Bullion Weekly

December 13, 2010 - Provided by Bullion Weekly from www.thebulliondesk.com

| BULLISH | BEARISH | OUTLOOK | |||

|

Impact of sovereign debt and QE. Funds return as buyers. Inflation, especially in China. |

ETF investors are taking profits. Treasury yields are rising. Gold/silver ratio looks stretched. |

Short Term: Medium Term: Long Term: |

Test support Challenge Head towards |

$1,370 $1,450 $1,500 |

|

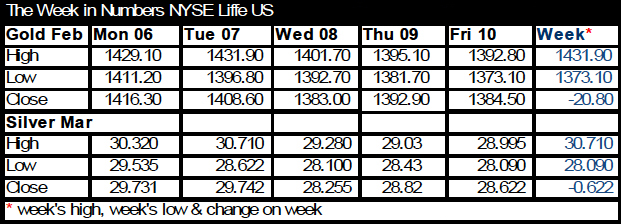

Last Week

- Flight-to-safety demand propelled bullion prices to fresh highs across the first half of last week, as eurozone default fears intensified, sparking renewed calls to increase the size of the bail-out package, while Federal Reserve Chairman Bernanke hinted at a possible QE3 during a weekend interview. Strong demand pushed gold to a fresh all-time high of $1,431 and silver to a 30-year peak of $30.71 by Tuesday's US opening.

- However, the gains were quickly reversed on news US officials had agreed to extend and expand a series of tax cuts, and rumours the People's Bank of China could raise interest rates over the weekend in order to stem inflation. Both metals fell quickly, with gold back under $1,400 by the end of the day and eventually touching a low on Wednesday of $1,371.60. Silver tumbled almost $2/oz and eventually bottomed at $27.98. Trade remained mixed across the remainder of the week, with gold posting a 1.7% decline while silver closed down 2.9%.

- In addition to the lifetime high in US Dollar-gold, gold also set record highs in euros, Sterling, Canadian Dollar, Indian Rupee, Yen and Yuan last week.

- The AU/AG ratio hit its lowest since February '07 at 46.5. Net silver ETF holdings increased 222.7-tonnes to a record 15,114-tonne compared with a 6-tonne fall in net gold holdings.

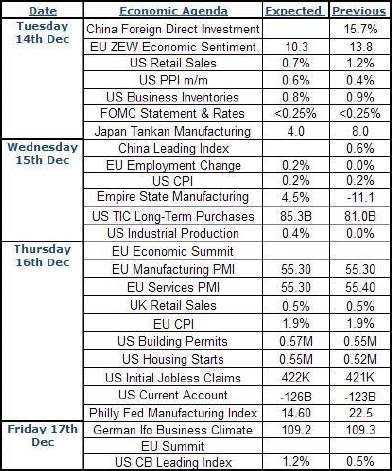

The Week Ahead

In the week ahead we expect a multitude of cross-currents to keep markets volatile.

The EU meets to discuss the formation of a permanent crisis resolution. An increased defence of the euro by Germany over the weekend will provide some with hope of greater unity within the EU, but ultimately risk is still present. We also note there will be a vote of confidence over Mr Berlusconi's government in Italy.

The Obama tax break faces a vote today in the Senate; recent news suggests that the bill will pass, but it will then face a tougher vote in the House. This could keep risk appetite buoyed, whilst speculation increases over whether US T-bond yields are rising in response to the deficit increasing or as a result of better forecast for economic growth. The FOMC is also due to meet, but we do not expect any changes in the language of the communiqué.

Investors will get the chance to gauge the new twospeed Europe, with German data coming out on at the same time as pan-European data. While in the US, the Empire State, Philly Fed manufacturing index and further data on the housing market will also no doubt be watched closely.

Focus – Bullion's Relative Performance

The gold/silver ratio touched its lowest level since February 2007 last week as silver continued to outperform gold, driven largely by high levels of investor substitution in addition to improving industrial off-take.

