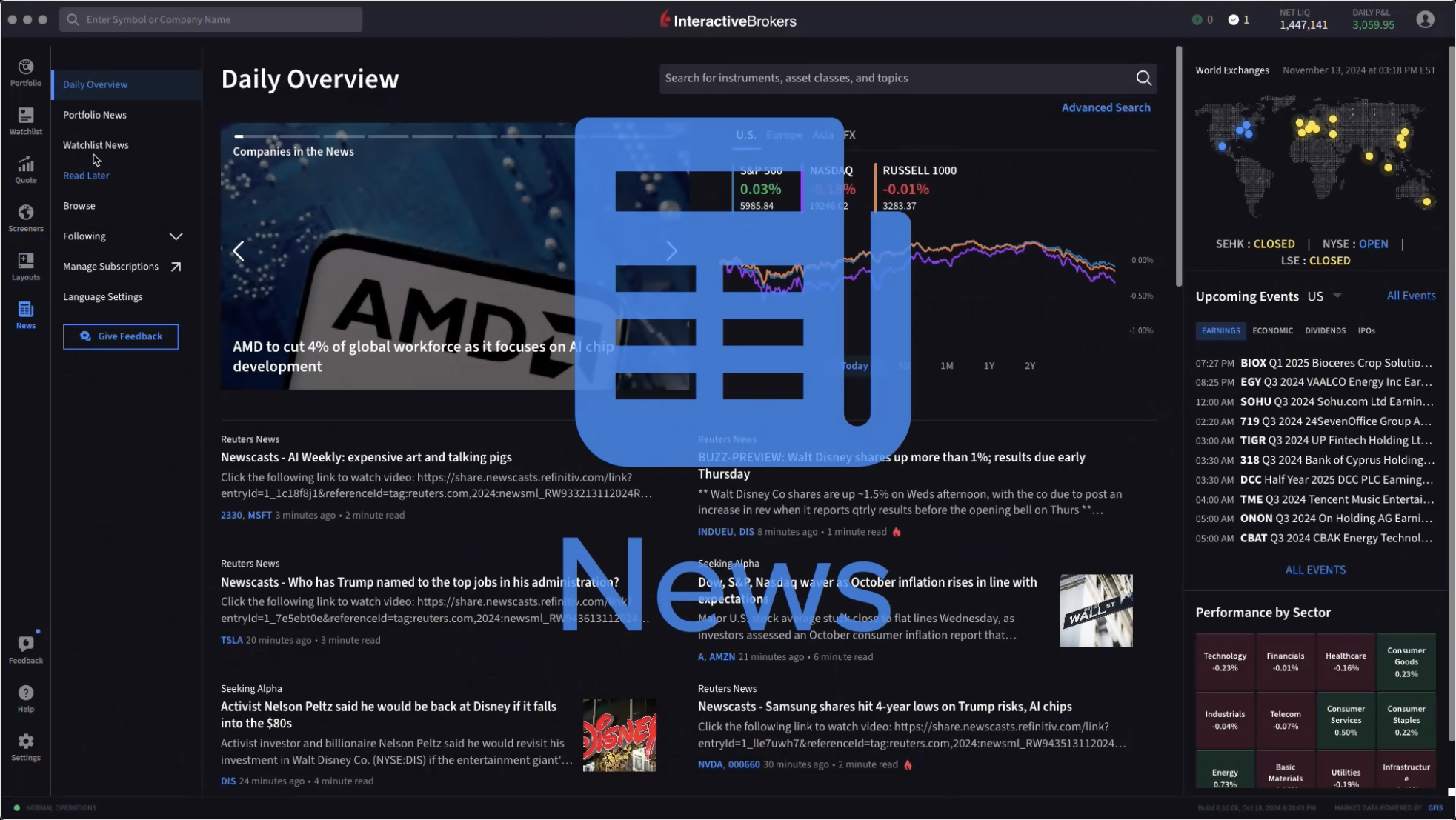

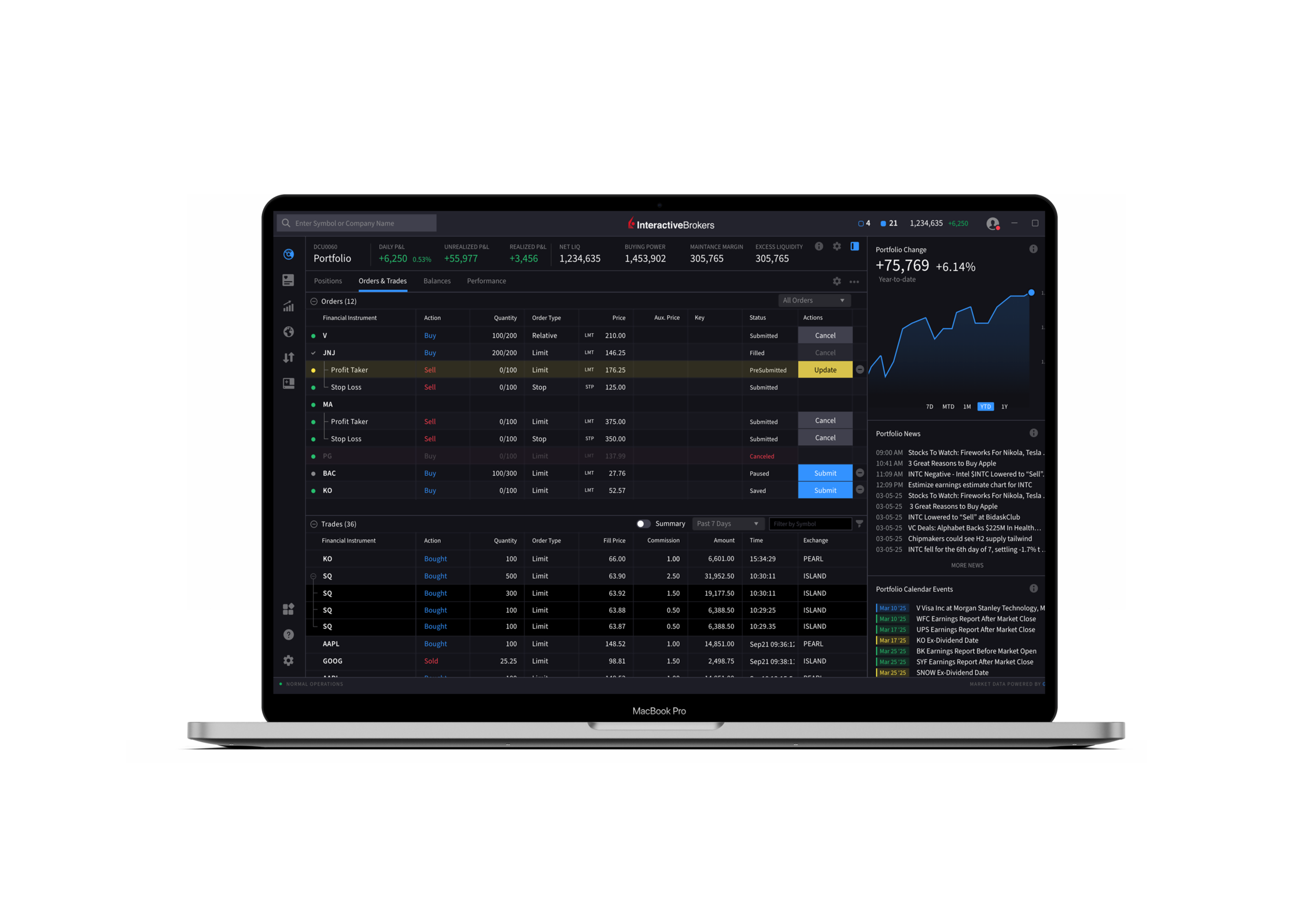

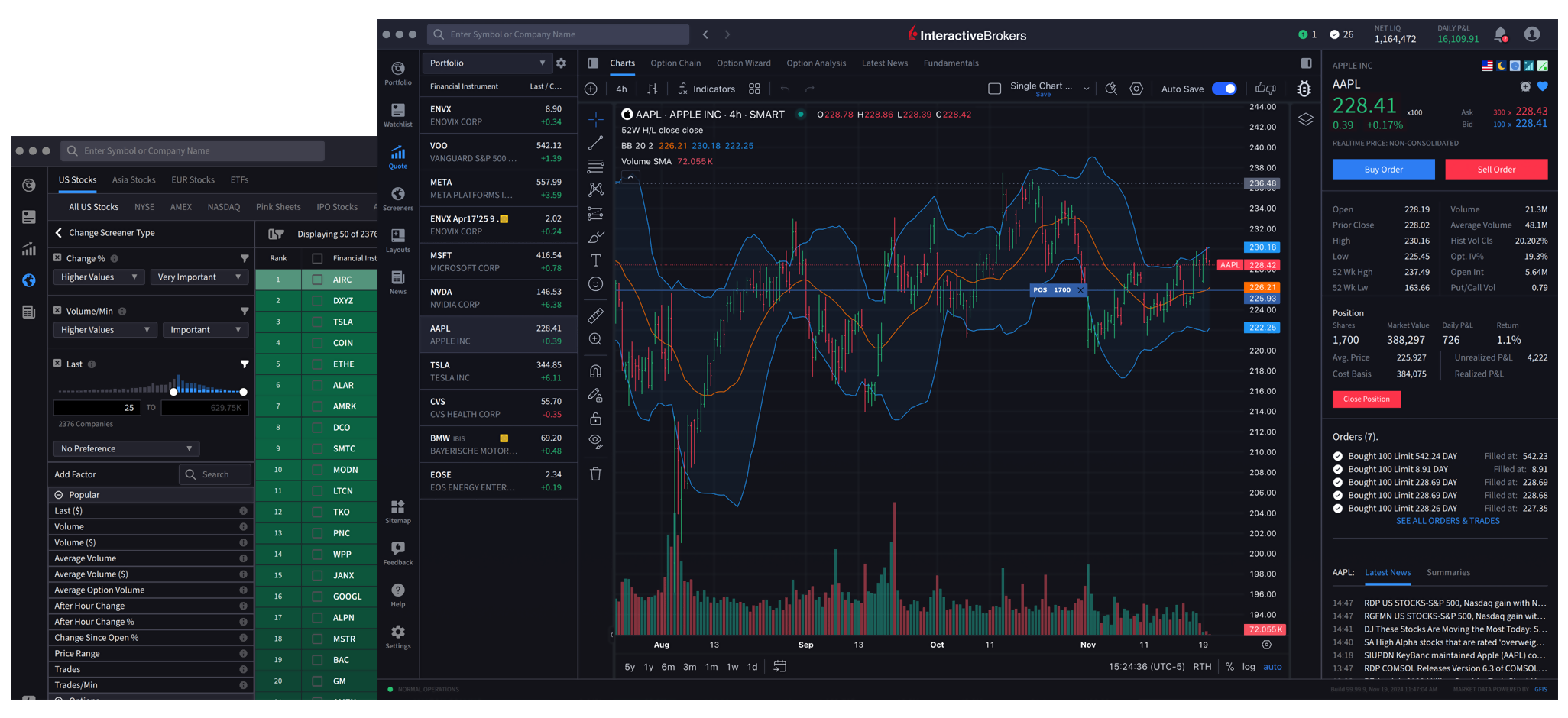

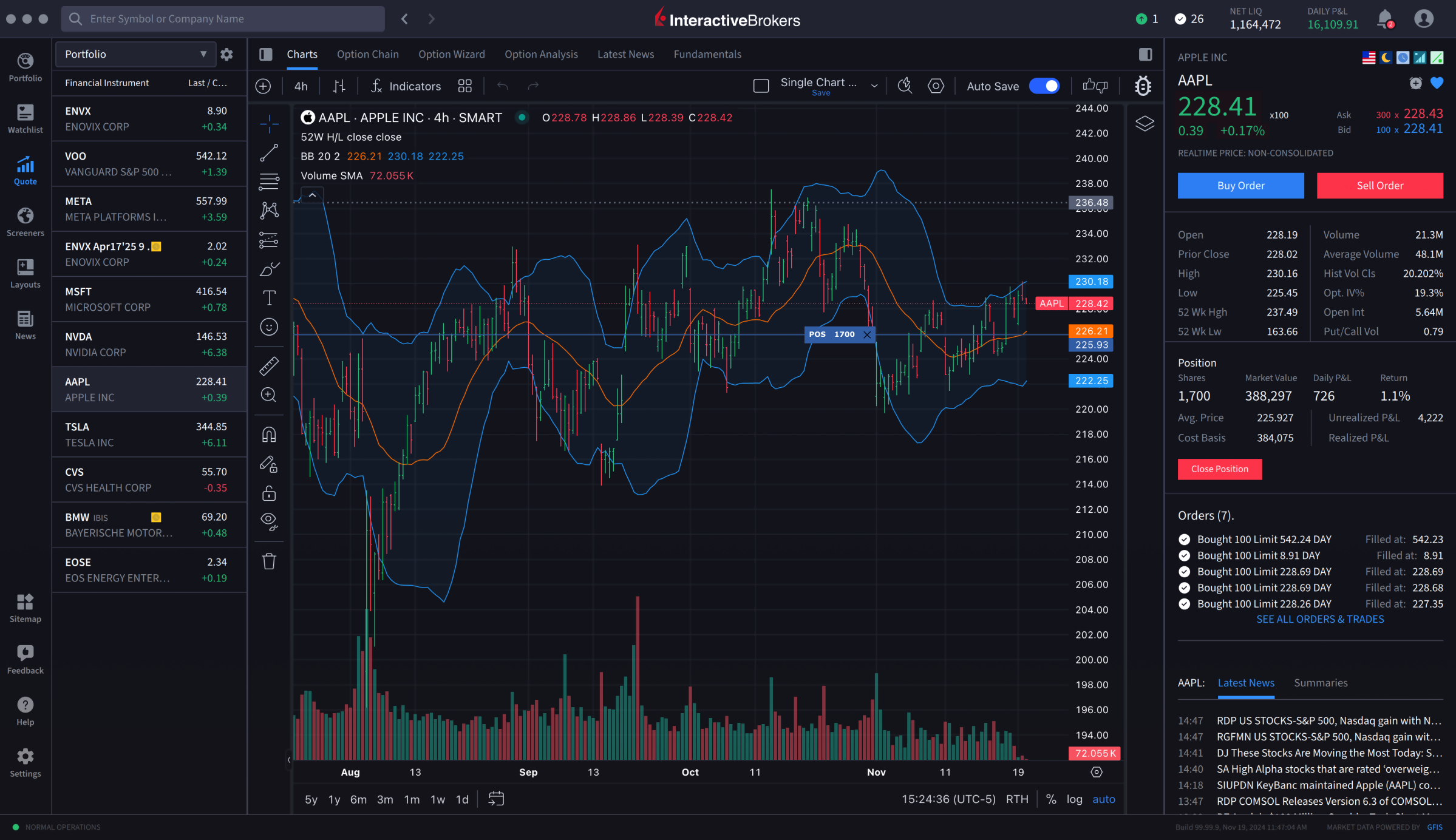

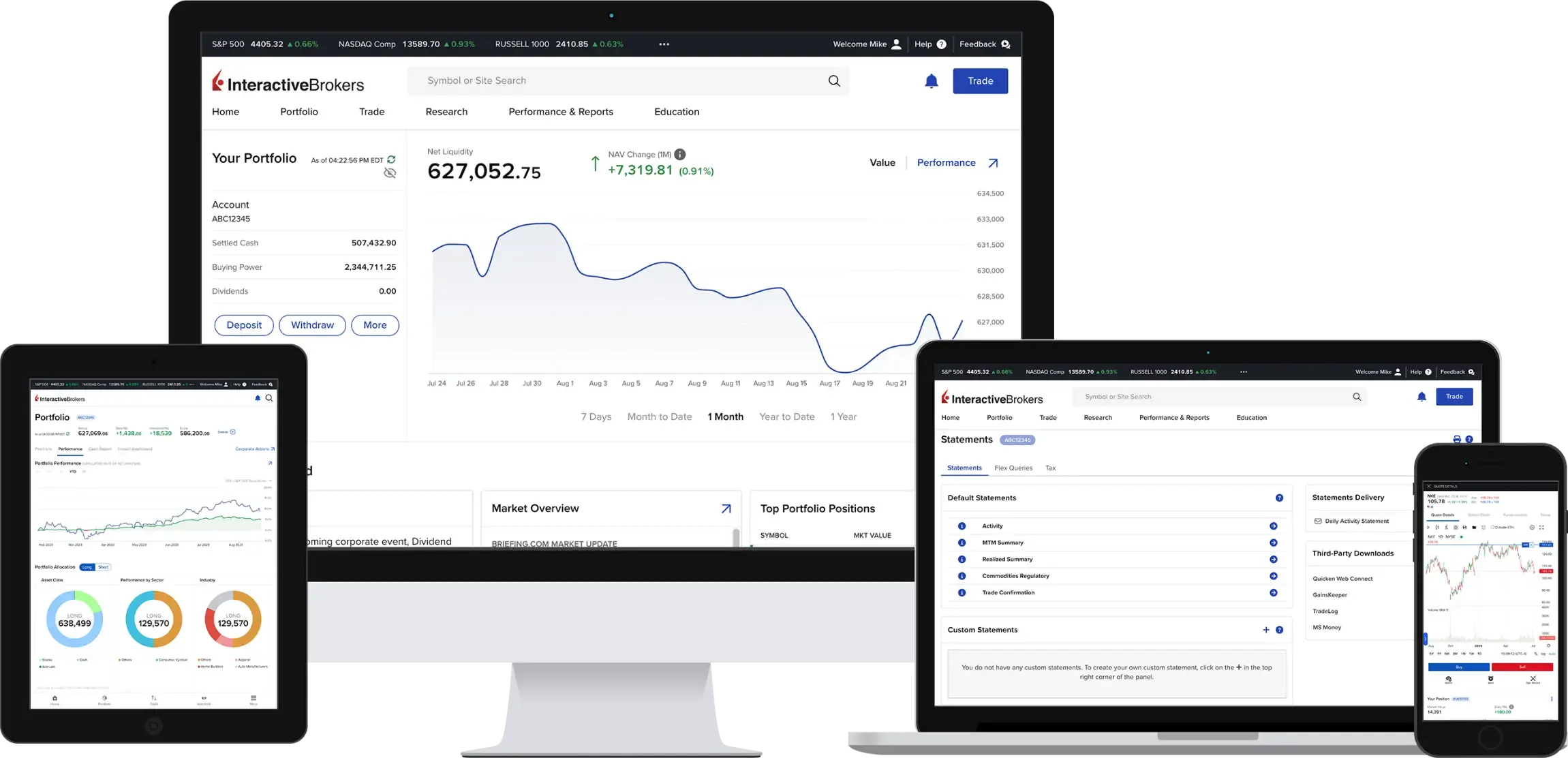

IBKR Desktop

IBKR Desktop - The Future of Trading. Available Today!

Built from scratch using a fresh UI framework, IBKR Desktop combines proven and modern technologies into a superior trading platform regardless of your trading experience.

IBKR Desktop is a powerful, streamlined, user-friendly trading platform that helps traders achieve precision and control over their trading strategies. The platform offers a highly customizable trading experience with a broad array of tools for technical and fundamental analysis, sophisticated charting capabilities and advanced order types, including conditional and algorithmic orders.

