TWS Statements Webinar Notes

| Quick Links | |

IB’s monthly and yearly statement format provides greater detail, easier viewing, and more flexibility. Enhancements include:

- Expand and contract sections with click-down detail to view individual sections and collapse redundant detail.

- Profit and loss across all transactions, positions, and asset types calculated in two methodologies:

- First In, First Out (FIFO) matching opening and closing positions.

- Mark-to-Market (MTM).

- A performance summary by asset class that gives a quick view of an account's profitability.

- Opening and closing balances with links for easy access to balance change details.

- Calculation of FX translation gain/loss due to currency fluctuations for accounts with multiple currencies.

- New customizable statement templates that allow you to create and save statements with just the information and sections that you need

Statements can be accessed through TWS from the View menu or separately through the Account Management, Reports Management section.

- Multi-account structures (Advisor, Broker, Institutions) may select one or more accounts from the drop down box.

- Monthly statements are generally available by 5 business days after the close of a month.

- Annual statements available by January 31 under normal business circumstances.

We provide web-based access to the following account statements:

- Daily account statements for 45 calendar days.

- Monthly account statements for the 2 prior years.

- Annual account statements for the 3 prior years.

Account statements older than this may be obtained for a processing fee of $100 for the first statement requested, plus $25 for additional statements requested at the same time.

You can select from two default formats for viewing statements, Full or Simple. We’ll first take a look at the Full template and all available Statement sections. Later in this session we will discuss the Simple template as well as how you can create customized statement templates to select only those sections you need and choose how to view P&L – in either FIFO or MTM format or both.

Our statements were designed from the top down with summary totals at the top of the statement, opening to greater detail in each section as you work towards the bottom. Hyperlinked fields provide quick access to corresponding detail sections.

Account Information summarizes the account information with Customer type, trading permissions and base currency.

- account type (Individual, Advisor Master, Advisor Client, Institutional, etc.).

- customer type (individual, partnership, etc.).

- account capabilities (cash or margin).

- trading permissions (stock, options, etc.).

- base currency of the account

The Equity Summary shows all positions by asset class (stock, securities options, warrants and bonds), cash, and accruals for the current as well as the prior period. There are no open futures positions as each night the gain or loss for futures contracts settles into cash.

- Current totals are split between long and short amounts.

- Click on the current (ending cash) or prior period (starting cash) amounts to see details of how the balances are derived.

- All non-base currency amounts are converted to the base currency at the close of period rate.

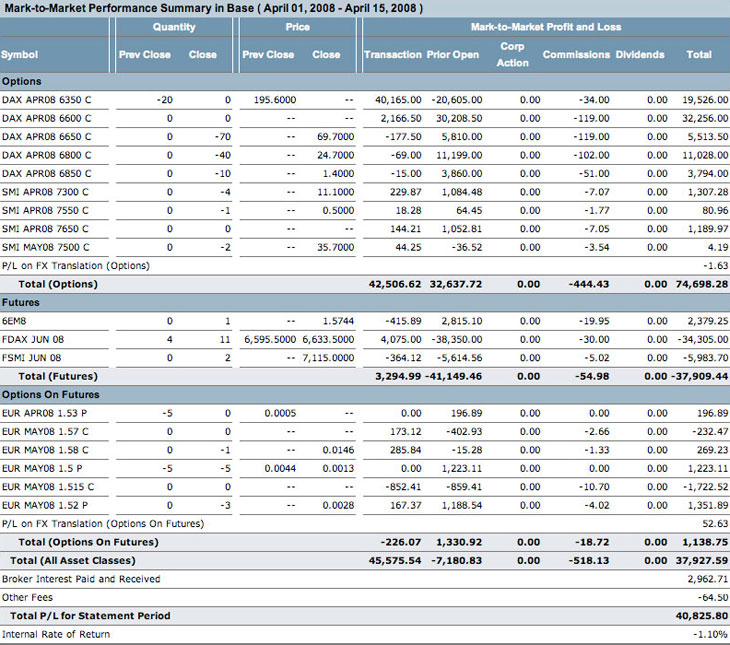

The MTM Performance Summary in Base shows profit and loss (P&L) by underlying and asset class. The MTM calculations for the statement period show daily profit or loss – assuming all open positions and transactions are settled at the end of the day and new positions are opened the next day.

The MTM calculations are split to simplify the presentations: calculations for transactions during the statement period and calculations for positions open at the beginning of a day. It also shows the internal rate of return for the statement period. To compute the IRR (Internal Rate of Return) we use a time-weighted average calculation method. This takes initial investment and cash flows, weighting each cash flow for its time period, and computes a return rate for the statement period. For an example of how we compute IRR, see Time-Weighted Method#3: The Microsoft Excel way.

