| |

Quarterly enhancements to our trading platform along with expanded product offerings result in more unique advantages for IB customers. We've highlighted several of our recent developments below, and invite you to visit us at interactivebrokers.com to learn more. |

|

|

IB Execution Quality for US and Europe

Tops Industry

Based on independent measurements, the Transaction Auditing Group, Inc. (TAG), a third-party provider of transaction analysis, has determined that during the first half of 2010:

- Interactive Brokers' US stock executions (for all market orders of 100 shares or more up to 10,000 shares) showed price improvement of 28 cents per 100 shares better than the rest of the industry1.

- Interactive Brokers' US option executions (for all market orders of 1-50 contracts) showed price improvement of 53 cents per contract better.

- Interactive Brokers' European stock executions showed price improvement of EUR 2.84 per 100 shares better than the rest of the industry2.

|

Our results are even more impressive when you consider that other industry-touted statistics only note the percent of orders that saw price improvement, and conveniently ignore the percent of their orders that were dis-improved or had no improvement and do not include the amount of price improvement. Our statistics are netted, showing the true bottom-line price improvement including all improved, dis-improved and unimproved amounts and the average price improvement of the executions.

For complete details, click to see the Smart Routing Overview  .

|

|

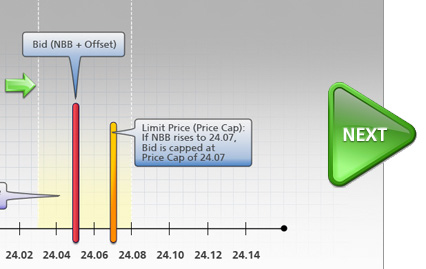

Order Types In Depth

IB supports more than 50 order types and algos at all levels of sophistication, designed to support varied trading strategies. To help illustrate the workings of these often-complex orders, we have added a pictorial walk-through of the order mechanics to many of our existing Order Types pages.

For more details and to see these in-depth graphical descriptions, click an order type from the Order Types  page.

|

New mobileTWS for Symbian Devices

We are pleased to announce the addition of the mobileTWS for Java ME to our growing collection of mobile trading solutions. mobileTWS for Java ME supports Symbian devices, including many of the most popular non-touch Nokia models.

For more details and to compare available models and features, see the Mobile Solutions  trading page.

|

|

Support for US Electronic Funds Transfers

Our Account Mangement online Bill Payment feature now supports electronic fund transfers for US financial institutions. An online bill payment deposit is a check or electronic fund transfer that originates from an online payment service provided by your financial institution. For electronic fund transfers, enter or select Interactive Brokers from your bank's list of supported electronic merchants. If your bank does not participate in the electronic bill payment service or has not yet added IB to their vendor list, IB will receive funds in the form of a paper check, which will be credited to your account and available after seven business days.

For more information on this and other types of fund transfers available from Account Management, see the Users' Guide  .

|

IRA Quarterly Fees

Effective October 1, 2010, IB will no longer be absorbing the IRA customer fee from our trustee, and will be passing on this quarterly fee of USD 7.50 to our IRA customers. The fee will be taken out at the end of each quarter. For new accounts, this fee will be applied beginning the first full quarter after the account is opened.

For details, visit the Other Fees  page.

|

New Lower Commissions

We are pleased to announce the following:

- We have lowered our bundled commissions on Mexican stocks from 0.2% of trade value to 0.1% of trade value.

- Stocks on Borsa Italiana are now offered via our low unbundled pricing structure.

|

New Products and Exchanges

We are pleased to announce the following:

- XINA50 futures on SGX (for non-US customers)

- E-mini and E-Micro S&P CNX NIFTY index futures on CME

- Mini VX index futures on CFE

- 3-year US Treasury note futures on ECBOT

- CBOT 7-year Interest Rate Swap on ECBOT

- CBOT 30-year Interest Rate Swap on ECBOT

- Nymex EMini Gold and Silver Index futures on NYMEX

- Sugar #16 112000 lbs futures on NYBOT

- MSCI EAFE Index futures on NYSELIFFE

To keep up-to-date on all of our recent product and exchange offerings, visit the New Products  page accessed from the Trading menu.

|

Large Size FX Trades

We now provide RFQs in TWS for large-sized FX trades between 10 and 50M. Once the RFQ is submitted, the appropriate size quote is live for 90 seconds, and updates dynamically. Note that you cannot pair on the same side for 30 seconds after you trade a size market.

For more information and to subscribe to this service, contact your IB Sales Representative  .

|

New Third-Party Tools

We have recently added the following third-party integrated software solutions to our Commercial Tools program:

- STEALTH by RTN Stealth Software, Inc.

- WideTrader by Computer House Snc.

- Options Software by Asio Investment Tools Inc.

- MTPredictor™

|

IB Student Trading Lab

The IB Student Trading Lab provides a financial education partnership between IB and an instructor, enabling educators to use IB's PaperTrader account free of charge in their financial, computer science, business and other applicable classes. Students register for a paper account and can trade forex and US stocks, options, futures, futures options, and bonds in a safe, simulated account using real time-market data.

