Options Margin Requirements

Options Margin Overview

Canada Options Margin Requirements

For residents of Canada trading options:

- Rules-based margin

The complete margin requirement details are listed in the sections below.

Please note that Interactive Brokers utilizes option margin optimization software to try to create the minimum margin requirement. However, due to the system requirements required to determine the optimal solution, we cannot always guarantee the optimal combination in all cases.

Option Strategies

The following tables show option margin requirements for each type of margin combination.

Notes:

The following formulas make use of the functions Maximum (x, y, ..), Minimum (x, y, ..) and If (x, y, z). The Maximum function returns the greatest value of all parameters separated by commas within the parenthesis. As an example, Maximum (500, 2000, 1500) would return the value 2000. The Minimum function returns the least value of all parameters separated by commas within the parenthesis. As an example, Minimum (500, 2000, 1500) would return the value of 500. The If function checks a condition and if true uses formula y and if false formula z. As an example If (20 < 0, 30, 60) would return the value 60. Note also that Margin requirements quoted in US dollars may also be satisfied with a non-US Dollar equivalent.

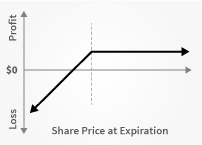

Long Call or Put

| Margin | |

| Initial | None. Long option cost is subtracted from cash. |

| Maintenance | None. |

| Cash or RSP/TFSA | |

| Initial | None. Long option cost is subtracted from cash. |

| Maintenance | None. |

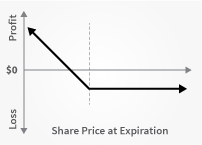

Short Naked Call

| Margin | |

| Initial | 100%* option market value + maximum ((( Percentage based on underlying statutory margin requirement* underlying market value) - out of the money amount), 10%* underlying market value, $250* number of contracts). Short sale proceeds are applied to cash. Underlying statutory margin requirement above is 15% for broad based index options. |

| Maintenance | Same as Initial. |

| Cash or RSP/TFSA | |

| Initial | N/A |

| Maintenance | N/A |

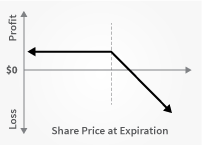

Short Naked Put

| Margin | |

| Initial | 100%* option market value + maximum (((Percentage based on underlying statutory margin requirement* (underlying market value) - out of the money amount), 10%* strike price, $250* number of contracts). Short sale proceeds are applied to cash. Underlying statutory margin requirement above is 15% for broad based index options. |

| Maintenance | Same as Initial. |

| Cash or RSP/TFSA | |

| Initial | N/A |

| Maintenance | N/A |

Covered Calls

Short a call option with an equity position held to cover full exercise upon assignment of the option contract.

| Margin | |

| Initial | abs(Short Call Value) + min(Long Stock Margin, max(0, Strike - Long Stock value + Long Stock Margin)) |

| Maintenance | Same as Initial. |

| Cash or RSP/TFSA | |

| Initial | Stock paid in full. |

| Maintenance | Stock paid in full. |

Covered Puts

Short a put option with an equity position held to cover full exercise upon assignment of the option contract.

| Margin | |

| Initial | Initial stock margin requirement + 100% of in the money option value. Short sale option proceeds are applied to cash. |

| Maintenance | Same as Initial. |

| Cash or RSP/TFSA | |

| Initial | N/A |

| Maintenance | N/A |

Call Spread

A long and short position of equal number of calls on the same underlying (and same multiplier) if the long position expires on or after the short position.

| Margin | |

| Initial | (Maximum (aggregate long call strike - aggregate short call strike, 0)). Long call cost is subtracted from cash and short call proceeds are applied to cash. |

| Maintenance | Same as Initial. |

| Cash or RSP/TFSA | |

| Initial | N/A |

| Maintenance | N/A |

Put Spread

A long and short position of equal number of puts on the same underlying (and same multiplier) if the long position expires on or after the short position.

| Margin | |

| Initial | (Maximum (aggregate short put strike - aggregate long put strike, 0 )). Long option cost is subtracted from cash and short option proceeds are applied to cash. |

| Maintenance | Same as Initial. |

| Cash or RSP/TFSA | |

| Initial | N/A |

| Maintenance | N/A |

Collar

Long put and long underlying with short call. Put and call must have same expiration date, same underlying (and same multiplier), and put exercise price must be lower than call exercise price.

| Margin | |

| Initial | (Initial stock margin requirement). Put option cost is subtracted from cash, short option proceeds are applied to cash. Equity with Loan Value of long stock: Minimum (current market value, call aggregate exercise price). |

| Maintenance | Minimum (((10%* put exercise price) + out-of-the-money put amount), (Percentage based on underlying statutory margin requirement* call exercise price)). |

| Cash or RSP/TFSA | |

| Initial | N/A |

| Maintenance | N/A |

Long Butterfly

Two short options of the same series (class, multiplier, strike price, expiration) offset by one long option of the same type (put or call) with a higher strike price and one long option of the same type with a lower strike price. All component options must have the same expiration, same underlying, and intervals between exercise prices must be equal.

| Margin | |

| Initial | None. Long option cost is subtracted from cash and short option proceeds are applied to cash. |

| Maintenance | None. |

| Cash or RSP/TFSA | |

| Initial | N/A |

| Maintenance | N/A |

Conversion

Long put and long underlying with short call. Put and call must have the same expiration date, underlying (multiplier), and exercise price.

| Margin | |

| Initial | (Initial stock margin requirement). Long stock and put cost is subtracted from cash, and short call proceeds are applied to cash. Equity with Loan Value of long stock: minimum (current market value, call aggregate exercise price). |

| Maintenance | (10%* aggregate exercise price). |

| Cash or RSP/TFSA | |

| Initial | N/A |

| Maintenance | N/A |

Reverse Conversion

Long call and short underlying with short put. Put and call must have same expiration date, underlying (multiplier), and exercise price.

| Margin | |

| Initial | (50%* short market value) + Maximum ((Put Exercise Price - Stock Market Price),0). Long call cost is subtracted from cash, short stock and put proceeds are applied to cash, and short position is subtracted from equity with loan value. Not allowed for IRA accounts. |

| Maintenance | (10% of Put Exercise price) + Maximum ((Put Exercise Price - Stock Market Price), 0). |

| Cash or RSP/TFSA | |

| Initial | N/A |

| Maintenance | N/A |

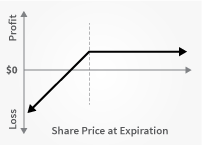

Protective Put

Long Put and Long Underlying.

| Margin | |

| Initial | (Initial stock margin requirement). Long stock and put cost is subtracted from cash. Same rules as cash for IRA Margin Accounts. |

| Maintenance | Minimum ((10%* aggregate put exercise price) + (100%* out of money amount), (stock maintenance margin requirement)). |

| Cash or RSP/TFSA | |

| Initial | N/A |

| Maintenance | N/A |

Notes:

- For Leverage Index Options, Minimum (15%* Leverage Factor, 100%)

Additional Canda Margin Requirements

For Residents of Canada:

Use the following links to view other margin requirements:

You can change your location setting by clicking here

Disclosures

- Minimum charge of USD 2.50 per share of underlying. This minimum does not apply for End of Day Reg T calculation purposes.

- Due to regulatory restrictions, Interactive Brokers does not currently offer margin lending to natural persons who are residents of Australia.

- IBKR house margin requirements may be greater than rule-based margin.