Bullion Weekly

January 17, 2011 - Provided by Bullion Weekly from www.thebulliondesk.com

| BULLISH | BEARISH | OUTLOOK | |||

|

Concerns about EU debt and QE may have receded but have not gone away. Good news is likely to be inflationary. Risk of an increase in geopolitical risk. |

Potential for further profit-taking. Opportunity costs rise. Dollar could rise further. |

Short Term: Medium Term: Long Term: |

Test support Regain lost ground Head towards |

$1,329/1,300 $1,400 $1,500 |

|

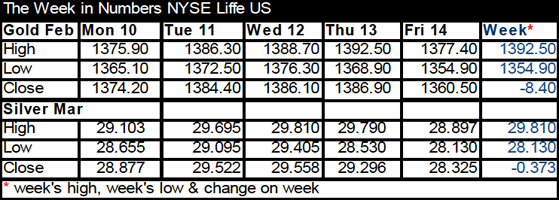

Last Week

- Bullion prices started to consolidate last week at lower levels but, once support had been found around $1,353 per ounce for gold and $28.34 for silver, buying soon emerged and the rebound then attracted even more buying. Indeed, the speed of the bounce suggested bargain hunters came back into the market with determination, which was enough to lift gold prices to $1,392.50 and silver to 29.81.

- But successful debt auctions in Portugal, Spain and Italy boosted the euro. Although that led to dollar weakness, which is normally a bullish factor for gold and silver, it did not have a positive effect on bullion prices this time.

- Fewer concerns about EU debt translated into reduced need for safe-haven investments, which prompted liquidation selling across the metals. The week ended with the dollar under pressure — the dollar index was around 79, the euro either side of 1.3400, gold at $1,360.50 and silver at $28.325.

- An increase in geopolitical tension after the overthrow of the Tunisian president has not yet boosted gold prices but the situation must be closely monitored. If the tension spreads to other Middle Eastern states, especially oil-producing countries, gold may rise as a hedge against an escalation in geopolitical risk.

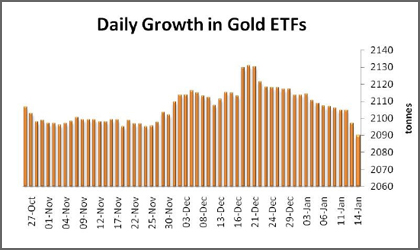

- The mood turned less bullish last week when investors started to take profits. Across the ETFs we follow, gold holdings dropped 17 tonnes and holding of silver fell an estimated 390 tonnes. In addition, funds cut their net long gold position by 24,946 contracts, a drop of some 12 percent over the week. It will now be interesting to see at what price the longs start to buy again.

The Week Ahead

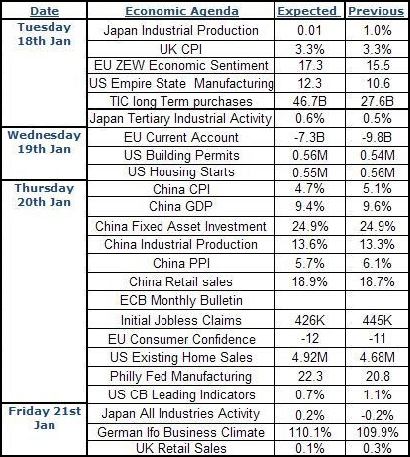

The Ecofin meeting of EU economic ministers on Tuesday is likely to affect bullion trading at the start of the week and its outcome is likely to influence prices over the week as a whole. But a swathe of economic data is also due this week, we note, which could well influence sentiment.

Comments by EU economic ministers have raised speculation that the EU could expand the existing bailout package and even cement it as a permanent bailout mechanism by March. This renewed optimism over the EU's latest attempt to curtail the crisis has removed some of gold's flight-to-quality appeal in the short term.

This week's heavy economic data load is likely to trigger considerably volatility in the currencies but, as we saw last week, the usual inverse relationship between gold and the dollar has been strained; the dominant factor in bullion has been liquidation selling.

Overall, we see bullion under pressure again this week while the market adjusts to the possibility that the risks from the sovereign debt crisis might have lessened. EU sovereign debt CDS spread movement could therefore be a good indicator for gold in the short term, we suspect.

