BME

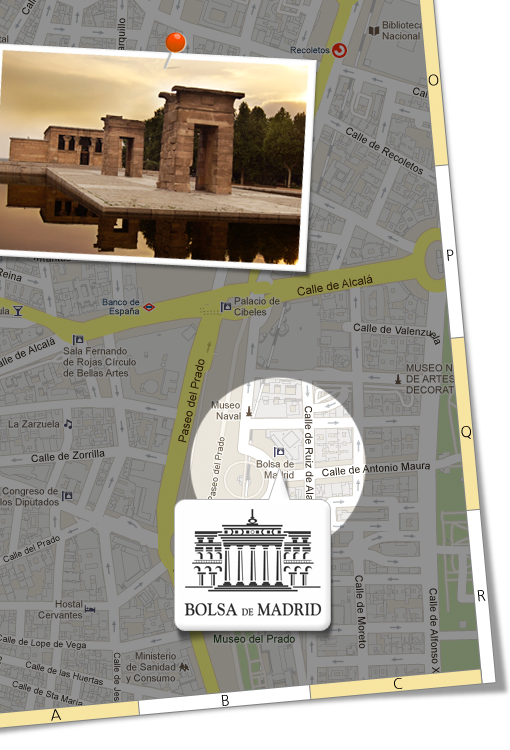

Bolsa de Madrid

The first commodity exchanges in Spain date back to the 14th century, but it wasn't until the 1831 publication of Ley de Creación de la Bolsa de Madrid (the law establishing the Madrid Stock Exchange), that the Spanish stock exchange officially got its start.

The Madrid Stock exchange (Bolsa de Madrid) lists, supervises and manages the official secondary market for equities, private fixed-income, public debt, warrants and certificates. The Bolsas y Mercados Españoles (BME) owned exchange is the largest of Spain's four regional stock exchanges. Bolsa de Madrid offers trading in equities and subscriptions rights, ETFs, warrants and certificates, and other products.

The Spanish market is characterized as an order-driven system, with liquidity providers (specialists) on some stocks. The Spanish electronic trading platform (SIBE) connects the four Spanish stock exchanges (Madrid, Barcelona, Bilbao and Valencia) and has supported the electronic trading of equity shares in the market since its implementation in 1995. All orders submitted to SIBE go to the same central computer and are prioritized according to price and time.

IBERCLEAR is responsible for managing settlement and clearing of securities and cash deriving from ordinary transactions executed in the securities markets.