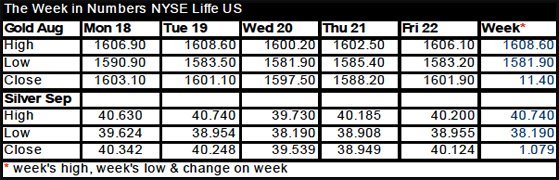

July 25, 2011 - Provided by Bullion Weekly from www.thebulliondesk.com

| BULLISH | BEARISH | OUTLOOK | |||

|

Prices move into uncharted water. Sovereign debt issues prevail. Dollar weakens again. |

Potential for a broad-based correction. Less liquidity as QE2 ends. Potential for a debt limit agreement. |

Short Term: Medium Term: Long Term: |

Pull back to Consolidate Extend gains |

$1,450-1,470 $1,500-1,550 $1,570-1,630 |

|

Sovereign debt problems in the US and EU are captivating the markets. The assumption is that the US will not default but whether an agreement is made on the debt ceiling before August 2 remains to be seen.

One way or another, we would not be surprised if ratings agencies disciplined the US for running this debt ceiling decision so close to the deadline.

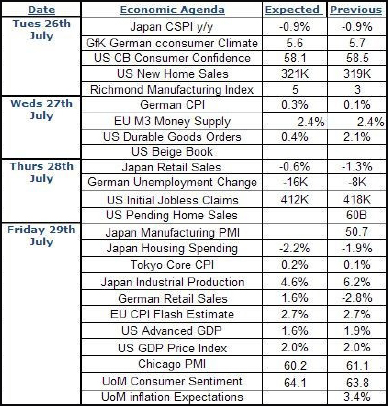

A close eye must also be kept on economic data this week, especially PMI data – last week's figures suggested a continued slowdown in manufacturing. More of the same this week could unnerve markets, which in turn could lead to greater risk reduction.

Should a broad-based correction get underway, gold and silver prices may get carried lower initially as the markets raise cash for margin payment. Still, we would expect dips in bullion to attract good buying.

The dollar is also holding at a relatively weak level and, while that remains the case, it is likely to be bullish for bullion.

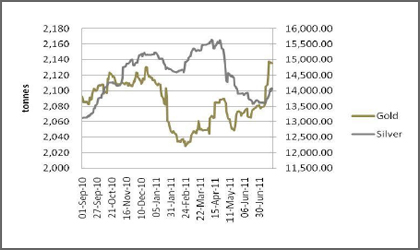

Rising default concerns on both sides of the Atlantic have boosted ETF investment demand again over the past few weeks, a sign that investors continue to view both gold and silver as safe-haven assets despite their elevated prices.

The two largest funds, the SPDR for gold and the iShares for listed silver, have recorded solid inflows over the past fortnight, with a total of 36.3 tonnes of gold and 316.7 tonnes silver added; several of the European listed funds have also seen good volumes of demand as concerns surrounding peripheral EU debt levels intensify.

Meanwhile, the recent price fluctuations have made OTC retail and investment demand through jewellery a little more opaque. Sales of coins and bars sales have moderated. Eagle coin sales to the end of last week totalled 40,000 ounces of gold, down from 107,000 ounces in May, data from the US mint showed. Silver demand was still robust, though, with month-to-date sales at 2.31 million ounces versus 3.65 million ounces in May.

Interestingly, gold's first test above $1,600 last week put prices in India at a discount when large volumes of scrap material flowed into the market at a time of limited seasonal demand. Local gold prices are also trading at a discount in China while demand on the Shanghai Gold Exchange remains robust, with turnover this month around five percent higher than at this time last year.

The accompanying chart illustrates the level of ETF investment interest in both gold and silver relative to the spread of the Greek 10-year bond over the German benchmark. While it is not an exact barometer, there is an increase in gold and/or silver holdings in the two-six weeks after the spread sets new peaks. It hit a record 1,565 basis points last week, suggesting further ETF-related price gains for bullion.

Gold prices gapped higher on Monday and look as though they may have just embarked on a second up leg, having consolidated throughout most of last week. The technical indicators are generally bullish, the MACD is rising and the stochastics have held up well and are now rising again.

The uppermost resistance line from the up channel is at around $1,648, so that seems a likely target. But the count from the first up leg, if this turns out to be a second, is around the $1,740 level.

Expect support initially around $1,610; if that is tested and fails to hold, though, we would expect good support between $1,600 and $1,580. Any move down below $1,580 would suggest a deeper pullback. Overall, expect the rally to continue and for dips to be well supported.

Silver prices have rallied out of a long sideways trading range, which looks constructive.

Prices did pop up above the upper Bollinger band last week but are now below it. But the upper Bollinger band is rising, making room for prices to climb further.

The stochastics have consolidated but have done so by holding up in the strong zone; while they remain strong, further gains look likely. The MACD is also trending higher, which looks encouraging.

Overall, we remain bullish on silver and expect the rally to extend back initially towards $46, although a return to the highs may well be on the cards further down the road.