This program is open to all college and high school educators and their students worldwide. If you know of anyone who might be interested, please encourage them to visit the IB Student Trading Lab  pages.

|

Technology Updates

We continue to update our trading platforms. Some of our most recent enhancements include:

TWS

- Risk Navigator: Support for a dynamic plot price scan which is generated over the most recent prices.

- Risk Navigator: The addition of the "Plot" dropdown selection list in the Report Selector, which drives the display in the P&L chart.

- ScaleTrader for Pairs: We have introduced several new "per leg" order type pairs for use in the ScaleTrader Pair and Combo tabs.

- The ability to email trade reports from the Trades window.

- The Rapid Order Entry panel now includes an "options only" layout with pre-filled expiry and strike fields based on the nearest in-the-money option.

- You can now submit orders directly from within a market scanner page. Previously these pages were view-only.

- Market data subscriptions submitted via Account Management now update immediately instead of over a 24-hour period.

- The new "single click" market data subscription buttons in beta 909 make it simple to update your market data subscriptions.

- Forex quotes display has been abbreviated to use K and M for thousands and millions. For example, 1,500,000 now displays as 1.5 M. In addition, traders can enter orders using these abbreviations.

API

- Calculate option price and the Greeks based on customer-supplied volatility and the underlying price.

- Calculate volatility based on customer-supplied options price and the underlying price.

For a complete listing of all the latest TWS updates, see the TWS Release Notes  .

|

|

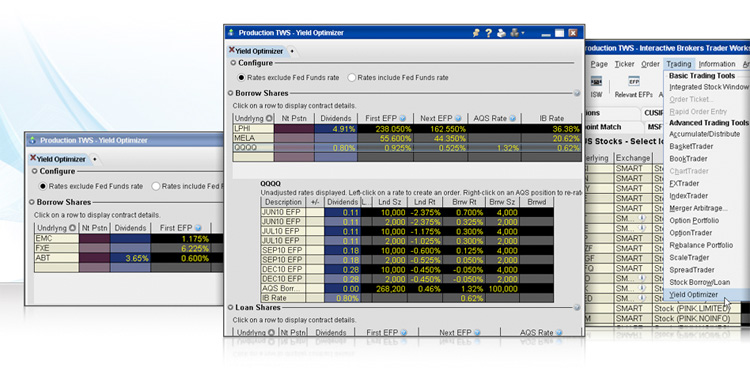

TWS Stock Borrow/Loan Marketplace

As our customers know, IB's TraderWorkstationTM is a comprehensive and versatile platform that lets you trade multiple products on numerous exchanges around the world from a single screen. The Traders' Edge focuses on an existing TWS tool that we think is worth a second look. This quarter we reintroduce you to the TWS Stock Borrow/Loan marketplace.

You have several choices when it comes to borrowing shares to support a short sale. You can simply put on the short sale, which results in borrowing from IB. Or you can access the wholesale market directly via AQS, which is supported in the TWS Stock Borrow/Loan window. Open the Stock/Borrow Loan window from the Trading Tools menu.

|

If you are considering lending your shares, use the Yield Optimizer to compare available rates. You can see the shares you have available for lending per position in the Loanable Quantity field, and see the IB indicative rate and the AQS wholesale rate. Additionally, IB presents the most cost-effective EFPs for investing your excess cash.

Please note that the TWS Stock/Borrow Loan feature is only available to customers who have a Portfolio Margin  account.

For more information on using our Stock Borrow/Loan offerings, see the TWS Users' Guide Stock Borrow/Loan  and

Yield Optimizer  sections.

|

|

Interactive Brokers LLC - member NYSE, FINRA, SIPC. [1] Source: The Transaction Auditing Group (TAG). Industry as a whole for the referenced periods according to TAG. [2] The TAG statistics for price improvement on IB orders routed to exchanges in

Europe include all orders routed for execution during regular trading hours

including all market and marketable limit orders and orders near the market

(orders having a limit price within one-tenth of a Euro from the quote price

at time of order receipt) on stocks listed on the included exchanges during

the first half of 2010, weighted by the volume executed on each exchange.

The exchanges are XETRA, EURONEXT, CHI-X, WIENER BORSE, TURQUOISE, LONDON

and NASDAQ OMX.

Any trading symbols displayed are for illustrative purposes only and are not intended to portray recommendations.

Options and Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading options read the "Characteristics and Risks of Standardized Options". Before trading futures, please read the CFTC Risk Disclosure. For a copy of either disclosure, call (203) 618-5800 or click here. Supporting documentation for any claims and statistical information will be provided upon request.

There is a substantial risk of loss in foreign exchange trading. The settlement date of foreign exchange trades can vary due to time zone differences and bank holidays. When trading across foreign exchange markets, this may necessitate borrowing funds to settle foreign exchange trades. The interest rate on borrowed funds must be considered when computing the cost of trades across multiple markets.

Interactive Brokers - 2 Pickwick Plaza - Greenwich CT 06830

|

|