This table does include Bonds, Bills, and Notes but not Forex. Users that hold those positions should have that in mind when looking at the Total P&L and Internal Rate of Return.

The most common method of determining P&L for stocks and options is First In, First Out (FIFO) where closing transactions are matched to opening transactions and a profit or loss is realized when a position is closed. The Realized and Unrealized Performance Summary in Base shows Profit & Loss (P&L) by underlying and asset class in your chosen base currency.

- Open positions are marked-to-market and the P&L is UNREALIZED.

- REALIZED P&L is determined when closing the position by matching First In, First Out (FIFO) transactions.

- To simplify tax reporting, the realized category splits gains and losses and displays long term, for positions held a year and a day, and short term positions held less than a year.

Commissions

- For MTM calculations, commissions are not included but are displayed as a separate column in the MTM Performance Summary.

- For FIFO, commissions are included with the cost basis and sales proceeds to determine the realized and unrealized P&L.

The Profit and Loss Report by Underlying section displays values sorted by underlying. You can find this data sorted by different criteria in other sections, as follows:

- FIFO Realized P&L - this value is taken from the Transactions.

- FIFO Unrealized P&L - this value comes from the Open Positions section.

- MTM P&L - this value comes from:

- MTM on Closed Positions section.

- + MTM P&L value in the Transactions section.

- Commissions are taken from the total in the Comm/Tax column in the Transactions section.

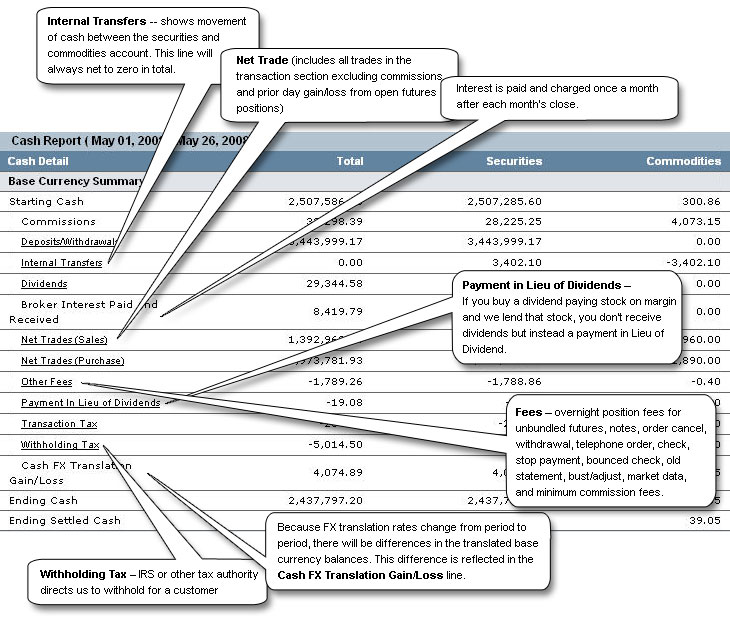

The Cash Report section details how each period's cash balance changes from the beginning of the period to the end of the period. For those statements with multiple currencies, all currencies are detailed separately and totaled in the Base Currency Summary section.

- Because FX translation rates change from period to period, there will be differences in the translated base currency balances. This difference is reflected in the Cash FX Translation Gain/Loss line.

- Starting Cash and Ending Cash lines represent trade date balances. We also show settlement date balances which represent cash that has been received from a clearing organization (i.e. if you sell stock today you will not receive the proceeds for three days).

- Interest is always paid and received on settlement balances, accrued during the month and paid after month close. A complete explanation of how interest is calculated can be found on the IB Interest Calculation Method page.

Three lines that merit further explanation in the Cash Report are Cash Activity, Net Trades (Sales) and Net Trades (Purchase).

- Cash Activity shows movement of cash to/from your securities and commodities accounts. These movements are done automatically to satisfy margin requirements. In general, we will keep as much cash as possible in your securities account. This line will always net to zero in total.

- The Net Trades (Sales) are made up of the following components:

- Proceeds from Securities Trades.

- Futures Mark-to-Market Gains.

- Cash from Corporate Actions.

and the Net Trades (Purchases) are made up of the following components:

- Purchase Price of Securities.

- Futures Mark-to-Market Losses.

- Cash from Corporate Actions.

