Stop Orders

A Stop order is an instruction to submit a buy or sell market order if and when the user-specified stop trigger price is attained or penetrated. A Stop order is not guaranteed a specific execution price and may execute significantly away from its stop price. A Sell Stop order is always placed below the current market price and is typically used to limit a loss or protect a profit on a long stock position. A Buy Stop order is always placed above the current market price. It is typically used to limit a loss or help protect a profit on a short sale.

Interactive Brokers may simulate certain order types on its books and submit the order to the exchange when it becomes marketable. The IB website contains a page with exchange listings. The linked page for each exchange contains an expandable "Order Types" section, listing the order types submitted using that exchange's native order type and the order types that are simulated by IB for that exchange. See our Exchange Listings.

For stop orders simulated by IB, customers may use IB's default trigger methodology or configure their own customized trigger methodology. Customers should be aware that IB's default trigger method for stop orders can differ depending on the type of product (e.g., stocks, options, futures, etc.).

To modify the trigger method for a specific stop order, customers can access the "Trigger Method" field in the order preset. Customers may also modify the default trigger method for all Stop orders by selecting the "Edit" menu item on their Trade Workstation trading screen and then selecting the "Trigger Method" dropdown list from the TWS Global Configuration menu item. For more information on modifying the trigger method, as well as a detailed description of the default trigger method for each product type, please see the TWS User's Guide section entitled "Modify the Stop Trigger Method" located here.

| Products | Availability | Routing | TWS | ||||

|---|---|---|---|---|---|---|---|

| Combos | US Products | Smart | Attribute | ||||

| Crypto | Non-US Products | Directed | Order Type | ||||

| EFPs | Lite | Time in Force | |||||

| Forex | |||||||

| Futures | |||||||

| FOPs | |||||||

| Options | |||||||

| Stocks | |||||||

| Warrants | |||||||

| View Supported Exchanges|Open Users' Guide | |||||||

Notes:

The Reference Table to the upper right provides a general summary of the order type characteristics. The checked features are applicable in some combination, but do not necessarily work in conjunction with all other checked features. For example, if Options and Stocks, US and Non-US, and Smart and Directed are all checked, it does not follow that all US and Non-US Smart and direct-routed stocks support the order type. It may be the case that only Smart-routed US Stocks, direct-routed Non-US stocks and Smart-routed US Options are supported.

Stop and Stop Limit Orders Short Video

For more short videos, see our IB Short Videos, Courses & Tours section.

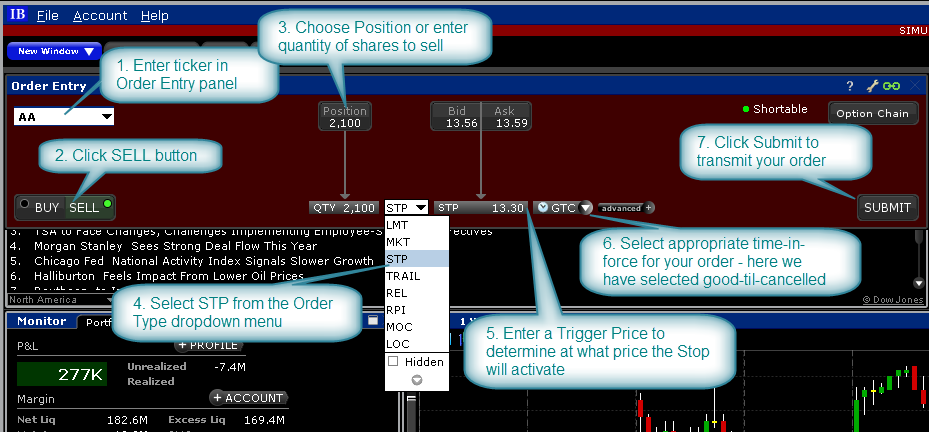

Mosaic Example

In this example, we have a long position of 2,100 shares in ticker AA, which is trading at $13.56/59. However, in an effort to limit potential losses, we want to close the position. To do this we want to set up a Stop order type that we want to activate in the event that the share price trades down to $13.30. Enter the appropriate ticker in the Order Entry panel and click the SELL button to create an order to sell shares. As this is an existing position, we can simply click on the Position field in order to populate the Quantity field with the entire position we want to sell. Form the Order Type dropdown menu, select the STP or Stop order type. Now input your desired stop price. This is the price at which the order will activate. Next, choose from the time-in-force selection menu the appropriate length of time you want the Stop order to remain in place. Day orders will be cancelled at the close of business if not filled, while GTC orders will remain intact until the user cancels the order or else it is filled. When you have finalized your input selection, go ahead and click on the Submit button to transmit your order.