A comprehensive selection of trading tools and data helps traders perform in-depth analysis and make better-informed trading decisions.

Access stocks, options, futures, currencies, bonds, funds and more across over 160 markets from a single screen to create diversification opportunities.

Personalize your trading experience with a highly customizable workspace that aligns with your trading preferences and maximizes efficiency.

Advanced and conditional order types give traders control over how and when trades are executed, allowing you to quickly implement straightforward or complex market strategies or react to market movements.

Built-in risk management tools help you proactively monitor and manage your risk profile.

Robust reporting and analytics help traders quickly understand trading outcomes and portfolio performance and calibrate their trading strategies.

In recent weeks, we have introduced several new features to IBKR Desktop, including:

Multi-Monitor Support

IBKR Desktop’s multi-monitor support helps you organize your workflow and multitask with ease.

Enhancements to Custom Layouts

We rolled out improvements to Custom Layouts to make it even easier for you to focus on critical information and minimize clutter. You can now select a Compact List layout or a default Option Trader layout from the Layouts menu.

Screeners Enhancements

Predefined screeners can now be included in your Screener list. In addition, we added a new tab called “Options” that contains various pre-defined underlying screeners tailored toward options traders and a “Complex Orders & Trades” screener that allows you to look at volumes by Option Strategies.

ForecastTrader

IBKR Desktop now integrates with ForecastTrader, allowing you to buy and sell exchange-listed Forecast and Event Contracts directly from the platform.

Contract Search

We added a comprehensive search tool that returns a list of products based on the filter criteria you have selected. These related results are clickable, and when clicked, the Quote window will open with a graph of the selected asset.

IBKR Desktop is currently available for individual accounts and Prop Trading accounts. Support for other account types will be added in the near future.