"As during Lehman Brothers' collapse, we [would] expect gold prices in dollars to come under pressure as liquidity dries up from the interbank lending market. But the impact on gold prices could be smaller this time around as a number of exchanges, clearing houses, and banks now accept gold as collateral" - Michael Widmer, Bank of America-Merrill Lynch

Dollar Index

The dollar is consolidating off its May low but attempts to rally have failed. So the downward trend has halted but consolidation rather than an upward trend has followed. This means the dollar could continue lower. If it does, that would be bullish for bullion. If the dollar rallies for safe-haven reasons, gold is likely to follow. |

Gold & Silver ETFs

Investment demand in the ETFs has jumped in recent weeks. The accumulation of gold ETFs has accelerated, while holdings in the silver ETFs have started to climb again after quite a drawn-out period of redemptions. The buying in the ETFs looks constructive and may well underpin these fresh up legs in prices. |

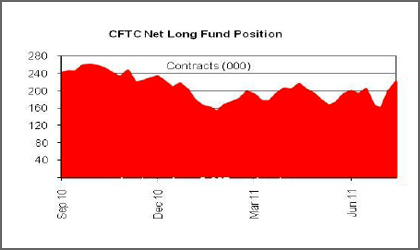

Funds

Fund investors increased their exposure to gold over the past two week, up 61,522 contracts or 39 percent. As the chart shows, the net long fund position in gold is still well below the peak. This is even more so in silver where the net fund long position stands at 20,749 contracts. The previous peak in September 2010 was 51,481 contracts – suggesting significant potential for silver to play catch-up. |

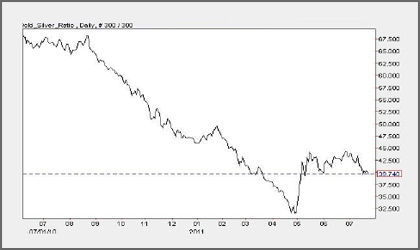

Gold : Silver Ratio

The gold/silver ratio became oversold. Although it has now consolidated, we wonder whether it is about to resume its downward trend. Support is being retested – if the ratio starts to fall below 39, it would suggest that silver is playing catch-up with gold, which would signal a bullish environment for bullion generally. |

Given the sovereign debt mess in Europe and the stalemate over the debt limit in the US, it is not surprising that gold is setting new highs. The very fact the world's reserve currency is in such a situation that the US needs to borrow more money to pay creditors and employees does not bode well. Little wonder, then, that holders of dollars want to diversify away from the dollar.

So gold, silver and commodity currencies are all doing well – these are seen as more valuable than the dollar and the euro. Even base metals are holding up relatively well because they have even better intrinsic value than bullion, although they are not as readily transferable as bullion.

Deteriorating economic data, especially softer manufacturing PMI data out in China and the EU, suggest that economic growth is slowing again. Central banks in the West may well be forced to embark on more quantitative easing if that continues, which would further debase the value of the underlying currencies.

With no concrete solution to the debt crises yet evident, it looks as though politicians and central banks will continue to muddle their way through. Mistakes may well be made along the way.

We remain bullish for bullion overall; we are aware that a broad-based correction may pull gold and silver prices lower initially but we would expect the secondary reaction to be bullish as some of the money coming out of other assets moves into bullion.

Terms & Conditions

The Terms and Conditions for this service are available below:

http://premium.basemetals.com/content/html/FMTermsandConditionsforonlineServices.html

Representations and Liability

1. Fastmarkets represents that:

(i) It will supply the Services in a professional way, using the care that can be reasonably expected for this type of business, and in accordance with the practices and policies which are commonly applicable in the information services industry:

(ii) it is duly empowered to supply the Information and Service(s) to the Client for the purposes specified in this Agreement and that the Service(s) and its use by the Client as specified in this Agreement will not infringe any intellectual property rights of any third party.

2. Although Fastmarkets will use all reasonable endeavours to ensure the accuracy and reliability of the Services, neither Fastmarkets, the Data Sources, or any third-party provider will be liable to the Client (or any third party) for direct, indirect or consequential loss or damage, including but not limited to loss of data, trading or other economic losses, arising out of any reliance on the accuracy of the Information (including but not limited to data, news and opinions) contained in the Service(s) or resulting in any way from the supply (or failure of supply) of the Services. However, Fastmarkets accepts liability for physical loss or damage to the Site caused by its negligence or wilful misconduct.

3. Except as expressly stated in this agreement, all express or implied conditions, warranties or undertakings, whether oral or in writing, in law or in fact, including warranties as to satisfactory quality and fitness for a particular purpose, are excluded.

4. The Client will indemnify Fastmarkets against any loss, damage or cost in connection with any claim or action that may be brought by any third party against Fastmarkets relating to any misuse of the Services by the Client.

5. To the extent permitted by law, under no circumstances will Fastmarkets' liability under this Agreement exceed the Service Fees paid to Fastmarkets by the Client, regardless of the cause or form of action.

Privacy Policy

The Fastmarkets Ltd Privacy Policy is available below:

http://premium.basemetals.com/content/html/Privacy_Policy.html

This Bullion Weekly is presented by an unaffiliated third party and Interactive Brokers LLC does not create the content of these presentations. You should review the contents of each presentation and make your own judgment as to whether the content is appropriate for you. Interactive Brokers LLC does not provide recommendations or advice. This presentation is not an advertisement or solicitation for new customers. It is intended only as an educational presentation.