Why Trade Globally with IBKR?

IBKR is the Professional's Gateway to the World's Markets

Watch VideoGlobal Market Access – Discover More Opportunities

Clients worldwide trade stocks, options, futures, currencies, bonds, funds and more on 170 global markets from a single unified platform. Explore all available products worldwide.

View Global MarketsFund your account and trade assets in 29 currencies.1

Learn About Account FundingScan the world for investment opportunities with the World Map Screener and the World Data Screener.

Try IBKR GlobalAnalyst

Professional Pricing - Maximize Your Returns

Commissions start at USD 0 on US listed stocks and ETFs,1 with low commissions on other products. There are no added spreads, ticket charges or account minimums.

Learn About CommissionsEarn interest rates of up to USD 3.14% on instantly available cash.3

Compare Interest RatesMargin rates up to 55% lower than the industry.2

Compare Margin RatesEarn extra income on your lendable shares.

See Stock Yield Enhancement- IBKR Lite provides commission-free trades in US exchange-listed stocks and ETFs. For complete information, see ibkr.com/commissions

- Low trading fees according to BrokerChooser Online Broker Survey 2026: Read the full article Online Broker Reviews, December 2025. "Interactive Brokers has low trading fees and one of the best margin rates in the industry. IB currently pays interest (up to 3.14% for USD) on cash balances if you have a $100k account (net asset value)."

- Restrictions apply. See additional information on interest rates. Credit interest rate as of January 7, 2026.

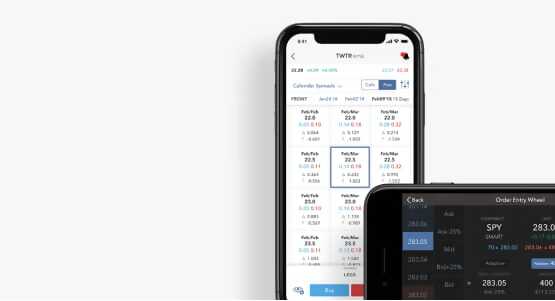

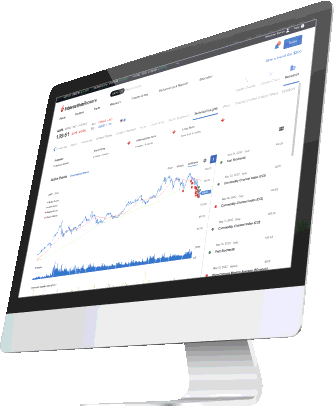

Powerful Trading Platforms To Help You Succeed

Award winning platforms for every investor from beginner to advanced on mobile, web and desktop.

Discover new investment opportunities with over 200 free and premium research and news providers.

Spot market opportunities, analyze results, manage your account and make better decisions with our free trading tools.

100+ order types - from limit orders to complex algorithmic trading - help you execute any trading strategy.

Real-time trade confirmations, margin specifics, transaction cost evaluation, advanced portfolio assessment and beyond.

The Best-Informed Investors Choose

Interactive Brokers

IBKR puts serious investors in control by combining low pricing, global market access, award-winning technology, and deep financial strength. With commissions starting at zero, equity capital of $19.5 billion,1 and 170+ global market centers, IBKR truly serves investors who demand more.

A Broker You Can Trust

When placing your money with a broker, you need to make sure your broker is secure and can endure through good and bad times in the broader financial markets. Our strong capital position, conservative balance sheet and automated risk controls are designed to protect IBKR from major market events that can threaten the stability of financial institutions.

Member of the

S&P 500

Nasdaq Listed: IBKR

$19.5B

Equity Capital*

74%

Privately Held*

$13.3B

Excess Regulatory Capital*

4.13M

Client Accounts*

3.62M

Daily Avg Revenue Trades*

IBKR Protection

*Interactive Brokers Group and its affiliates. For additional information view our Investors Relations - Earnings Release section.

TRADERS' ACADEMY

WEBINARS

TRADERS' INSIGHT

PODCASTS

QUANT BLOG

STUDENT TRADING LAB

On-Demand Educational Resources –

Never Stop Learning

Interactive Brokers provides several resources to help you better understand IBKR products and services, markets and technology.

Award Winning Platform & Services

#1 Professional Trading

#1 International Trading

Best Online Broker,

for Advanced Traders

#1 Best Online Broker

5 out of 5 stars

Best for

Advanced Traders

Best Online Broker

Open Your Account Today!

Download an app and sign up, or sign up online

Disclosures

- Available currencies vary by Interactive Brokers affiliate.

- IBKR Lite provides commission-free trades in US exchange-listed stocks and ETFs. For complete information, see ibkr.com/commissions.

- For complete information, see our margin rate comparison

- Rates are subject to change. Restrictions apply. For additional information, see our interest rates. Credit interest rate as of January 7, 2026 .

- Interactive Brokers Group and its affiliates. For additional information view our Investors Relations - Earnings Release section.