Try IBKR Desktop Today

EXPANDED OFFERING

Additional Cryptocurrency Tokens Now Available at IBKR

IBKR Advantage

Additional Security for the Uninvested Cash Held in Your Brokerage Account

NEW OFFERING

Participating in Class Action Lawsuits Is Straightforward with IBKR’s Securities Class Action Recovery Solution

- Automated Claims Processing

Saves you from the time-consuming process of filing claims manually. - Maximized Recovery

Ensures eligible investors receive their fair share of a settlement. - No Upfront Costs

Services are offered on a contingency basis, with all recovered amounts subject to a 20% contingency fee as detailed in the Terms & Conditions.

- Individual, Joint, or Trust Account User

- Small Business Account User

- Proprietary Trading Group Master

- Broker Master (Master Account only)

- Broker Clients

- Advisor Clients

- Investment Manager Master Accounts

- Funds

Interested in subscribing to the Securities Class Action Recovery service?

If you would like to subscribe to the Securities Class Action Recovery service, please log in to Portal and navigate to the User ("head/shoulders" icon) > Settings – Securities Class Action Recovery menu item.

New Tools

New Features Added

to IBKR Trading Platforms

IBKR Trader Workstation (TWS)

Our flagship desktop platform is designed for seasoned, active traders who trade multiple products and require power and flexibility. We recently introduced the following features and/or enhancements to TWS:

- Forecast Contracts via ScaleTrader and Accumulate/Distribute Algo: You can now trade Forecast Contracts and Event Contracts using ScaleTrader and the Accumulate/Distribute Algo with TWS.

- ForecastEx Contracts on select CME futures are now available for eligible clients (beta release).

IBKR Desktop

Our newest client-driven desktop trading platform combines the most popular tools from our flagship Trader Workstation (TWS) with a growing suite of original features suggested by our clients. Recent enhancements include:

- Multi-Monitor Support

IBKR Desktop’s multi-monitor support helps you organize your workflow and multitask with ease. - Enhancements to Custom Layouts

Custom Layouts improvements make it even easier for you to focus on critical information and minimize clutter. From the Layouts menu, you can now select a Compact List layout or a default Option Trader layout. - Screeners Enhancements

Predefined screeners can now be included in your Screener list. In addition, we added a new tab called "Options" that contains various pre-defined underlying screeners tailored toward options traders and a “Complex Orders & Trades” screener that allows you to look at volumes by Option Strategies.

- IBKR ForecastTrader

We added integrated support for ForecastTrader, which allows you to buy and sell exchange-listed forecast contracts and event contracts. - Contract Search

We added a comprehensive search tool that returns a list of products based on the filter criteria you have selected. Clicking a search result opens a window displaying the asset’s graph.