Please note the following caveats related to the Net Trade Lines:

- Futures Options are available under two settlement styles; those that settle like securities, and those that settle like futures. Each style will be lumped into the proper category indicated above.

- All mark-to-market gains and losses for futures will be netted and applied either as a single mark-to-market gain or loss.

It should also be noted that because exchanges outside of the US and Canada allow for the cross margining of futures and cash settled options, all European and Asian cash settled futures will be reflected in the commodities account, whereas in the US and Canada they will be reflected in the securities account.

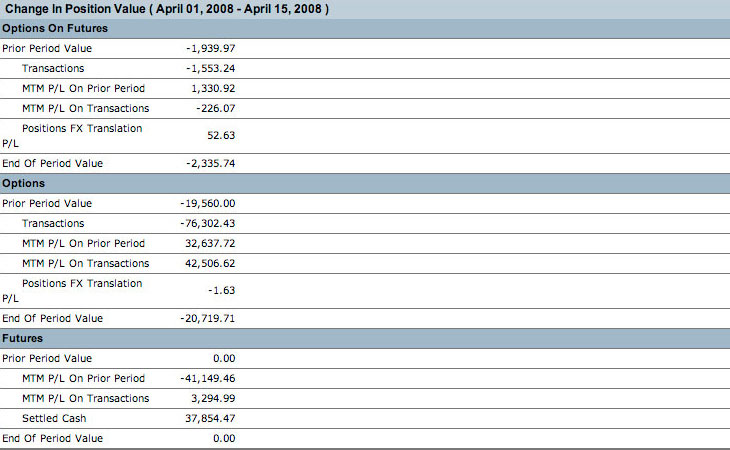

The change in position value section explains the changes in your position value from the beginning of the period to the end of the period.

- Changes in position value are due to transactions and changes in market prices.

- Details for these changes can be found in the Transaction and the Mark-to-Market P/L on Prior Period Positions sections.

This section shows all open positions, the cost basis by lot, and the FIFO unrealized profit or loss.

- Positions are segregated by asset type, currency and symbol.

- The cost basis, closing value, and unrealized P&L for positions in a non-base currency are also translated to the base currency using the exchange rates that were in effect on the day of the opening transaction.

- The unrealized profit or loss calculated in this section will be used in the Realized/Unrealized Performance Summary section above.

The Transaction section shows all transactions segregated by asset type and currency.

- FIFO and MTM profit and loss is shown for all realized (closed) transactions.

- Commissions are included with the cost basis and FIFO profit or loss.

- For MTM profit or loss, commissions are listed as a separate line in the Mark to Market Performance Summary above.

- This section also shows a summary of how positions change from the beginning of the period to the end of the period for each asset class in the base currency.

- The change for the period consists of new transactions as well as MTM changes in the value of the position.

- If positions are held in a non-base currency, there will also be a Position FX Translation Gain/Loss which reflects changes in value to the position due to a fluctuation in FX rates that are used to translate to the base currency.

- The Futures section will begin and end with a value of zero since all MTM fluctuations are settled into cash at the end of each trading day.

- Transaction amount, commissions/taxes, cost basis, FIFO P&L and MTM P&L for non-base currencies are all converted to the base currency in effect on the day of the transaction.

Interest is paid and charged once a month after each month's close. During the month we accrue interest each day, and when interest is actually posted to the account, the daily accruals are reversed.

- The interest accruals are presented for each currency held and are translated to the base currency using the conversion rates in effect at the time of the transaction.

- Interest accruals are a balance sheet item and reflected in the Equity Summary at the top of the statement.

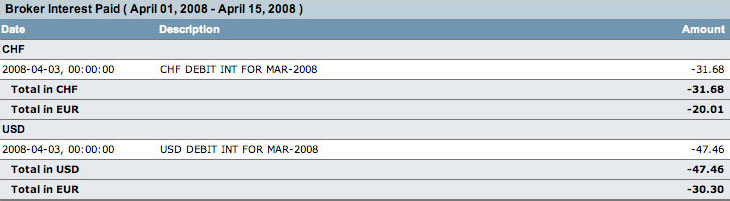

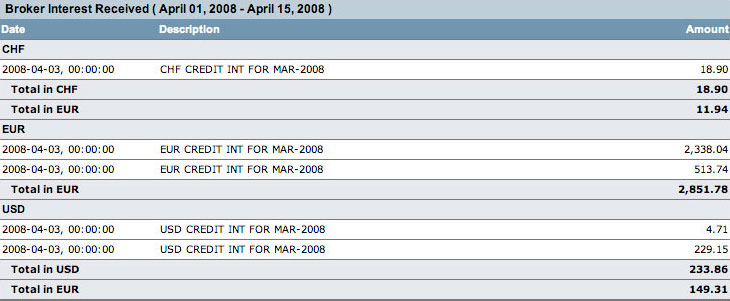

When interest is paid after the close of each month it is reflected in the Broker Interest Paid and Received sections.

