Expanded Offerings

Turnkey Solutions for

Registered Investment Advisors

Streamline Your Trade Allocation Workflow

with the IBKR Allocation Order Tool

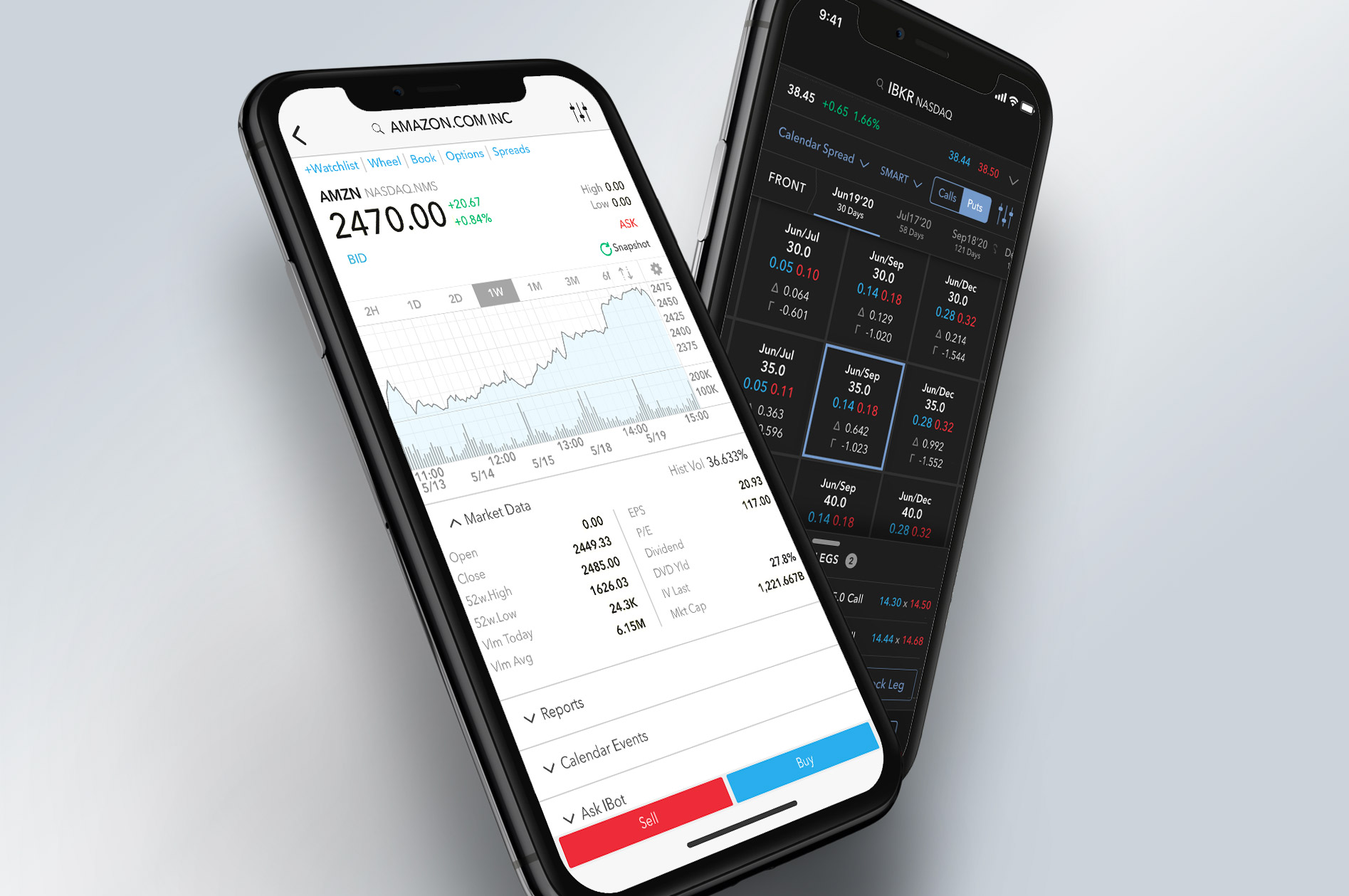

Interactive Brokers offers a unique trade allocation tool that makes it simple for advisors to trade at the same price for multiple clients.

The IBKR Allocation Order Tool transforms and streamlines the creation, execution, and allocation of group orders. Gone are the hours of setting up an order only to find an error or, even worse, that the market opportunity has passed. Now you can develop and deploy investment strategies in minutes to help capture opportunities in volatile markets.

- Use a single screen to quickly enter trade allocations across many client accounts, advisors or strategies

- Reduce or exit existing positions

- Increase or open new positions

- "Rotate" positions (close some and open others almost simultaneously)

- Increase or decrease positions by a specific percentage, or set per-account allocations by cash balance or buying power

- Scan advisor accounts, client accounts or strategies invested in a security and filter accounts by position size, market value, percent of P&L, cash balance or buying power

- Allocate the Total Quantity or Cash Quantity for a user-specified value proportionally (via position, cash balance or buying power), or equally

- Create and save multiple allocation profiles

- Modify your order or allocations on the fly

The Allocation Order Tool is available in the latest version of TWS. Click the link below to download TWS and try the Allocation Order Tool with a Live Trading, Paper Trading or Advisor Demo account.

Create, Test and Deploy Investment Strategies with Portfolio Builder

Our Portfolio Builder tool helps you turn investment strategy into action.

Use top-tier research and fundamentals data to create a strategy and then use up to eight years of historical data to back test and calibrate your strategy. When your strategy's historical performance meets your standards, invest with a mouse click and then track your portfolio’s performance.

Advisors are already configured to use Portfolio Builder to build and back test strategies. However, if you would like to use Portfolio Builder to invest, you will need to enable your account for Model Portfolios. To enable your account, log in to Advisor Portal, select the Settings > Account Settings menu and click the "Configuration (Gear)" icon next to Model Portfolios.

Greenwich Compliance Helps US Advisors with

Registration and Compliance Needs

Greenwich Advisor Compliance Services Corporation (Greenwich Compliance) was launched in 2016 to help advisors trading on the Interactive Brokers platform meet their compliance and registration needs in the United States.

We offer resources and services to help advisors with issues ranging from registration to day-to-day compliance and can help advisors of all stripes, from established registered advisors to those just starting their own firms. Greenwich Compliance professionals have regulatory and industry experience and can help advisors navigate the maze of regulatory requirements and compliance obligations that they face.

Whether you are transitioning from a financial advisory firm, big bank or wirehouse, or starting your own firm, you are likely to have questions about the complex SEC and state registration requirements. Greenwich Compliance professionals are available for a free consultation to answer your questions about when and where to register.

Registration Services

Greenwich Compliance offers direct expert registration and start-up compliance services. At a reasonable cost, Greenwich Compliance professionals take an active role in helping firms through the registration process, including assistance with:

- Preparing and completing Form ADV and other SEC or state application documents your firm or staff need to file.

- Drafting client agreements, compliance documents and manuals.

- Locating third-party providers offering operational and administrative start-up services commonly used by new businesses.

Greenwich Compliance gives advisors customized service and puts in the time to know you and your firm's needs. We strive to provide you with a tailored approach to get you started on the road to running the properly registered and compliant firm your regulators and clients expect.

Compliance Services

Advisors on the Interactive Brokers trading platform can contact Greenwich Compliance for answers to their basic day-to-day compliance questions. Greenwich Compliance will also help guide advisors who need targeted compliance services to third-party providers that specialize in a variety of advisor compliance services, many of whom offer discounts to advisors trading through IBKR.

Visit Greenwich Compliance for more information.