| Assumptions | |

|---|---|

| Action | SELL |

| Qty | 2,100 |

| Order Type | STP |

| Market Price | MKT |

| Stop Price | 13.30 |

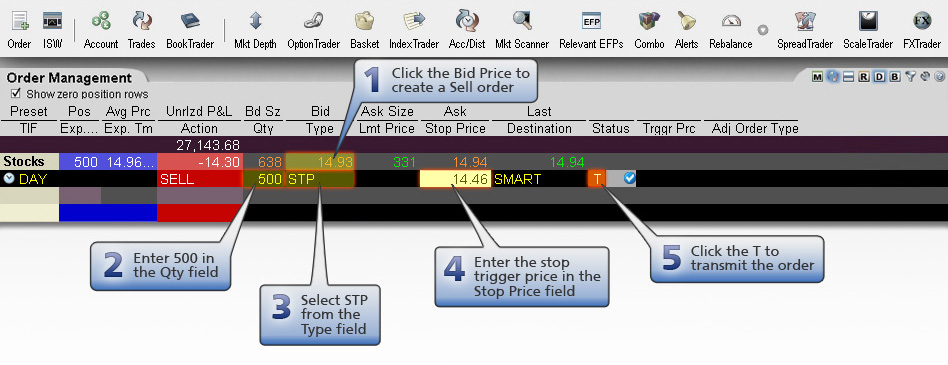

Classic TWS Example

Order Type In Depth - Stop Sell Order

Step 1 – Enter a Stop Sell Order

You're long 500 shares of XYZ stock at an Average Price of 14.96 (your entry price). You want to sell those 500 shares but you want to limit your loss to $250.00, so you create a Stop order with a Stop Price of 14.46. If the price of XYZ falls to 14.46, a market order to sell 500 shares will be triggered at that price.

| Assumptions | |

|---|---|

| Avg Price | 14.96 |

| Action | SELL |

| Qty | 500 |

| Order Type | STP |

| Market Price | 14.93 |

| Stop Price | 14.46 |

Step 2 – Order Transmitted, Market Price Begins to Fall

The price of XYZ begins to fall from 14.93. If it touches your Stop Price of 14.46, a market order to sell 500 shares will be submitted.

| Assumptions | |

|---|---|

| Avg Price | 14.96 |

| Qty | 500 |

| Order Type | STP |

| Market Price | 14.93 and falling |

| Stop Price | 14.46 |

Step 3 – Market Price Falls to Stop Price, Order Filled

The price of XYZ continues to fall and touches your Stop Price of 14.46. A market order to sell 500 shares is immediately submitted and filled at 14.46 per share. By using a Stop Sell order, you have limited your loss to $250.00.

| Assumptions | |

|---|---|

| Avg Price | 14.96 |

| Qty | 500 |

| Order Type | STP |

| Market Price | 14.46 |

| Stop Price | 14.46 |

Important Characteristics and Risks of Using Stop Orders

A Stop Order - i.e., a Stop (Market) Order - is an instruction to buy or sell at the market price once your trigger ("stop") price is reached. Please note that a Stop Order is not guaranteed a specific execution price and may execute significantly away from its stop price, especially in volatile and/or illiquid markets.

Stop Orders may be triggered by a sharp move in price that might be temporary. If your Stop Order is triggered under these circumstances, you may buy or sell at an undesirable price. Sell Stop Orders may make price declines worse during times of extreme volatility. If triggered during a sharp price decline, a Sell Stop Order also is more likely to result in an execution well below the stop price.

Placing a limit price on a Stop Order may help manage some of these risks. A Stop Order with a limit price - a Stop (Limit) Order - becomes a limit order when the stock reaches the stop price. By using a Stop (Limit) Order instead of a regular Stop Order, you will receive more certainty regarding the execution price, but there is the possibility that your order will not be executed at all if your limit price is not available in the market when the order is triggered.

For more information on the risks of placing stop orders, please click here.

IB may simulate stop orders with the following default triggers:

- Sell Simulated Stop Orders become market orders when the last traded price is less than or equal to the stop price.

- Buy Simulated Stop Orders become market orders when the last traded price is greater than or equal to the stop price.

IB may simulate market orders on exchanges. For details on market order handling using simulated orders, click here.

Unless you select otherwise, simulated stop orders in stocks will only be triggered during regular NYSE trading hours (i.e., 9:30 a.m. to 4 p.m. EST, Monday to Friday). IB's default trigger methodology also contains additional conditions which can vary depending on the type of product traded. For a detailed description of IB's trigger methodology, including information on how to modify the default trigger methodology, see the Trigger Method topic in the TWS User's Guide.

With the exception of single stock futures, simulated stop orders in U.S. futures contracts will only be triggered during regular trading hours unless you select otherwise. Regular trading hours can be determined by mousing over the clock in the time in force field or the contract description window.

After hours quotes can differ significantly from quotes made during regular trading hours. Stop orders configured to trigger outside of regular NYSE trading hours with a trigger method set to Bid/Ask may trigger in illiquid markets and/or on quotes with wide bid/ask spreads.

Native stop orders sent to IDEM are only filled up to the quantity available at the exchange. Any unfilled stop order quantity will be cancelled.

For special notes and details on U.S. futures stop and stop limit orders, click here.