Focus – Reduced Need For Safe Havens

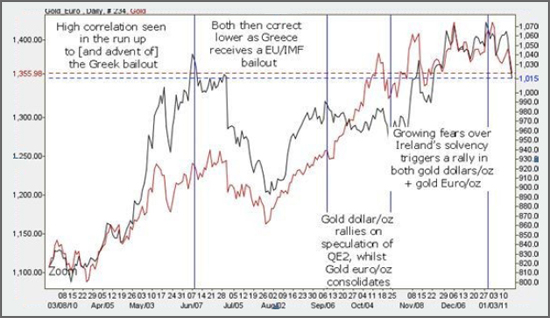

The EU sovereign debt crisis has had two distinct phases — the first was the Greek bailout (February-June) and the second was the Irish bailout (mid-October-December 2010).

Looking at prices in dollars (the red line on chart, right) and the euro (the black line), gold in both currencies had a high correlation rate during and after each of the bailouts. Between these periods, the correlation lessened: gold in dollars continued to rally on QE2 speculation while gold in euros consolidated.

Gold dollars/oz and gold euro/oz both peaked recently on January 4 and have since traded lower in tandem — similar to the aftermath of the first bailout.

Gold euro/oz has led the decline with a high-to-low drop of 5.5 percent, while gold in dollars has fallen 4.5 percent, which indicates that investors have felt less of a need for safe havens. Chinese and Japanese support for the debt-plagued EU nations and comments from Germany hinting that the EU bailout fund could be expanded seem to have buoyed broad market confidence. This culminated in relatively successful auctions of Portuguese, Spanish and Italian debt last week.

Gold could be set to continue lower in the near term, especially with confidence in the US recovery also soothing concerns about the aftermath of QE. Indeed, the fact that bullion has sold off while the dollar has weakened suggests profit taking and reduced interest in gold overall.

But we think this correction could be relatively short lived for several reasons: first, an increased bailout fund increases liquidity but does not solve market worries over sovereign debt; second, the physical market could well become a buyer again and set a floor for the market; and third, we expect inflationary concerns to emerge as a bullish factor for gold before long.

Technical Analysis – Gold

Gold closed negatively on Friday and has continued lower this morning. The stochastics are bearish — the K% line is in the weak range.

Prices closed below the 7 DMA, 21 DMA and 50 DMA, leaving support from the 100 DMA at $1,349. Gold also found support from the lower Bollinger bands on Friday, we note.

The metal closed below and failed to retake the neckline of the head-and-shoulders formation at $1,390, which suggests a downside target of $1,305.

Gold has other long-term trendline support at $1,360 and trendline resistance at $1,370-$1,390. Support for the metal is now seen at $1,360-$1,355-$1,352-$1,348-$1,340-$1,325-$1,319. Resistance is seen at $1,365-$1,378-$1,393.

Overall, we remain bearish in the short term but bullish in the medium-to-long term. We also think that this downside correction could well be constructive.

Technical Analysis – Silver

Silver closed negatively on Friday and continued to retrace this morning. Silver closed below the 50 DMA last week, which was bearish, but found support from the bottom of the Bollinger bands. This morning the momentum indicators remain weak.

Silver found support from the 23.6% Fibo level at $23.04 this morning. It has fallen below the bottom of the old triangle formation and now has trendline resistance at $28.27-$28.79-$30.09-$30.49. Other support is seen at $27.85-$27.76-$27.56-$26.91.

Overall, we are still bearish on silver and think there could well be further losses on a break below $28.00. In the wider picture, we have turned neutral.

Trader Talk

"There's been a lot of profit in gold and people are getting nervous that there might not be more. The big boys are starting to get out. They know that these prices aren't cheap in anybody's mind"

- Leonard Kaplan, president of Prospector Asset Management

Market Drivers

Dollar Index

The dollar climbed on good economic data at the start of the year but last week started to correct when good news lifted the euro. The dollar is now in a sideways range — the direction in which it finally breaks out will no doubt set the next move for bullion. |

ETFs

Profit-taking has picked up further across the ETFs, with some 17 tonnes of gold and some 130 tonnes of silver sold. But the drops are not that big yet — gold's holdings are down 1.9 percent from the highs and silver holdings are down 3.2 percent. Key will now be whether profit-taking gathers momentum. |