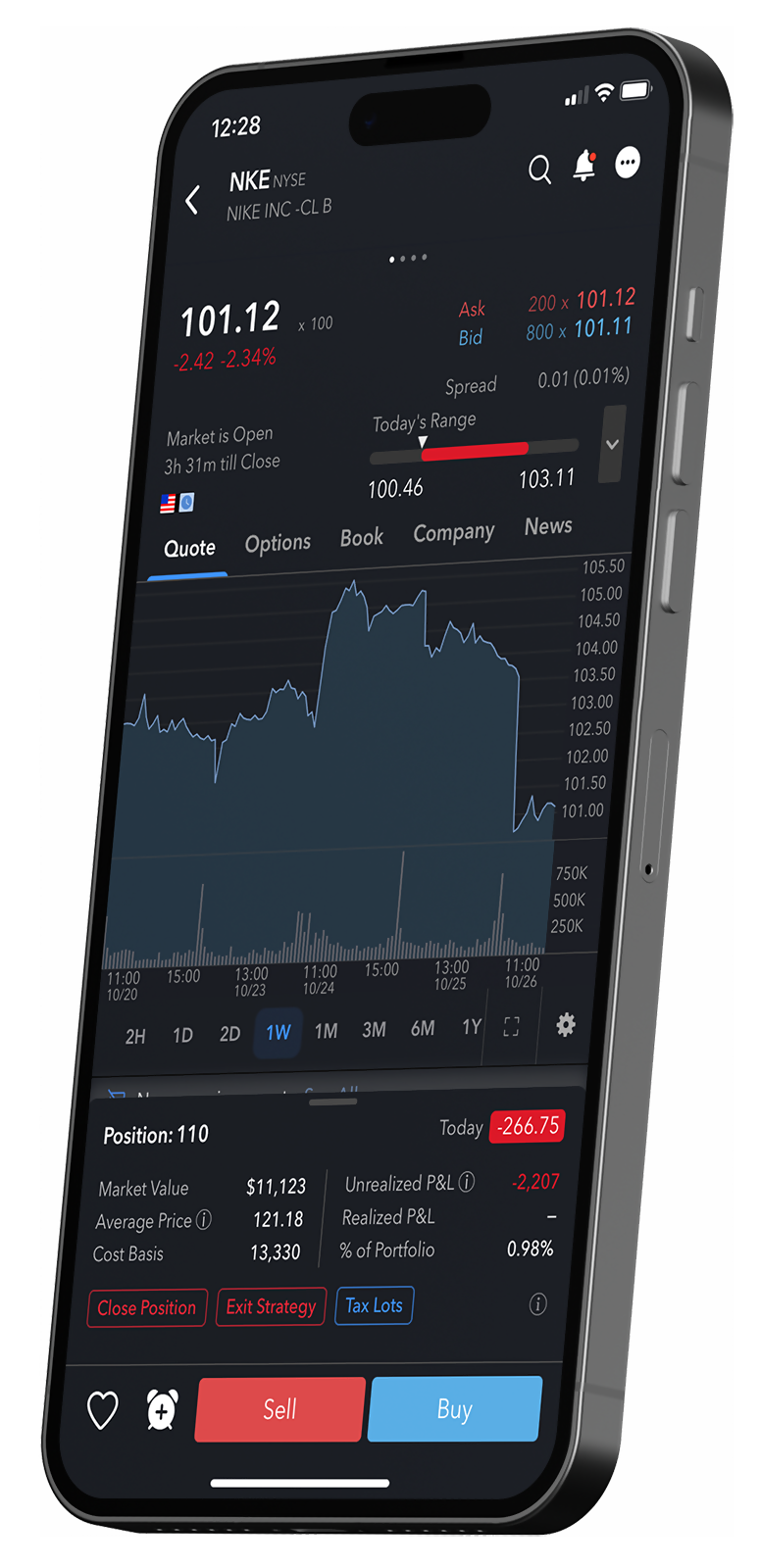

IBKR Mobile

Used by experienced traders who need the power to trade stocks, options, futures, currencies, bonds, and more across more than 160 markets worldwide on-the-go. No matter where you are, you can access it all, including advanced order types and trading tools. We recently enhanced IBKR Mobile with the following features:

- MultiSort Screeners

MultiSort Screeners lets you find and sort data using multiple factors simultaneously. This is essential for traders and investors who need to evaluate diverse information, such as fundamental data, past performance, and technical indicators. MultiSort makes it easy to input multiple preferences and quickly see the most relevant results. Choose up to 10 sort factors by selecting the toggle button to the right of the factor. Use the drop-down menus to specify whether a lower or higher value is most desirable. As you modify factors, the screener updates in real-time. Currently available on iPhone. Android arrives later this year. - IBKR ForecastTrader

Forecast contracts are now seamlessly integrated into the IBKR Mobile app (iPhone and Android).

Client Portal

Access all the features you need with our easy-to-use web platform. View, trade, and manage your account with a single login. No downloads are required. Visit our website to learn more.

- Transaction History

Client Portal now includes a Transaction History section that provides a complete view of all your account transactions, allowing you to quickly view, search and filter your transaction history, including trades, dividends and transfers.

IBKR GlobalTrader and IMPACT by Interactive Brokers

IBKR GlobalTrader and IMPACT provide a streamlined experience for trading stocks, ETFs and options worldwide. Invest with as little as $1 and trade in fractions. Visit our website to learn more.

Options involve risk and are not suitable for all investors. For information on the uses and risks of options, you can obtain a copy of the Options Clearing Corporation risk disclosure document titled "Characteristics and Risks of Standardized Options" by visiting ibkr.com/occ.

Multiple leg strategies, including spreads, will incur multiple commission charges.

Scan to download the

IBKR GlobalTrader app.

Scan to download the

IBKR Mobile app.

Scan to download the

IMPACT app.

NEW PRODUCTS

Interactive Brokers Expands Global Reach with Ljubljana Stock Exchange Access

NEW PRODUCTS

It is Easier than Ever to Find

Your Next Investment Opportunity

- Monday - Thursday Options on Corn (ZC), Wheat (ZW), Soybean (ZS), Soybean Oil (ZL) and Soybean Meal (ZM) Futures

- Soybean Oil (ZL) and Soybean Meal (ZM) Friday Weekly Options

- Micro Futures on Corn (MZC), Wheat (MZW), Soybean (MZS), Soybean Oil (MZL) and Soybean Meal (MZM)

- Solana (SOL) and Micro Solana (MSL) Futures

- Natural Gas Monday (HN), Tuesday (IN), Wednesday (JN) and Thursday (KN) Financial Options

- 1-Ounce Gold Futures (1OZ)

- Micro Japanese Yen/US Dollar Futures (MJY)

- ASML (ASLM)

- ASM International (ASMM)

- BE Semiconductor (BESM)

- LVMH (MC1M)

- Kering (KR1M)

- L'Oreal (OR1M)

- EssilorLuxottica (EF1M)

- Three Month ESTR Indexed Futures Contract

- NSE IFSC Nifty 50 Index Futures: The Nifty 50 Index tracks the 50 largest and most liquid companies listed on India's National Stock Exchange (NSE), including sectors such as financial services, technology, oil & gas, and consumer goods. With Nifty 50 Index Futures, individual investors and institutions can efficiently manage portfolio risk and diversify into India's dynamic economy using a single, liquid product.

- In March 2025, KRX received certification from the US Commodity Futures Trading Commission (CFTC) for KOSPI 200 and Mini KOSPI 200 futures contracts.

- Persons located in the United States with Futures trading permission can now access KOSPI 200 and Mini KOSPI 200 futures.

NEW TOOL

New Services for

Advisors of Any Size

Interactive Brokers offers turnkey solutions that help advisors of any size build competitive advantage, efficiently manage their business and serve clients at a lower cost.

NEW TOOL

New Services for

Advisors of Any Size

Interactive Brokers offers turnkey solutions that help advisors of any size build competitive advantage, efficiently manage their business and serve clients at a lower cost.

During Q1 2025, we rolled out several enhancements to our Advisor services, including:

Documents and Agreements Downloads:

Eligible Advisors can now download certain agreements and documents via a .Zip file directly from Advisor Portal. Contact us to enable this service. Please note the user accessing the documentation must be a user of our Secure Login System Two-Factor Authentication.

Complex or Leveraged Exchange-Traded Products:

We modified the advisor account application to note that requesting CLP trading permission up front may help minimize delays if CLP permissions are requested after account opening.