These sections are sorted by currency, are translated to the base currency, and tie to the Mark to Market Performance Summary as well as the Cash Report.

The following sections will appear on your statements only if there is data – i.e.: If your positions do not have dividends, the Dividend section will not appear.

This section is segregated by asset class and currency.

- Expand / contract for details by symbol.

- Just as in the Mark to Market Performance Summary section above, MTM profit and loss is calculated in two components:

- MTM gains from transactions during the statement period and

- MTM gains or losses for positions that are carried into a new trading day.

- Prior MTM profit or loss not in the base currency is translated to the base currency at the exchange rate in effect on the day of the prior period calculation.

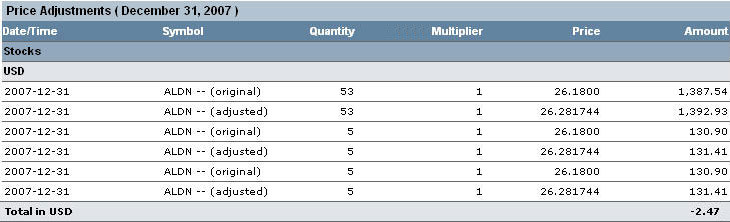

This section shows any price adjustments that were made to your account based on actual execution prices.

- Each adjustment transaction includes the trade date, quantity, price and trade amount for both the original and adjusted trade.

- A positive adjustment is debited to your account; a negative adjustment is credited.

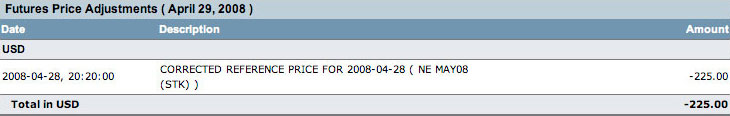

This section shows any price adjustments that were made to your account based on actual execution prices of your futures. Each adjustment transaction includes the trade date, underlying symbol, and amount.

Institutional customers with IBExecution or IBPrime Services will have an Unsettled Transfer section which details DVP, NSCC, CMTA, and GUS trade give-ups into and out of our broker.

- For give-up transactions the trade will appear from the day of trade until the day of settlement broken into trade date sections and sorted by the stage of the give-up process.

- Give-up trades will also appear in the Transaction section on the trade date as a trade, and will be removed from the Transaction section on the settlement date as a transfer.

- Take-up trades appear from the day of notification until the day of settlement. They will also appear in the Transaction section on the date of trade notification. Give-up and Take-up trades appear together and are differentiated by a To (Give-up) or a From (Take-up) indicator in the Direction column.

Institutional customers with IBExecution services that pre-trade allocate options trades will have an Unbooked Transactions section.

- This section will detail option trades that are immediately given up to a third-party broker and that are not booked into your account before being given-up.

- This section is for informational purposes only.

The Withholding Tax table displays Federal withholding tax on dividends, calculated for each currency based on tax rules for that country. The description for each line also displays the amount of tax per share.

Transaction Tax – stamp taxes charged in European markets.

The Corporate Actions section is sorted by asset class and currency.

The Dividends section lists all dividend payments by currency. Each currency total is also displayed in your base currency. If your positions do not have dividends this table will not appear.

If you buy a dividend-paying stock on margin and we lend that stock, you will receive Payment in Lieu of Dividend instead of the dividend. This payment is treated as ordinary income for US tax purposes.

The Other Fees section details miscellaneous charges, (overnight position fees for unbundled futures, notes, order cancel, withdrawal, telephone order, check, stop payment, bounced check, old statement, bust/adjust, market data, and minimum commission fees) is sorted by currency, is translated to the base currency in effect on the day of the fee, and ties to the Performance Summary as well as the Cash Summary.

Advisors and Brokers who charge their clients fees will have a Client Fee section on the master account statement.

- Commission or wrap fee revenues from the client are reflected in the Revenue column, and commission expenses paid to IB for execution and clearing services are reflected in the Expense column.

- The net is the profit made by the advisor or broker.

- This section is segregated by currency and ties to the Performance Summary and the Cash Summary.

- Fees in a non-base currency are translated to the base currency using the conversion rate in effect on the day of the fee.