Funds

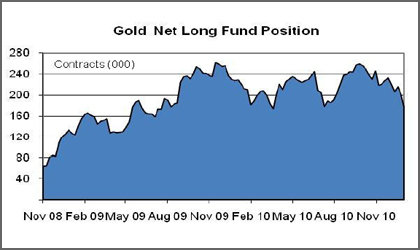

The trend in the net fund long position is falling. Last week longs cut their exposure in gold by 15,972 contracts and 8,974 short contracts were added. Silver was less affected, with 1,913 long positions being cut and 1,147 short positions being cut too. The net long fund gold position stands at 177,372 contracts; the low in March was 173,766 contracts. |

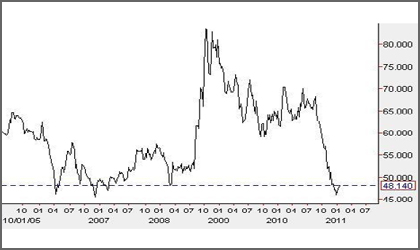

Gold : Silver Ratio

The low on the ratio was around 45 in 2007 — it got down to 45.44 recently and is trying to bounce. We have been waiting for a rebound, which may now be getting underway. If it gathers momentum, it is likely to be bearish for bullion prices, especially silver. |

Conclusion

Gold and silver prices have started to correct on profit-taking, which has been sparked by a pick-up in optimism over a recovery in the US and greater confidence that the EU governments, helped by promises of support from China and Japan, will be able to handle the sovereign debt crisis.

These developments, plus the successful debt auctions last week, have provided some respite but how long this lasts remains to be seen. Some investors are adjusting their exposure to safe havens, however, which is likely to keep bullion prices under pressure for a while.

We expect recent debt actions have just bought governments more time; we doubt the problems have gone away and, when they return, the need for safe havens will also return.

And if growth does start to recover, inflation is likely to become an issue given all the liquidity in the markets, which is likely to boost demand for gold and silver again.

We would also keep a close eye on the geopolitical events in the Middle East Middle — if unrest spreads, it could start to worry the oil market. Unrest in the Middle East was, after all, one of the main triggers of the 1980s spike in bullion prices.

Terms & Conditions

The Terms and Conditions for this service are available below:

http://premium.basemetals.com/content/html/FMTermsandConditionsforonlineServices.html

Representations and Liability

1. Fastmarkets represents that:

(i) It will supply the Services in a professional way, using the care that can be reasonably expected for this type of business, and in accordance with the practices and policies which are commonly applicable in the information services industry:

(ii) it is duly empowered to supply the Information and Service(s) to the Client for the purposes specified in this Agreement and that the Service(s) and its use by the Client as specified in this Agreement will not infringe any intellectual property rights of any third party.

2. Although Fastmarkets will use all reasonable endeavours to ensure the accuracy and reliability of the Services, neither Fastmarkets, the Data Sources, or any third-party provider will be liable to the Client (or any third party) for direct, indirect or consequential loss or damage, including but not limited to loss of data, trading or other economic losses, arising out of any reliance on the accuracy of the Information (including but not limited to data, news and opinions) contained in the Service(s) or resulting in any way from the supply (or failure of supply) of the Services. However, Fastmarkets accepts liability for physical loss or damage to the Site caused by its negligence or wilful misconduct.

3. Except as expressly stated in this agreement, all express or implied conditions, warranties or undertakings, whether oral or in writing, in law or in fact, including warranties as to satisfactory quality and fitness for a particular purpose, are excluded.

4. The Client will indemnify Fastmarkets against any loss, damage or cost in connection with any claim or action that may be brought by any third party against Fastmarkets relating to any misuse of the Services by the Client.

5. To the extent permitted by law, under no circumstances will Fastmarkets' liability under this Agreement exceed the Service Fees paid to Fastmarkets by the Client, regardless of the cause or form of action.

Privacy Policy

The Fastmarkets Ltd Privacy Policy is available below:

http://premium.basemetals.com/content/html/Privacy_Policy.html

This Bullion Weekly is presented by an unaffiliated third party and Interactive Brokers LLC does not create the content of these presentations. You should review the contents of each presentation and make your own judgment as to whether the content is appropriate for you. Interactive Brokers LLC does not provide recommendations or advice. This presentation is not an advertisement or solicitation for new customers. It is intended only as an educational presentation.