Transfer on Death (TOD)/Account Inheritance:

The semi-electronic application now supports TOD for Joint Tenants with Rights of Survivorship and Tenants by Entirety.

Client Password Reset: Professional Advisors in the US can now use the Advisor Client Security Tool to directly assist their clients with password resets.

New Advisor Client Application Process:

All advisor clients of Interactive Brokers LLC must now complete semi-electronic applications and sign using the IBKR-provided Docusign option or print, sign and return a physical copy of their application.

Client Consent of Advisor Fees:

Advisors who are clients of Interactive Brokers LLC can send fee changes to clients for endorsement using the IBKR-provided Docusign option or ask that a client physically sign a document.

New End-of-Period Invoicing Method:

When invoicing a client, the advisor can choose either monthly or quarterly billing periods, or monthly or quarterly based on period ending values, and set a maximum fee as a percentage of net liquidation value.

Advisor Updates of Client Emails:

Users subscribed to our Streamlined Advisor Authorization model can now update client email addresses for those clients who participate in our Two-Factor Authentication (2FA) secure login system or retain access to the old email address.

Three-Tier Advisor Client Approvals:

Master/Top-Level advisors can now approve client applications under the second-level advisor master account.

Move Client to New Advisor:

Advisor clients can now move their accounts from one advisor to another as long as the client and FA are within the same entity and under the same pricing structure. In addition, the client cannot have open Money Manager accounts and cannot move if the new advisor cannot trade the same products as the client account.

Transaction History:

Advisor Portal now includes a Transaction History section that provides a complete view of all your account transactions, allowing you to quickly view, search and filter your transaction history, including trades, dividends and transfers.

FEATURED OFFERING

News and Research Providers Available on the IBKR Platform

- Focus: Research - Fundamental, Macro

- Asset Class Coverage: Equities, Foreign Exchange, Commodities, Cryptocurrencies

- Supported Languages: English, Traditional Chinese, Simplified Chinese, Japanese, Arabic, Russian, Spanish, Italian, German

- Frequency: Real-time, hourly, daily

This is a complimentary tool and does not require a subscription.

- Focus: Strategy - Screening, Forecasting

- Asset Class Coverage: Equities

- Supported Languages: English

- Frequency: Daily

- Focus: Strategy - Forecasting

- Asset Class Coverage: Equities

- Supported Languages: English

- Frequency: Daily

Estimize is a complimentary service and does not require a subscription.

- Focus: Research - Macro, Quantitative, Thematic

- Asset Class Coverage: Equities

- Supported Languages: English

- Frequency: Intraday

- Focus: Research - Fundamental, Quantitative, Analyst Reports

- Asset Class Coverage: Equities

- Supported Languages: English

- Frequency: Intraday

ISS EVA provides complimentary services and does not require a subscription.

- Focus: Research - Macro, Quantitative, Thematic

- Asset Class Coverage: Equities, Options

- Supported Languages: English, Traditional Chinese, Simplified Chinese, Japanese, Arabic, Russian, Spanish, Italian, German

- Frequency: Real-time

- Focus: Strategy - Backtesting

- Asset Class Coverage: Options

- Supported Languages: English

- Frequency: Daily

ORATS is a complimentary service and does not require a subscription.

- Focus: Strategy - Validation, Forecasting

- Asset Class Coverage: Equities, Funds/ETFs

- Supported Languages: English

- Frequency: Intraday

- Focus: Research - Fundamental, Technical, Macro

- Asset Class Coverage: Equities, Fixed Income, Foreign Exchange, Funds/ETFs

- Supported Languages: English

Trading Central is only available in the listed professional data bundle.

- Focus: News - Global News

- Asset Class Coverage: Equities, Fixed Income, ETFs

- Supported Languages: English

- Frequency: Weekly

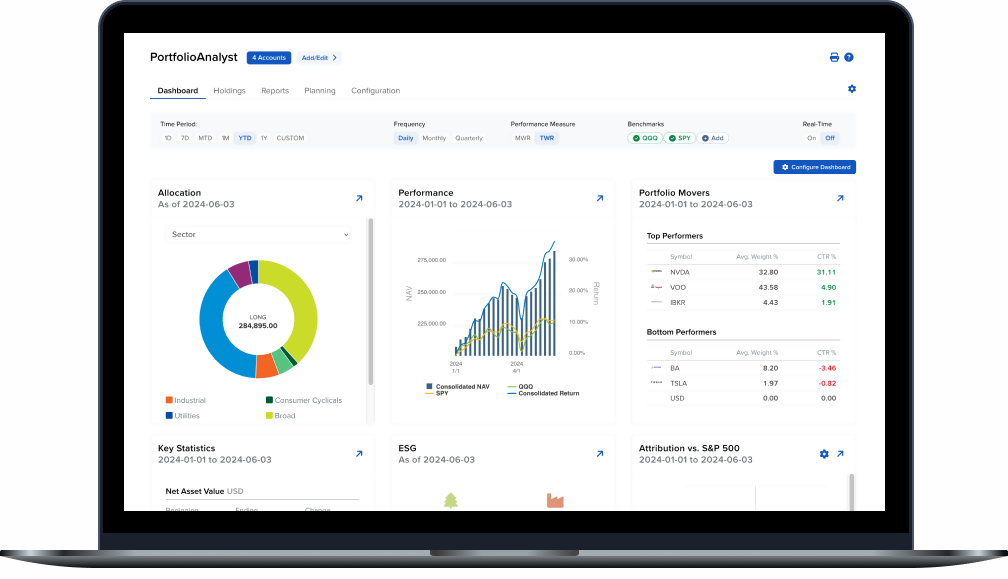

EXPANDED OFFERING

PortfolioAnalyst

Brokerage Accounts

Bank Accounts

Annuities

Student Loans

Mortgages

Credit Cards

Auto Loans

Other Assets or Liabilities

- Interest Rate Sensitivity Widget: View your fixed income portfolio’s interest rate sensitivity in detail, as a summary, and in a corresponding report section.