But while gold has underperformed silver over the past couple of months, the move in the ratio is merely balancing out the peaks seen during late 2008 (89.5) at the height of the financial crisis when gold stood out as a clear safe-haven asset of choice. The longer-term average still stands at around 63:1.

The combination of investment and industrial demand has also led to stronger gains in silver against its base metal cousins. Currently the silver/copper ratio is at 0.10, the highest since early 2009 when silver had already begun to recover, while base metals prices were attempting to establish a base; the ratio hit 0.14 in February '09. However, tighter fundamentals in the copper market and the pending introduction of physically-backed copper ETFs could see a sea-change in ratio momentum in the coming months, something we will continue to monitor.

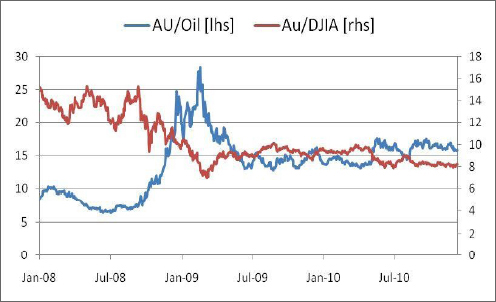

Meanwhile, in spite of the poorer performance of gold relative to silver, the accompanying chart suggests gold has been moving broadly in line with other market sectors such as crude oil and the Dow Jones. While there has been an overall increase in risk sentiment and improving macro-economic picture over the past 12-months, the fact the gold/oil and gold/Dow ratios have been fairly flat suggests continued portfolio diversification as background uncertainty surrounding issues such as eurozone debt and the effect of quantitative easing draws investors towards bullion.

Technical Analysis – Gold

Gold closed neutrally last Friday, setting the metal up to add to gains this morning. The metal is closing in on $1,400, but has resistance from the 7DMA. The momentum indicators have ticked higher but remain in subdued ranges. Trendline support is seen at $1,365-$1,348, whilst trendline resistance is seen at $1,405-$1,449. The metal also has support from the 21DMA and 50DMA. There is level support at $1371-$1372, and support from the 23.6% Fibo at $1,366.

A positive close tonight, preferably over resistance at $1,398-$1,400-$1,402, could well support another run higher in the coming sessions. However, before becoming bullish on such a close we would like to see the stochastics cross higher. But a failed run-up to $1,424-$1,429 could herald another move back to $1,371-$1,366-$1,353-$1,348 before year-end. As such we are neutral-positive, and looking for evidence that prices can sustain themselves above $1,400.

Technical Analysis – Silver

Silver closed negatively on Friday, forming a spinning bottom. This morning prices have rallied strongly, breaking above Thursday and Friday's highs. But like gold, silver's momentum indicators are not yet positive for prices. The metal remains well supported by the 21DMA, whilst it has pierced over the 7DMA. Trendline support is seen at $28.41-$27.42-$27.07, whilst trendline resistance is seen at $30.67-$32.14.

The metal seems to be attempting to rebound off last week's lows which were well supported, as indicated by the long tails. As such we are neutral-positive. We are looking for an improvement in the stochastics and a close back over $29.01-$29.41 in order to confirm further upside potential. In the wider picture we remain positive on the metal, based on the fact that it is trading over long term trendline support at $27.07.

Trader Talk

"There was this widespread expectation six months ago that we were going to have a double dip recession," says Steven Bleiberg, manager of the Legg Mason Lifestyle funds. "That whole mindset has petered out."

Market Drivers

Dollar Index

The dollar is consolidating around the 80 level on the dollar index, but whether it is the longer-term down trend or the medium-term up trend that dominates remains to be seen. A break out of the 80.40 to 79.00 range is likely to signal which direction the dollar heads next. Until then expect choppy trading. |

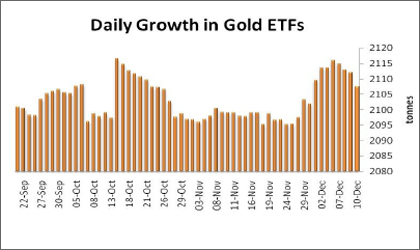

ETFs

The chart shows further redemptions across the gold ETFs, which is a slight concern as this is an important group of investors. As the chart shows, the fact that there have been two pull backs from around the 2,115 tonnes holdings' level suggests there is a good deal of profittaking going on. |