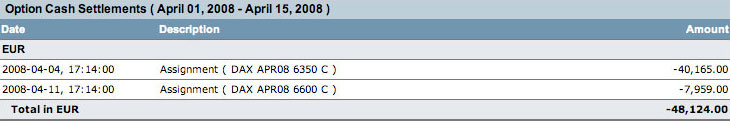

The option cash settlements shows the details of your index options, which settle in cash and not stock.

The Deposits/Withdrawals table shows all activity into and out of your account.

Position transfer to or from another broker will be reflected in the Account/Brokerage Transfers section. Common securities transfer systems include ACATs in the U.S. and ATONs in Canada.

- Date of transfer.

- From Account - account number from which the transfer originates.

- To Account - the account to which the position goes.

- Description - description of the position

- Cash Transfer - the value of the cash transfer.

- Quantity - the share or unit quantity. For a cash transfer this field is blank.

- Transfer Price - the price per share at which IB accepts the incoming transfer.

- Position Transfer - the Quantity x Transfer Price

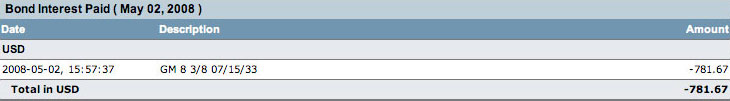

When interest for bonds is paid after the close of the month, it is reflected in the Bond Interest Paid section. This section is sorted by currency, are translated to the base currency, and tie to the Mark to Market Performance Summary as well as the Cash Report.

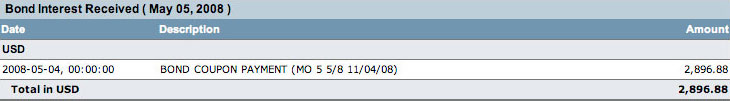

When interest for bonds is received after the close of the month, it is reflected in the Bond Interest Received section. This section is sorted by currency, are translated to the base currency, and tie to the Mark to Market Performance Summary as well as the Cash Report.

When selecting the statements to view, notice there are now two default formats for viewing statements in the Template drop down, Full and Simple. You can also create and save customized statement templates with just the sections you need and with P&L in either FIFO or MTM format or both.

In Account Management | Reports Management | Activity Statements:

Under View Statements select a template to view:

- Full Default is the complete statement with all activity and includes all information over a year, a month, or a date-range. Annual Statement is only available in Full default view.

- Simple Default allows you to see a simpler monthly or daily view that includes FIFO details – but excludes Mark-to-Market Performance Summary and P&L, Change in Position Value, and MTM P&L on Prior Period Positions.

- Create and Edit Templates section allows you to specify the sections to include, the amount of detail and the P&L format you prefer.

- Then save your layout to include in the Template list along with the Full Default and Simple Default templates.

- Create as many custom templates as you need, and view your activity using any selected template at any time.

Once selected, a new browser window opens with your statement displayed in the requested format.

Hide Lot detail for positions, transactions and prior MTM – will consolidate transactions by order number.

- Pending Transfers

- Unbooked Transactions

- Adjustments

- IBG Notes

- Withholding Tax

- Transaction Tax

- Prior Period Positions (if MTM is enabled)

- Change in Position Value (if MTM enabled)

- Dividends

- Payment in Lieu of Dividends

- Client Fees

- Other Fees

- Cash Activity

- Deposits/Withdrawals

- Interest Accruals

- ACAT Transfers

- Interest Received

- Interest Paid

You can view the statements in Excel:

- Store the HTML statement locally on your hard-drive by clicking the File menu and then choosing Save from the menu options.

- Once the file is saved locally, open Microsoft Excel and choose the HTML file that you saved.

Margin Report shows margin requirements for all open single and combination positions. The report displays Available Funds (to determine if you can put on a new trade) and excess liquidity (when depleted you risk liquidations).

In the TWS Account window you get real-time margin summary amounts. As of 16:15 ET each day we record your margin and equity information across all asset classes and exchanges for the Margin Report.

- Breaks out security and commodity amounts for Equity with Loan Value, Net Liquidation Value and current Initial and Maintenance margin.

- View Margin Detail for each open position, including combination positions.

- Margin for FX trades is broken out onto separate lines.

- Total line is displayed for each currency in which you hold a position, along with the total in your base currency.

- Margin requirements details by product can be found on the Interactive Brokers web site under Trading | Margin.

Real-time Trade Confirmations are available from Account Management. From the left navigation panel select Report Management, and then Trade confirmations.

Below is an example of a Trade Confirmations Report.