Bullion Weekly

May 03, 2011 - Provided by Bullion Weekly from www.thebulliondesk.com

| BULLISH | BEARISH | OUTLOOK | |||

|

Concerns over financial, geopolitical risks. Dollar weakness. Strong up trends. |

Evidence of fund profit-taking. Silver looks overstretched. Attempted rebounds in dollar, Au/Ag ratio. |

Short Term: Medium Term: Long Term: |

Pull back towards Consolidate Head towards |

$1,500 $1,490-$1530 $1,600 |

|

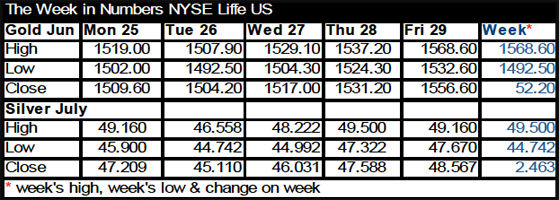

Last Week

- The bulls continued to dominate last week – continuing concerns surrounding inflation, Mena unrest, currency debasement and eurozone debt default triggered a further influx of investment diversification into bullion.

- Silver dominated initially, surging towards $50 per ounce on Monday on aggressive buying and in thin conditions, due to extended Easter holidays. Spot metal touched $49.81, surpassing the record high fix from January 18, 1980 of $49.45. Post-weekend profit-taking and an increase in margin requirements sent it back to consolidate around $44.60-46.25 on the following day before it returned to challenge $48-49.50 on Thursday and Friday.

- Gold briefly touched $1,518 on Monday before taking a backseat, base-building around $1,500. But strong buying emerged on Thursday and Friday as peripheral eurozone debt-default fears jumped, sending bond-premiums and credit default swaps for Greece, Spain and Ireland to fresh highs; the Greek/German 10-year premium surged to 1,306 basis points from 947 basis points at the end of March. Gold touched $1,538.50 on Thursday before surging to $1,569.45 on Friday.

- Thin trading, with most of Europe closed for May Day celebrations, and the news of the death of Osama bin Laden have resulted in a volatile start to the bullion market this week, with gold surging to a record $1,575 on Monday; but silver opened more than $5 lower from Friday's closing level after another margin increase by CME Group.

- The surge in US dollar gold prices has also resulted in new lifetime peaks in several other denominations, including Canadian dollars, sterling, the yen and the rupee.

The Week Ahead

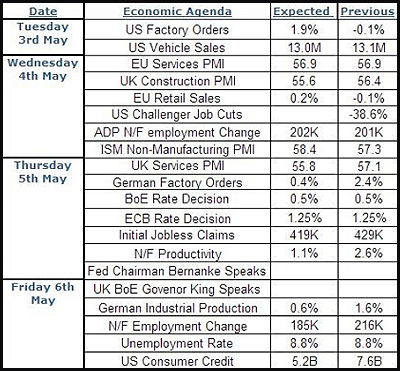

The ECB rate-setting meeting on Thursday and the US employment report on Friday both have significant implications for the dollar and bullion.

Bullion has a negative correlation to employment data – negative data implies that the Fed could leave the 'punch bowl' out for a while longer.

If the ECB raises rates again, this could leave the dollar vulnerable to further losses; but a pause in the ECB's rate-setting cycle could be slightly positive for the dollar.

The continuing risk from unrest in Syria, civil war in Libya, the possibility of an al-Qaeda retaliation following bin Laden's death and further issues in negotiating Portugal's EU/IMF bailout could provide bullion with further upside impetus, we note.

Overall, the fundamentals remain positive for bullion in the medium term but the increased volatility on the bullion charts after the substantial run-ups and the overcrowded dollar short trade also suggest increased risk for bullion in the short term.

Focus – Dollar losing appeal

Bullion prices have scaled fresh peaks over the past week, with gold surpassing $1,550 and silver flirting with $50. As we have noted, several factors are driving the market – negative real interest rates, rising inflation concerns and political unrest in the Mena region.