- "What's New" Widget: View the newest enhancements, features and tools at-a-glance with the "What's New" widget.

- PDF Report Generation: Generate a PDF for the data you are viewing in the Greeks, Attribution vs. Benchmark, Fixed Income, Projected Income and Activity widgets.

- External Account Management: If external data becomes stale, select the "Refresh" option to update your information. If the data connection for your linked account breaks, you can select "Fix It" to repair the connection rather than having to delink/relink the account.

EXPANDED OFFERING

New Funds and Fund Families

Available at the Mutual Fund Marketplace

The Interactive Brokers Mutual Fund Marketplace provides clients from over 200 countries and territories with access to more than 43,500 funds from over 535 fund families, including Allianz, American Funds, BlackRock, Fidelity, Franklin Templeton, Invesco, MFS and PIMCO.

Unlike most firms, IBKR never charges a custody fee. In addition, we offer over 18,000 funds with no transaction fees and low, transparent commissions. Within the US, commissions are the lesser of USD 14.95 or 3% of the trade value, while fee funds outside the US are EUR 4.95 (or equivalent).

To help provide you with a broad selection of funds, we recently added the following fund families to the Marketplace:

Global Fund Families

- Aditum Investment Management (AE)

- Arcus Investment Limited (LU)

- Artemis Investment Management (LU)

- Emirates NBD Asset Management Limited (AE)

- Findlay Park Investment Management Ltd. (IE)

- Goldman Sachs Equity Investment (NL)

- Goldman Sachs Paraplufonds 4N (NL)

- J O Hambro Capital Management Limited (IE)

- KBI Global Investors (IE)

- Kepler Partners LLP (IE)

- Lion Global Investment Limited (SG)

- Merian Global Investment (UK) Limited LTD (IE)

- Partners Group (LU)

- NS Partners Europe (LU)

- Quilter Investors Limited (GB)

- Troy Asset Management (GB / IE)

- TwentyFour Asset Management LLP (GB)

US Fund Families

- Grant Park Funds

- Modern Capital Funds

- Mondrian Funds

Smart Investors Never Stop Learning

The following courses were updated during Q1 2025:

In addition, support for additional languages was added for the following courses:

Select a Webinar Title to learn more and participate:

Featured Articles

Organize a Trading Competition

2025

Share Your Opinion!

Vote for IBKR in the Waters Rankings 2025 Awards!

The Waters Rankings celebrate the outstanding initiatives, innovations, and achievements of technology and data providers in the industry over the past year. Voted on by thousands of end-users from both the buy side and sell side, the Waters Rankings offer a true reflection of the industry's top service providers across 35 categories. Voting is open through June 6, 2025, and takes just a minute or two to complete.

Vote for Interactive Brokers in the Financial Times Investors’ Chronicle Survey!

The Financial Times Investors' Chronicle survey is an annual initiative conducted jointly by the Investors' Chronicle and the Financial Times. This survey invites readers to share their opinions on various investment platforms, stockbrokers, and financial service providers. The collected feedback contributes to the Celebration of Investment Awards, which recognize excellence in the investment industry.

An Award-Winning Year!

In 2025, Interactive Brokers has been recognized around the world for low costs, breadth of product and advanced trading technology.

2025 StockBrokers.com Review

- #1 Active Traders

- #1 Ethical Investing

- #1 International Trading

- #1 Margin Trading

- #1 Professional Trading

- #1 Range of Investments

- #1 Trader App

- Best in Class Active Traders

- Best in Class Beginners

- Best in Class Casual Investors

- Best in Class Ease of Use

- Best in Class Education

- Best in Class Futures Trading

- Best in Class High Net Worth Investors

- Best in Class Investor Community

- Best in Class Mobile Trading Apps

- Best in Class Options Trading

- Best in Class Overall

- Best in Class Passive Investors

- Best in Class Platforms & Tools

- Best in Class Range of Investments

- Best in Class Research

2025 ForexBrokers.com Online Broker Review

- 5 out of 5 stars Overall

- #1 Professional Trading

- #1 ESG Offering

- #1 Innovation

- #1 Institutional Clients

- #1 New Trading Tool

- #1 Professional Trading

- #1 Range of Investments

- Best in Class Algo Trading

- Best in Class Commissions & Fees

- Best in Class Crypto Trading

- Best in Class Education

- Best in Class Mobile Trading Apps

- Best in Class Overall

- Best in Class Platforms & Tools

- Best in Class Professional Trading

- Best in Class Range of Investments

- Best in Class Research

- Best in Class TradingView

- Best in Class Trust Score

2025 BrokerChooser Best Online Brokers

- Best Online Broker

- Best Broker for Stock Trading

- Best Broker for Margin Trading

- Best Broker for TradingView

- Best Broker for Day Trading

- Best Broker Account for Businesses

2025 Good Money Guide Awards

- Best DMA/Investment Account

- Best Futures Broker

- Best Options Broker