Mutual Fund Replicator

Many ETFs offer rates of return comparable to those of mutual funds - but with lower management fees. Compared with mutual funds, ETFs also offer trading throughout the day during market hours, potential tax benefits, and the ability to borrow money against ETF holdings at rates as low as 1%. Use the Mutual Fund Replicator to find comparable ETFs and quickly compare management fees and rates of return.

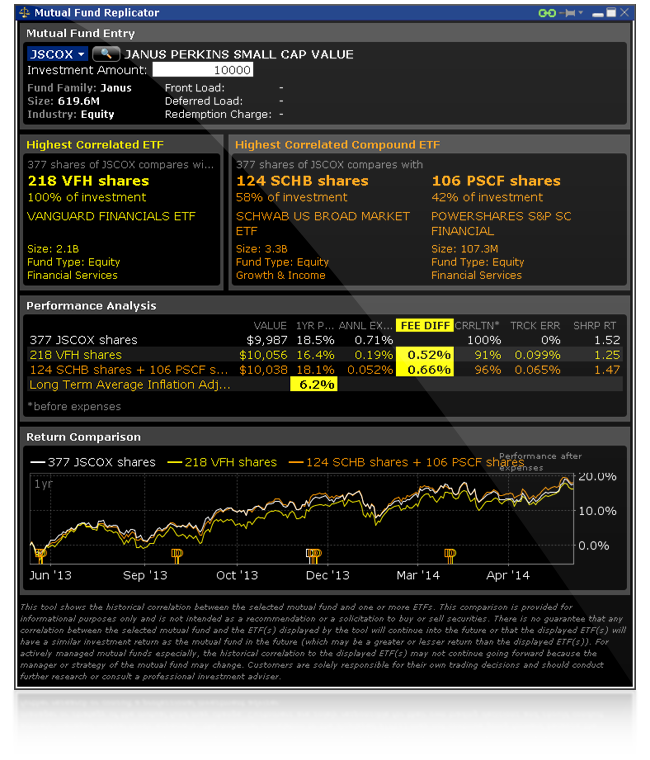

The Mutual Fund Replicator scans the markets for ETFs that replicate the performance of a selected mutual fund:

- The easy-to-read interface quickly focuses in on the fee savings for correlated ETFs over mutual funds.

- Both highest correlated single ETF and highest correlated ETF combinations are displayed.

- Compare the one-year performance of correlated ETFs to the selected mutual fund.

- Correlated ETFs are conveniently displayed in the ideal quantities to most closely replicate the specified fund's performance.

- Return Comparison charts the mutual fund and comparable ETFs together, including management fees, for easy visual analysis.