The debasement of fiat currencies resulting from various quantitative easing programmes has also been a major factor; however, the weakness in the dollar has also been fuelling broad commodity gains in recent weeks.

The US currency is approaching pre-financial-crisis lows, with the DXY threatening to smash through its all-time low of 70.70 due to a lack of technical support. But when other currencies are facing similar problems, why is the dollar under so much pressure? Factors include the Federal Reserve's easy-money policies, huge national debts and deficits and, consequentially, the possibility of a ratings downgrade following the recent outlook downgrade.

But what would be necessary to turn the dollar higher? Monday's killing of bin Laden prompted a brief bounce in the dollar but the interest rate differential between the US and particularly the eurozone continues to keep the greenback under pressure despite the debt problems facing the PIIGS. But while the ECB is defending the euro, raising interest rates last month in a bid to stem inflation, neither Fed chairman Ben Bernanke nor most FOMC mmbers appear to be in a rush to raise rates.

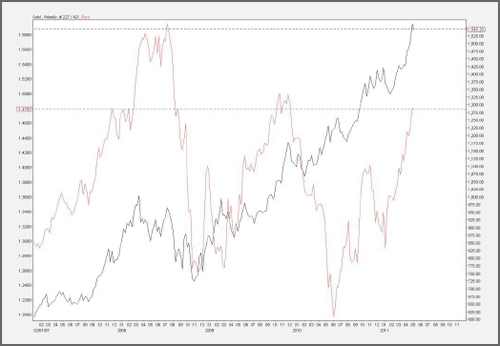

The end of the second leg of the Fed's quantitative easing programme in June may mark a turning point for the dollar but a rebound could be negative for risk appetite given the strong inverse correlation between equities and the dollar so far this year. A stronger dollar is generally negative for gold as well, although as the accompanying chart shows gold has performed well in recent years in both strong and weak dollar environments.

Technical Analysis – Gold

After a strong bullish weekly close last week, gold opened inside last week's open/close range, raising the chance of a reversal this week unless it can close above $1,569.

The stochastics and RSI look to have turned lower but remain in their strong ranges. Gold has bullish support from the 5 WMA at $1,515 and further trendline support at $1,488-$1,539.

Overall, prices could consolidate or retrace in the short term after the strong run higher, thereby building a base to challenge $1,575-$1,627 again in the short-to-medium term.

In the wider picture, bullion still looks bullish – it is trading in the long-term bullish up trading range of $1,627-$1,394 and above the medium-term bullish trading range of $1,539-$1,456.

Technical Analysis – Silver

Silver closed positively last week but formed a loud spinning top formation. This week prices have opened a long way below last week's low, indicating increased volatility and a possible short-term top.

The momentum indicators have now crossed lower but the RSI is still in the strong range. Silver has also opened below the 5 WMA for the first time since January 17; a close below this level would be bearish.

Silver has moved back into the long-term bullish trading range of $41.98-$46.38 and has further support from the long-term bullish up trendline at $39.59 and the 32.8% Fibonacci retracement level at $40.86.

We will therefore remain positive in the medium term as long as silver remains above $41.98-$40.86. But there may be some further consolidation or even more retracement in the short term, we suspect.

Trader Talk

"There are very few commodities where we know the direction of their movement in the next six months to a year. People like to get in on things that are rising in prices. Over time, it has not been the way to get rich." - Warren Buffet.

Market Drivers

Dollar Index

The trend in the dollar continues to push lower, which is no doubt a supportive factor for bullion prices. But we would be wary because the dollar looks oversold. The technical indicators have turned higher again – indicating the index is trying to rebound. If it succeeds in doing so, expect bullion prices to drop. |

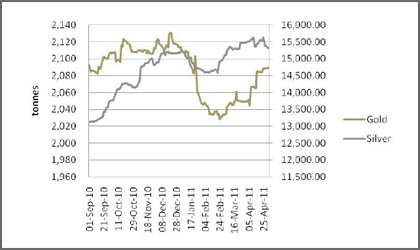

Gold & Silver ETFs

The volume of gold held in the ETFs we follow has been climbing again, which is encouraging. But holdings in the silver ETFs has started to decline, which points to redemptions. |

