守势相对委托单

守势相对委托单为交易者提供了一种寻求比全国最佳买卖价(NBBO)保守的价格,同时保持委托单与最佳出价(对买单)或最佳要价(对卖单)挂钩的方法。委托单价格按市场的变化获自动调整以保持委托单的保守价格。对买单,您的委托单价格与带有一个保守偏离值的NBB(全国最佳出价)挂钩,如果NBB上涨,您的出价也随之上涨。如果NBB下跌,将不做调整,否则的话您的委托单将变为积极的并被执行。对卖单,您的价格与带有保守偏离值的NBO(全国最佳要价)挂钩,如果NBO下跌,您的出价也可随之下调。如果NBO上涨,将没有价格调整,否则的话您的委托单将成为积极的并获执行。除了偏离值外,您可以设定一个绝对上限,该上限可以做为一个限价,并将防止您的委托单以高于或低于某个特定水平被执行。守势相对委托单与相对/挂钩委托单相似,不同之处仅在于守势相对委托单买价减去偏离值,相对委托单买价加上偏离值。

注:

页面右上方的参考表格提供了对委托单类型特点的总体概述。打勾的功能适用于一些组合,但不一定能与所有其它打勾的功能一同使用。例如,如果期权和股票、美国产品和非美国产品以及智能传递和直接传递都被打勾了,这并不能说明所有的美国及非美国的智能和直接传递的股票都支持该委托单类型。有可能是这样的情况:只有智能传递的美国股票、直接传递的非美国股票和智能传递的美国期权被支持。

举例

委托单类型详解 - 守势相对买单

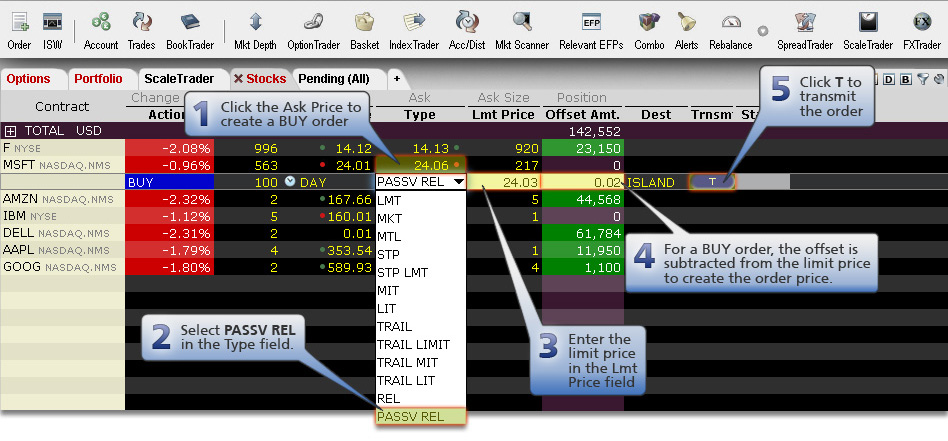

第一步 - 输入一个守势相对买单

当您使用守势相对委托单时,限价区域的值变为价格上限。NBB减去偏离值(相对值)可得到买单的委托单价格(但不显示),NBO加上偏离值可得到卖单的委托单价格。您希望买进100股XYZ股票,并希望委托单价格比当前最佳出价保守,来增加以较好价格执行委托单的机会。

当前XYZ股票的NBBO是$24.01 - 24.06。您创建了一份100股的买单并选择PASSV REL(守势相对)为委托单类型。您输入24.03做为限价,该价格为您委托单的价格上限:这是您能接受的最高价格。您输入一个0.02偏离值,然后传递委托单。

| 假设 | |

|---|---|

| 行动 | 买 |

| 数量 | 100 |

| 委托单类型 | 守势相对(PASSV REL) |

| 市场价格(NBBO)范围 | $24.01 - 24.06 |

| 限价(价格上限) | 24.03 |

| 偏离(相对)值 | 0.02 |

第二步 - 委托单传递

您的委托单以起始出价$23.99(NBB24.01 - 0.02偏离值)提交,该价格比NBB$24.01保守。

| 假设 | |

|---|---|

| 行动 | 买 |

| 数量 | 100 |

| 委托单类型 | 守势相对(PASSV REL) |

| 市价(NBBO)范围 | $24.01 - 24.06 |

| 限价(价格上限) | 24.03 |

| 偏离(相对)值 | 0.02 |

| 出价 | 23.99 |

第三步 - 价格上涨,委托单未获执行

市价上涨,XYZ的NBBO涨至$24.03-$24.08。您的出价随之涨至$24.01。委托单未能执行。如果市场继续涨至$24.03-24.07,您的出价将被限制在$24.03。

| 假设 | |

|---|---|

| 行动 | 买 |

| 数量 | 100 |

| 委托单类型 | 守势相对(PASSV REL) |

| 市价(NBBO)范围 | $24.03 - 24.08 |

| 限价(价格上限) | 24.03 |

| 偏离(相对)值 | 0.02 |

| 出价 | 24.01 |

第四步 - 价格下跌,委托单获执行

市价下跌,XYZ的NBBO跌至$23.98-24.03。您的出价保持在$24.01且以该价格执行。

| 假设 | |

|---|---|

| 行动 | 买 |

| 数量 | 100 |

| 委托单类型 | REL |

| 市价(NBBO)范围 | $23.98 - 24.03 |

| 限价(价格上限) | 24.03 |

| 偏离(相对)值 | 0.02 |

| 出价 | 24.01 |