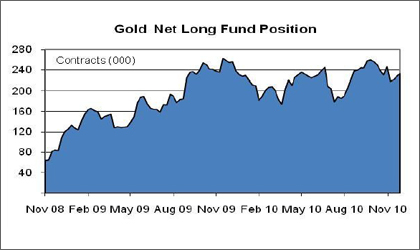

Funds

The funds have been net buyers again, with the gross long position climbing 3,680 contracts last week while the shorts covered 1,464 lots. In silver, the longs have been buying, but the shorts have stepped up their selling, so the net position dropped 1,065 contracts. Given the gold : silver ratio we remain wary of silver. |

Gold : Silver Ratio

The low on the ratio was around 45 in 2007, the ratio is getting close to that level again and generally is looking over-stretched. Although there is little to stop the ratio moving to a new trading range, given the extent of the fall in recent months we would be wary of a correction. |

Conclusion

Gold and silver prices are consolidating, and the fact the wider markets have not been rattled by more talk of quantitative easing, the continuing debt situation in Europe and the high inflation levels in China, does suggest they are comfortable in the current financial climate. In this case we would not be surprised if gold and silver underwent further consolidation at lower numbers.

However, we actually think the sovereign debt in Europe, QE in the US and high inflation in China are all issues the markets should be worried about and therefore we would not be surprised to see a more meaningful correction across markets - that is initially likely to drag bullion down with it as risk is reduced. But the secondary impact is likely to be bullish for gold and silver as safe-haven buying returns. The combination of inflation in Asia, ultra-loose monetary policy in the West, plus the implications of quantitative easing, are likely to keep demand healthy for gold and silver as they act as non-fiat money.

Terms & Conditions

The Terms and Conditions for this service are available below:

http://premium.basemetals.com/content/html/FMTermsandConditionsforonlineServices.html

Representations and Liability

1. Fastmarkets represents that:

(i) It will supply the Services in a professional way, using the care that can be reasonably expected for this type of business, and in accordance with the practices and policies which are commonly applicable in the information services industry:

(ii) it is duly empowered to supply the Information and Service(s) to the Client for the purposes specified in this Agreement and that the Service(s) and its use by the Client as specified in this Agreement will not infringe any intellectual property rights of any third party.

2. Although Fastmarkets will use all reasonable endeavours to ensure the accuracy and reliability of the Services, neither Fastmarkets, the Data Sources, or any third-party provider will be liable to the Client (or any third party) for direct, indirect or consequential loss or damage, including but not limited to loss of data, trading or other economic losses, arising out of any reliance on the accuracy of the Information (including but not limited to data, news and opinions) contained in the Service(s) or resulting in any way from the supply (or failure of supply) of the Services. However, Fastmarkets accepts liability for physical loss or damage to the Site caused by its negligence or wilful misconduct.

3. Except as expressly stated in this agreement, all express or implied conditions, warranties or undertakings, whether oral or in writing, in law or in fact, including warranties as to satisfactory quality and fitness for a particular purpose, are excluded.

4. The Client will indemnify Fastmarkets against any loss, damage or cost in connection with any claim or action that may be brought by any third party against Fastmarkets relating to any misuse of the Services by the Client.

5. To the extent permitted by law, under no circumstances will Fastmarkets' liability under this Agreement exceed the Service Fees paid to Fastmarkets by the Client, regardless of the cause or form of action.

Privacy Policy

The Fastmarkets Ltd Privacy Policy is available below:

http://premium.basemetals.com/content/html/Privacy_Policy.html

This Bullion Weekly is presented by an unaffiliated third party and Interactive Brokers LLC does not create the content of these presentations. You should review the contents of each presentation and make your own judgment as to whether the content is appropriate for you. Interactive Brokers LLC does not provide recommendations or advice. This presentation is not an advertisement or solicitation for new customers. It is intended only as an educational presentation.