Funds

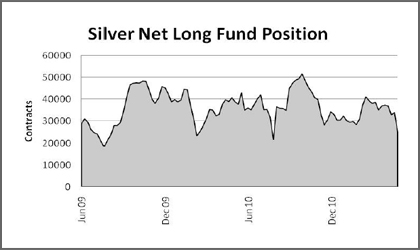

The net long silver position dropped 8,771 contracts last week to 24,995 contracts. The recent peak was 51,481 contracts late in September. So the recent spike has come about despite liquidation selling. The net fund gold position dropped 13,660 contracts, more than reversing the gains from the previous week, but the position is quite high overall. |

Gold : Silver Ratio

The gold/silver ratio chart shows a rebound is finally getting underway, which suggests that bullion prices may well fall further in the short term and that silver is likely to fall at a faster pace than gold. But like the dollar index, the trend in the ratio has been strong, so the rebound may just be another short-lived blip. |

Conclusion

Bullion prices have been driven higher on a combination of issues including continued dollar weakness, a high level of geopolitical risk and further concerns over EU debt, US budget deficits and global inflation. But volatility in bullion prices has increased over the past week or so; its emergence after such strong gains may well be a sign of a change in underlying sentiment – at least for a while.

Silver seems the most likely to suffer a meaningful correction – ETF and fund investors have been taking profits and a fledgling rebound in the gold/silver ratio also suggests a general correction. Should the dollar also manage to rebound, a deeper correction could unfold.

Overall, we remain friendly to bullion over the medium term and expect dips to remain well supported. But there may be some meaningful dips in the short term. After the gains of late, these would not be surprising and are likely to be quite constructive.

Terms & Conditions

The Terms and Conditions for this service are available below:

http://premium.basemetals.com/content/html/FMTermsandConditionsforonlineServices.html

Representations and Liability

1. Fastmarkets represents that:

(i) It will supply the Services in a professional way, using the care that can be reasonably expected for this type of business, and in accordance with the practices and policies which are commonly applicable in the information services industry:

(ii) it is duly empowered to supply the Information and Service(s) to the Client for the purposes specified in this Agreement and that the Service(s) and its use by the Client as specified in this Agreement will not infringe any intellectual property rights of any third party.

2. Although Fastmarkets will use all reasonable endeavours to ensure the accuracy and reliability of the Services, neither Fastmarkets, the Data Sources, or any third-party provider will be liable to the Client (or any third party) for direct, indirect or consequential loss or damage, including but not limited to loss of data, trading or other economic losses, arising out of any reliance on the accuracy of the Information (including but not limited to data, news and opinions) contained in the Service(s) or resulting in any way from the supply (or failure of supply) of the Services. However, Fastmarkets accepts liability for physical loss or damage to the Site caused by its negligence or wilful misconduct.

3. Except as expressly stated in this agreement, all express or implied conditions, warranties or undertakings, whether oral or in writing, in law or in fact, including warranties as to satisfactory quality and fitness for a particular purpose, are excluded.

4. The Client will indemnify Fastmarkets against any loss, damage or cost in connection with any claim or action that may be brought by any third party against Fastmarkets relating to any misuse of the Services by the Client.

5. To the extent permitted by law, under no circumstances will Fastmarkets' liability under this Agreement exceed the Service Fees paid to Fastmarkets by the Client, regardless of the cause or form of action.

Privacy Policy

The Fastmarkets Ltd Privacy Policy is available below:

http://premium.basemetals.com/content/html/Privacy_Policy.html

This Bullion Weekly is presented by an unaffiliated third party and Interactive Brokers LLC does not create the content of these presentations. You should review the contents of each presentation and make your own judgment as to whether the content is appropriate for you. Interactive Brokers LLC does not provide recommendations or advice. This presentation is not an advertisement or solicitation for new customers. It is intended only as an educational presentation.